Form Dr-17b - Suggested Format For Florida Sales And Use Tax Surety Bond

ADVERTISEMENT

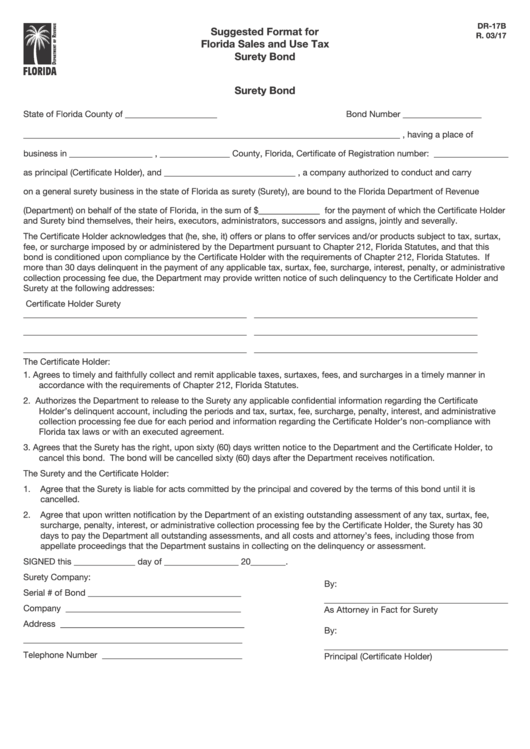

DR-17B

Suggested Format for

R. 03/17

Florida Sales and Use Tax

Surety Bond

Surety Bond

State of Florida County of _____________________

Bond Number __________________

______________________________________________________________________________________ , having a place of

business in ___________________ , ________________ County, Florida, Certificate of Registration number: _________________

as principal (Certificate Holder), and ______________________________ , a company authorized to conduct and carry

on a general surety business in the state of Florida as surety (Surety), are bound to the Florida Department of Revenue

(Department) on behalf of the state of Florida, in the sum of $______________ for the payment of which the Certificate Holder

and Surety bind themselves, their heirs, executors, administrators, successors and assigns, jointly and severally.

The Certificate Holder acknowledges that (he, she, it) offers or plans to offer services and/or products subject to tax, surtax,

fee, or surcharge imposed by or administered by the Department pursuant to Chapter 212, Florida Statutes, and that this

bond is conditioned upon compliance by the Certificate Holder with the requirements of Chapter 212, Florida Statutes. If

more than 30 days delinquent in the payment of any applicable tax, surtax, fee, surcharge, interest, penalty, or administrative

collection processing fee due, the Department may provide written notice of such delinquency to the Certificate Holder and

Surety at the following addresses:

Certificate Holder

Surety

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

The Certificate Holder:

1. Agrees to timely and faithfully collect and remit applicable taxes, surtaxes, fees, and surcharges in a timely manner in

accordance with the requirements of Chapter 212, Florida Statutes.

2. Authorizes the Department to release to the Surety any applicable confidential information regarding the Certificate

Holder’s delinquent account, including the periods and tax, surtax, fee, surcharge, penalty, interest, and administrative

collection processing fee due for each period and information regarding the Certificate Holder’s non-compliance with

Florida tax laws or with an executed agreement.

3. Agrees that the Surety has the right, upon sixty (60) days written notice to the Department and the Certificate Holder, to

cancel this bond. The bond will be cancelled sixty (60) days after the Department receives notification.

The Surety and the Certificate Holder:

1.

Agree that the Surety is liable for acts committed by the principal and covered by the terms of this bond until it is

cancelled.

2.

Agree that upon written notification by the Department of an existing outstanding assessment of any tax, surtax, fee,

surcharge, penalty, interest, or administrative collection processing fee by the Certificate Holder, the Surety has 30

days to pay the Department all outstanding assessments, and all costs and attorney’s fees, including those from

appellate proceedings that the Department sustains in collecting on the delinquency or assessment.

SIGNED this ______________ day of _________________ 20________.

Surety Company:

By:

Serial # of Bond ___________________________________

__________________________________________

Company ________________________________________

As Attorney in Fact for Surety

Address __________________________________________

By:

__________________________________________________

__________________________________________

Telephone Number ________________________________

Principal (Certificate Holder)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1