Form Wtw 16b - Examples Of Family Income (Region 2)

ADVERTISEMENT

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES

STATE OF CALIFORNIA - HEALTH AND HUMAN SERVICES AGENCY

EXAMPLES OF FAMILY INCOME (REGION 2)

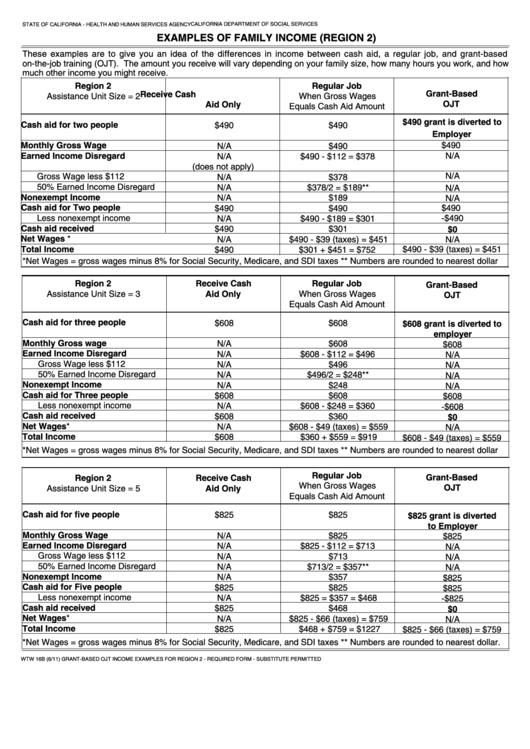

These examples are to give you an idea of the differences in income between cash aid, a regular job, and grant-based

on-the-job training (OJT). The amount you receive will vary depending on your family size, how many hours you work, and how

much other income you might receive.

Region 2

Regular Job

Grant-Based

Receive Cash

Assistance Unit Size = 2

When Gross Wages

OJT

Aid Only

Equals Cash Aid Amount

$490 grant is diverted to

Cash aid for two people

$490

$490

Employer

Monthly Gross Wage

$490

N/A

$490

Earned Income Disregard

N/A

N/A

$490 - $112 = $378

(does not apply)

N/A

Gross Wage less $112

N/A

$378

50% Earned Income Disregard

N/A

$378/2 = $189**

N/A

Nonexempt Income

N/A

$189

N/A

Cash aid for Two people

$490

$490

$490

Less nonexempt income

-$490

N/A

$490 - $189 = $301

Cash aid received

$490

$301

$0

Net Wages *

N/A

$490 - $39 (taxes) = $451

N/A

Total Income

$490 - $39 (taxes) = $451

$490

$301 + $451 = $752

*Net Wages = gross wages minus 8% for Social Security, Medicare, and SDI taxes ** Numbers are rounded to nearest dollar

Region 2

Receive Cash

Regular Job

Grant-Based

Assistance Unit Size = 3

Aid Only

When Gross Wages

OJT

Equals Cash Aid Amount

Cash aid for three people

$608

$608

$608 grant is diverted to

employer

Monthly Gross wage

N/A

$608

$608

Earned Income Disregard

N/A

$608 - $112 = $496

N/A

Gross Wage less $112

N/A

$496

N/A

50% Earned Income Disregard

N/A

$496/2 = $248**

N/A

Nonexempt Income

N/A

$248

N/A

Cash aid for Three people

$608

$608

$608

Less nonexempt income

N/A

$608 - $248 = $360

-$608

Cash aid received

$608

$360

$0

Net Wages*

N/A

$608 - $49 (taxes) = $559

N/A

Total Income

$608

$360 + $559 = $919

$608 - $49 (taxes) = $559

*Net Wages = gross wages minus 8% for Social Security, Medicare, and SDI taxes ** Numbers are rounded to nearest dollar

Regular Job

Grant-Based

Region 2

Receive Cash

When Gross Wages

OJT

Assistance Unit Size = 5

Aid Only

Equals Cash Aid Amount

Cash aid for five people

$825

$825

$825 grant is diverted

to Employer

Monthly Gross Wage

N/A

$825

$825

Earned Income Disregard

N/A

$825 - $112 = $713

N/A

Gross Wage less $112

N/A

$713

N/A

50% Earned Income Disregard

N/A

$713/2 = $357**

N/A

Nonexempt Income

N/A

$357

$825

Cash aid for Five people

$825

$825

$825

Less nonexempt income

N/A

$825 = $357 = $468

-$825

Cash aid received

$825

$468

$0

Net Wages*

N/A

$825 - $66 (taxes) = $759

N/A

Total Income

$825

$468 + $759 = $1227

$825 - $66 (taxes) = $759

*Net Wages = gross wages minus 8% for Social Security, Medicare, and SDI taxes ** Numbers are rounded to nearest dollar.

WTW 16B (6/11) GRANT-BASED OJT INCOME EXAMPLES FOR REGION 2 - REQUIRED FORM - SUBSTITUTE PERMITTED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1