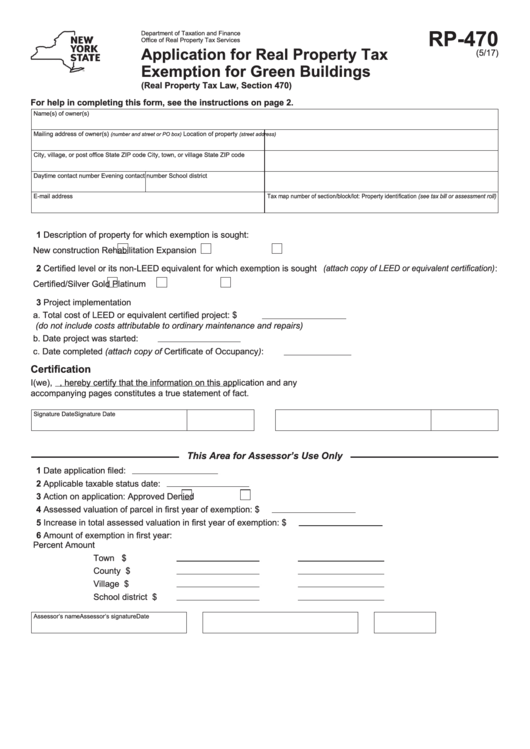

RP-470

Department of Taxation and Finance

Office of Real Property Tax Services

Application for Real Property Tax

(5/17)

Exemption for Green Buildings

(Real Property Tax Law, Section 470)

For help in completing this form, see the instructions on page 2.

Name(s) of owner(s)

Mailing address of owner(s)

Location of property

(number and street or PO box)

(street address)

City, village, or post office

State

ZIP code

City, town, or village

State

ZIP code

Daytime contact number

Evening contact number

School district

E-mail address

Tax map number of section/block/lot: Property identification (see tax bill or assessment roll)

1 Description of property for which exemption is sought:

New construction

Rehabilitation

Expansion

2 Certified level or its non-LEED equivalent for which exemption is sought (attach copy of LEED or equivalent certification):

Certified/Silver

Gold

Platinum

3 Project implementation

a. Total cost of LEED or equivalent certified project: $

(do not include costs attributable to ordinary maintenance and repairs)

b. Date project was started:

c. Date completed (attach copy of Certificate of Occupancy):

Certification

I(we),

, hereby certify that the information on this application and any

accompanying pages constitutes a true statement of fact.

Signature

Date

Signature

Date

This Area for Assessor’s Use Only

1 Date application filed:

2 Applicable taxable status date:

3 Action on application:

Approved

Denied

4 Assessed valuation of parcel in first year of exemption: $

5 Increase in total assessed valuation in first year of exemption: $

6 Amount of exemption in first year:

Percent

Amount

Town

$

County

$

Village

$

School district

$

Assessor’s name

Assessor’s signature

Date

1

1 2

2

![Form Rp-421-i [albany] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Form Rp-421-i [albany] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/320/3207/320781/page_1_thumb.png)

![Form Rp-421-i [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Form Rp-421-i [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/320/3208/320837/page_1_thumb.png)

![Form Rp-421-j [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Form Rp-421-j [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/320/3208/320854/page_1_thumb.png)

![Form Rp-421-n [oneonta] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Form Rp-421-n [oneonta] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/320/3208/320859/page_1_thumb.png)