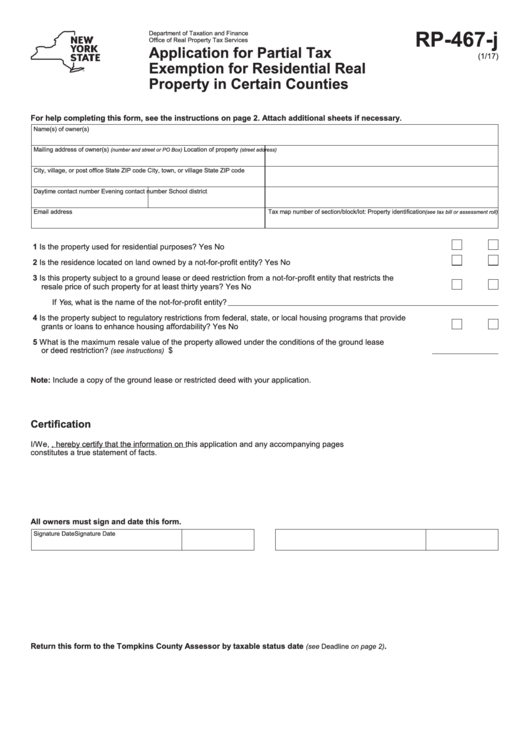

RP-467-j

Department of Taxation and Finance

Office of Real Property Tax Services

Application for Partial Tax

(1/17)

Exemption for Residential Real

Property in Certain Counties

For help completing this form, see the instructions on page 2. Attach additional sheets if necessary.

Name(s) of owner(s)

Mailing address of owner(s)

Location of property

(number and street or PO Box)

(street address)

City, village, or post office

State

ZIP code

City, town, or village

State

ZIP code

Daytime contact number

Evening contact number

School district

Email address

Tax map number of section/block/lot: Property identification

(see tax bill or assessment roll)

1 Is the property used for residential purposes?........................................................................................................... Yes

No

2 Is the residence located on land owned by a not-for-profit entity? ............................................................................ Yes

No

3 Is this property subject to a ground lease or deed restriction from a not-for-profit entity that restricts the

resale price of such property for at least thirty years? ............................................................................................... Yes

No

If Yes, what is the name of the not-for-profit entity?

4 Is the property subject to regulatory restrictions from federal, state, or local housing programs that provide

grants or loans to enhance housing affordability? ..................................................................................................... Yes

No

5 What is the maximum resale value of the property allowed under the conditions of the ground lease

or deed restriction?

....................................................................................................................... $

(see instructions)

Note: Include a copy of the ground lease or restricted deed with your application.

Certification

I/We,

, hereby certify that the information on this application and any accompanying pages

constitutes a true statement of facts.

All owners must sign and date this form.

Signature

Date

Signature

Date

Return this form to the Tompkins County Assessor by taxable status date

.

(see Deadline on page 2)

1

1 2

2