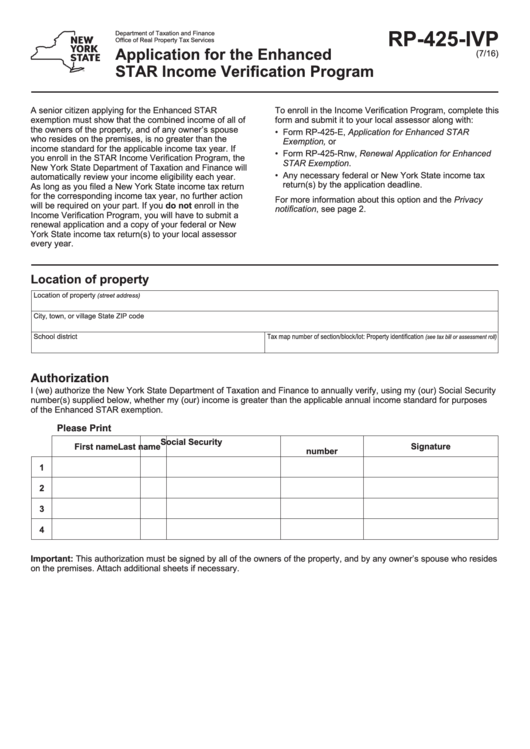

RP-425-IVP

Department of Taxation and Finance

Office of Real Property Tax Services

Application for the Enhanced

(7/16)

STAR Income Verification Program

A senior citizen applying for the Enhanced STAR

To enroll in the Income Verification Program, complete this

exemption must show that the combined income of all of

form and submit it to your local assessor along with:

the owners of the property, and of any owner’s spouse

• Form RP-425-E, Application for Enhanced STAR

who resides on the premises, is no greater than the

Exemption, or

income standard for the applicable income tax year. If

• Form RP-425-Rnw, Renewal Application for Enhanced

you enroll in the STAR Income Verification Program, the

STAR Exemption.

New York State Department of Taxation and Finance will

• Any necessary federal or New York State income tax

automatically review your income eligibility each year.

return(s) by the application deadline.

As long as you filed a New York State income tax return

for the corresponding income tax year, no further action

For more information about this option and the Privacy

will be required on your part. If you do not enroll in the

notification, see page 2.

Income Verification Program, you will have to submit a

renewal application and a copy of your federal or New

York State income tax return(s) to your local assessor

every year.

Location of property

Location of property

(street address)

City, town, or village

State

ZIP code

School district

Tax map number of section/block/lot: Property identification

(see tax bill or assessment roll)

Authorization

I (we) authorize the New York State Department of Taxation and Finance to annually verify, using my (our) Social Security

number(s) supplied below, whether my (our) income is greater than the applicable annual income standard for purposes

of the Enhanced STAR exemption.

Please Print

Social Security

First name

M.I.

Last name

Signature

number

1

2

3

4

Important: This authorization must be signed by all of the owners of the property, and by any owner’s spouse who resides

on the premises. Attach additional sheets if necessary.

1

1 2

2