Instructions For Form Rp-421-N-Ins Oneonta - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities

ADVERTISEMENT

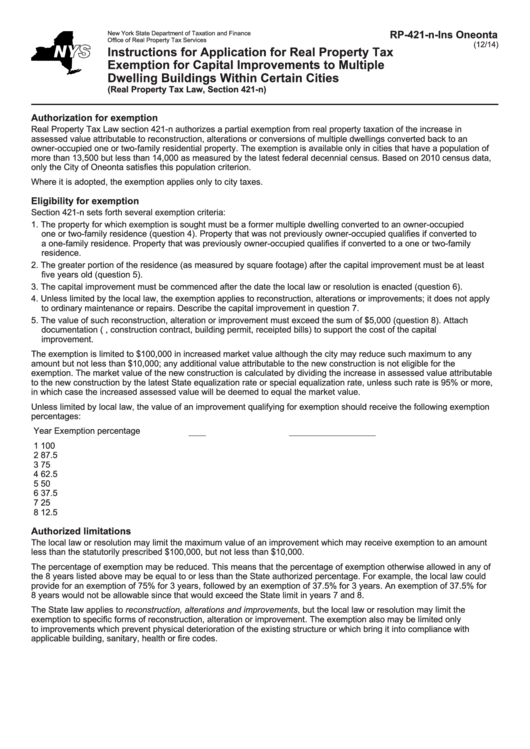

RP-421-n-Ins Oneonta

New York State Department of Taxation and Finance

Office of Real Property Tax Services

(12/14)

Instructions for Application for Real Property Tax

Exemption for Capital Improvements to Multiple

Dwelling Buildings Within Certain Cities

(Real Property Tax Law, Section 421-n)

Authorization for exemption

Real Property Tax Law section 421-n authorizes a partial exemption from real property taxation of the increase in

assessed value attributable to reconstruction, alterations or conversions of multiple dwellings converted back to an

owner-occupied one or two-family residential property. The exemption is available only in cities that have a population of

more than 13,500 but less than 14,000 as measured by the latest federal decennial census. Based on 2010 census data,

only the City of Oneonta satisfies this population criterion.

Where it is adopted, the exemption applies only to city taxes.

Eligibility for exemption

Section 421-n sets forth several exemption criteria:

1. The property for which exemption is sought must be a former multiple dwelling converted to an owner-occupied

one or two-family residence (question 4). Property that was not previously owner-occupied qualifies if converted to

a one-family residence. Property that was previously owner-occupied qualifies if converted to a one or two-family

residence.

2. The greater portion of the residence (as measured by square footage) after the capital improvement must be at least

five years old (question 5).

3. The capital improvement must be commenced after the date the local law or resolution is enacted (question 6).

4. Unless limited by the local law, the exemption applies to reconstruction, alterations or improvements; it does not apply

to ordinary maintenance or repairs. Describe the capital improvement in question 7.

5. The value of such reconstruction, alteration or improvement must exceed the sum of $5,000 (question 8). Attach

documentation (e.g., construction contract, building permit, receipted bills) to support the cost of the capital

improvement.

The exemption is limited to $100,000 in increased market value although the city may reduce such maximum to any

amount but not less than $10,000; any additional value attributable to the new construction is not eligible for the

exemption. The market value of the new construction is calculated by dividing the increase in assessed value attributable

to the new construction by the latest State equalization rate or special equalization rate, unless such rate is 95% or more,

in which case the increased assessed value will be deemed to equal the market value.

Unless limited by local law, the value of an improvement qualifying for exemption should receive the following exemption

percentages:

Year

Exemption percentage

1

100

2

87.5

3

75

4

62.5

5

50

6

37.5

7

25

8

12.5

Authorized limitations

The local law or resolution may limit the maximum value of an improvement which may receive exemption to an amount

less than the statutorily prescribed $100,000, but not less than $10,000.

The percentage of exemption may be reduced. This means that the percentage of exemption otherwise allowed in any of

the 8 years listed above may be equal to or less than the State authorized percentage. For example, the local law could

provide for an exemption of 75% for 3 years, followed by an exemption of 37.5% for 3 years. An exemption of 37.5% for

8 years would not be allowable since that would exceed the State limit in years 7 and 8.

The State law applies to reconstruction, alterations and improvements, but the local law or resolution may limit the

exemption to specific forms of reconstruction, alteration or improvement. The exemption also may be limited only

to improvements which prevent physical deterioration of the existing structure or which bring it into compliance with

applicable building, sanitary, health or fire codes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2![Instructions For Form Rp-421-j-ins [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Instructions For Form Rp-421-j-ins [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/362/3622/362237/page_1_thumb.png)

![Instructions For Form Rp-421-i-ins [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Instructions For Form Rp-421-i-ins [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/362/3622/362242/page_1_thumb.png)

![Instructions For Form Rp-421-i-ins [albany] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Instructions For Form Rp-421-i-ins [albany] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/362/3622/362247/page_1_thumb.png)

![Form Rp-421-n [oneonta] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Form Rp-421-n [oneonta] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/320/3208/320859/page_1_thumb.png)

![Form Rp-421-n [oneonta] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Form Rp-421-n [oneonta] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/362/3622/362221/page_1_thumb.png)

![Form Rp-421-i [albany] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Form Rp-421-i [albany] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/320/3207/320781/page_1_thumb.png)

![Form Rp-421-i [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Form Rp-421-i [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/320/3208/320837/page_1_thumb.png)

![Form Rp-421-j [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Form Rp-421-j [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/320/3208/320854/page_1_thumb.png)