Instructions For Form Rp-421-F-Ins - Application For Real Property Tax Exemption For Capital Improvements To Residential Property

ADVERTISEMENT

RP-421-f-Ins (9/08)

NYS DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

INSTRUCTIONS FOR APPLICATION FOR

REAL PROPERTY TAX EXEMPTION FOR

CAPITAL IMPROVEMENTS TO RESIDENTIAL PROPERTY

(Real Property Tax Law, Section 421-f)

AUTHORIZATION FOR EXEMPTION:

Section 421-f of the Real Property Tax Law authorizes a partial exemption from real property taxation of the

increase in assessed value attributable to reconstruction, alterations or improvements made to residential property.

Counties, cities (other than New York City), towns and villages may hold public hearings and then adopt local laws

granting the exemption. School districts, other than those in the cities of New York, Buffalo, Rochester, Syracuse

and Yonkers, have the option to pass a resolution providing that the exemption applies to school taxes.

Where it is adopted, the exemption applies to taxes and special ad valorem levies; the exemption does not

apply to special assessments.

ELIGIBILITY FOR EXEMPTION:

Section 421-f sets forth several exemption criteria:

1. The property for which exemption is sought must be a one or two family residence (question 4).

2. The greater portion of the residence (as measured by square footage) after the capital improvement

must be at least five years old (question 5).

3. The capital improvement must be commenced after the date the local law or resolution is enacted

(question 6).

4.

Unless limited by the local law, the exemption applies to reconstruction, alterations or improvements; it

does not apply to ordinary maintenance or repairs. Describe the capital improvement in question 7.

5.

The value of such reconstruction, alteration or improvement must exceed the sum of $3,000 (question 8).

Attach documentation (e.g., construction contract, building permit, receipted bills) to support the

cost of capital improvement.

The exemption is limited to $80,000 in increased market value although a municipality may reduce such

maximum; any additional value attributable to the new construction is not eligible for the exemption. The market

value of the new construction is calculated by dividing the increase in assessed value attributable to the new

construction by the latest State equalization rate or special equalization rate, unless such rate is 95 percent or more,

in which case the increased assessed value will be deemed to equal the market value. In Nassau County, the class

one ratio is to be used to determine the market value of the improvement.

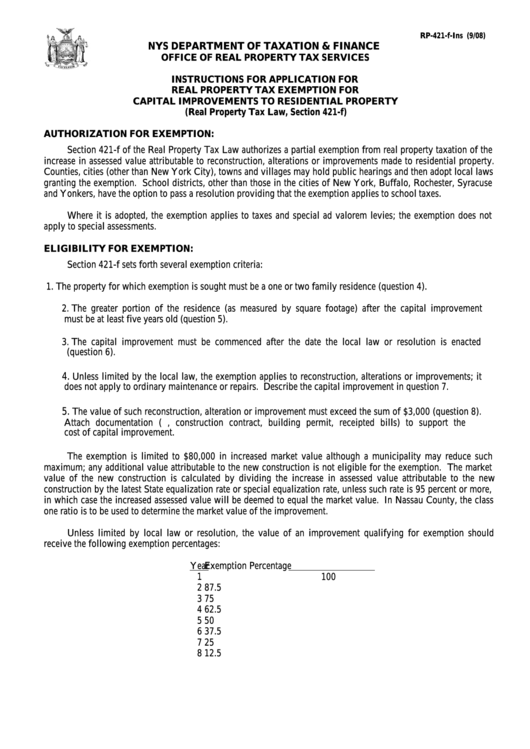

Unless limited by local law or resolution, the value of an improvement qualifying for exemption should

receive the following exemption percentages:

Year

Exemption Percentage

1

100

2

87.5

3

75

4

62.5

5

50

6

37.5

7

25

8

12.5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2

![Instructions For Form Rp-421-j-ins [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Instructions For Form Rp-421-j-ins [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/362/3622/362237/page_1_thumb.png)