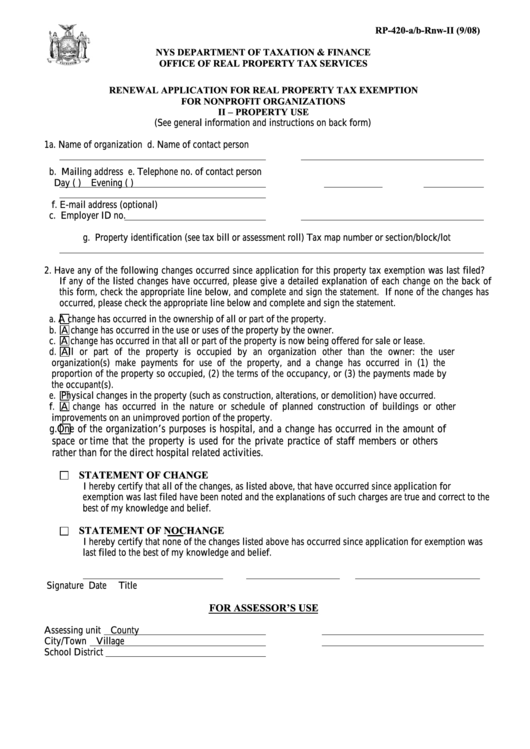

RP-420-a/b-Rnw-II (9/08)

NYS DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

RENEWAL APPLICATION FOR REAL PROPERTY TAX EXEMPTION

FOR NONPROFIT ORGANIZATIONS

II – PROPERTY USE

(See general information and instructions on back form)

1a. Name of organization

d. Name of contact person

b. Mailing address

e. Telephone no. of contact person

Day (

)

Evening (

)

f. E-mail address (optional)

c. Employer ID no.

g. Property identification (see tax bill or assessment roll) Tax map number or section/block/lot

2. Have any of the following changes occurred since application for this property tax exemption was last filed?

If any of the listed changes have occurred, please give a detailed explanation of each change on the back of

this form, check the appropriate line below, and complete and sign the statement. If none of the changes has

occurred, please check the appropriate line below and complete and sign the statement.

a. A change has occurred in the ownership of all or part of the property.

b. A change has occurred in the use or uses of the property by the owner.

c. A change has occurred in that all or part of the property is now being offered for sale or lease.

d. All or part of the property is occupied by an organization other than the owner: the user

organization(s) make payments for use of the property, and a change has occurred in (1) the

proportion of the property so occupied, (2) the terms of the occupancy, or (3) the payments made by

the occupant(s).

e. Physical changes in the property (such as construction, alterations, or demolition) have occurred.

f. A change has occurred in the nature or schedule of planned construction of buildings or other

improvements on an unimproved portion of the property.

g. One of the organization’s purposes is hospital, and a change has occurred in the amount of

space or time that the property is used for the private practice of staff members or others

rather than for the direct hospital related activities.

STATEMENT OF CHANGE

I hereby certify that all of the changes, as listed above, that have occurred since application for

exemption was last filed have been noted and the explanations of such charges are true and correct to the

best of my knowledge and belief.

STATEMENT OF NO CHANGE

I hereby certify that none of the changes listed above has occurred since application for exemption was

last filed to the best of my knowledge and belief.

Signature

Date

Title

FOR ASSESSOR’S USE

Assessing unit

County

City/Town

Village

School District

1

1 2

2