*171381*

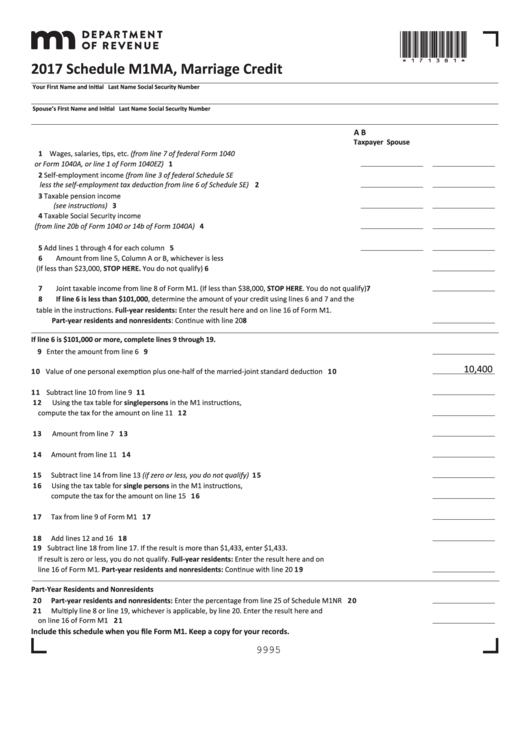

2017 Schedule M1MA, Marriage Credit

Your First Name and Initial

Last Name

Social Security Number

Spouse’s First Name and Initial

Last Name

Social Security Number

A

B

Taxpayer

Spouse

1 Wages, salaries, tips, etc. (from line 7 of federal Form 1040

or Form 1040A, or line 1 of Form 1040EZ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Self-employment income (from line 3 of federal Schedule SE

less the self-employment tax deduction from line 6 of Schedule SE) . . . . . . . . . . . . . . . . . . . . . . . 2

3 Taxable pension income

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Taxable Social Security income

(from line 20b of Form 1040 or 14b of Form 1040A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Add lines 1 through 4 for each column . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Amount from line 5, Column A or B, whichever is less

(If less than $23,000, STOP HERE. You do not qualify) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Joint taxable income from line 8 of Form M1. (If less than $38,000, STOP HERE. You do not qualify) . . . . . . . . . . . . . . . 7

8 If line 6 is less than $101,000, determine the amount of your credit using lines 6 and 7 and the

table in the instructions. Full-year residents: Enter the result here and on line 16 of Form M1.

Part-year residents and nonresidents: Continue with line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

If line 6 is $101,000 or more, complete lines 9 through 19.

9

Enter the amount from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10,400

10

Value of one personal exemption plus one-half of the married-joint standard deduction . . . . . . . . . . . . . . . . . . . . . . 1 0

11

Subtract line 10 from line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 1

12

Using the tax table for single persons in the M1 instructions,

compute the tax for the amount on line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 2

13

Amount from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 3

14

Amount from line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 4

15

Subtract line 14 from line 13 (if zero or less, you do not qualify) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 5

16

Using the tax table for single persons in the M1 instructions,

compute the tax for the amount on line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 6

17

Tax from line 9 of Form M1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 7

18

Add lines 12 and 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 8

19

Subtract line 18 from line 17. If the result is more than $1,433, enter $1,433.

If result is zero or less, you do not qualify. Full-year residents: Enter the result here and on

line 16 of Form M1. Part-year residents and nonresidents: Continue with line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 9

Part-Year Residents and Nonresidents

20

Part-year residents and nonresidents: Enter the percentage from line 25 of Schedule M1NR . . . . . . . . . . . . . . . . . . 2 0

21

Multiply line 8 or line 19, whichever is applicable, by line 20. Enter the result here and

on line 16 of Form M1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 1

Include this schedule when you file Form M1. Keep a copy for your records.

9995

1

1 2

2