*171841*

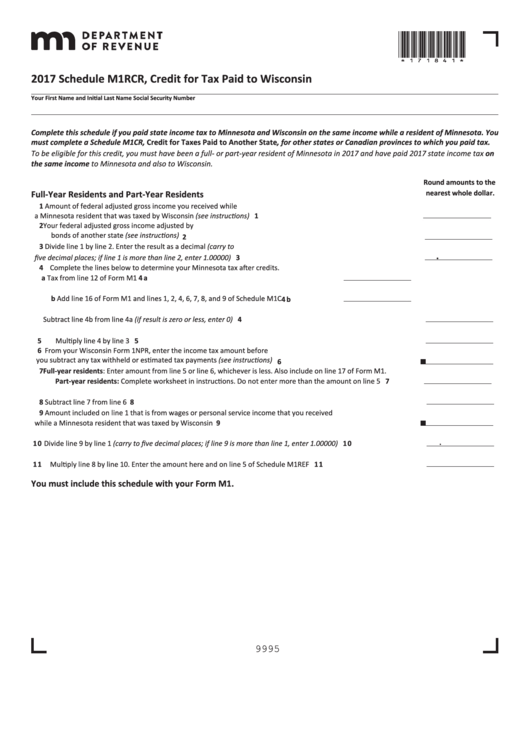

2017 Schedule M1RCR, Credit for Tax Paid to Wisconsin

Your First Name and Initial

Last Name

Social Security Number

Complete this schedule if you paid state income tax to Minnesota and Wisconsin on the same income while a resident of Minnesota. You

must complete a Schedule M1CR, Credit for Taxes Paid to Another State, for other states or Canadian provinces to which you paid tax.

To be eligible for this credit, you must have been a full- or part-year resident of Minnesota in 2017 and have paid 2017 state income tax on

the same income to Minnesota and also to Wisconsin.

Round amounts to the

nearest whole dollar.

Full-Year Residents and Part-Year Residents

1 Amount of federal adjusted gross income you received while

a Minnesota resident that was taxed by Wisconsin (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Your federal adjusted gross income adjusted by U .S . bond interest and/or

bonds of another state (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Divide line 1 by line 2 . Enter the result as a decimal (carry to

.

five decimal places; if line 1 is more than line 2, enter 1.00000) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Complete the lines below to determine your Minnesota tax after credits.

a Tax from line 12 of Form M1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 a

b Add line 16 of Form M1 and lines 1, 2, 4, 6, 7, 8, and 9 of Schedule M1C . . . . . . . . . 4 b

Subtract line 4b from line 4a (if result is zero or less, enter 0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Multiply line 4 by line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6

From your Wisconsin Form 1NPR, enter the income tax amount before

you subtract any tax withheld or estimated tax payments (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Full-year residents: Enter amount from line 5 or line 6, whichever is less . Also include on line 17 of Form M1 .

Part-year residents: Complete worksheet in instructions. Do not enter more than the amount on line 5 . . . . . . . . . 7

8 Subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Amount included on line 1 that is from wages or personal service income that you received

while a Minnesota resident that was taxed by Wisconsin . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

.

10

Divide line 9 by line 1 (carry to five decimal places; if line 9 is more than line 1, enter 1.00000) . . . . . . . . . . . . . . . . 1 0

11 Multiply line 8 by line 10. Enter the amount here and on line 5 of Schedule M1REF . . . . . . . . . . . . . . . . . . . . . . . .

1 1

You must include this schedule with your Form M1.

9995

1

1 2

2