Real Estate Purchase Agreement Template

ADVERTISEMENT

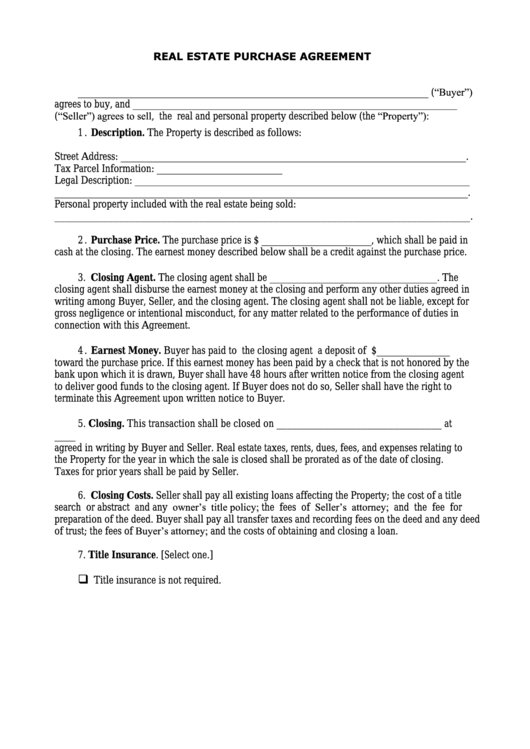

REAL ESTATE PURCHASE AGREEMENT

___________________________________________________________________ (“Buyer”)

agrees to buy, and ______________________________________________________________

(“Seller”) agrees to sell, the real and personal property described below (the “Property”):

1 . Description. The Property is described as follows:

Street Address: __________________________________________________________________.

Tax Parcel Information: ________________________

Legal Description: ________________________________________________________________

_______________________________________________________________________________.

Personal property included with the real estate being sold:

______________________________________________________________________________.

2 . Purchase Price. The purchase price is $ _____________________, which shall be paid in

cash at the closing. The earnest money described below shall be a credit against the purchase price.

3. Closing Agent. The closing agent shall be ________________________________. The

closing agent shall disburse the earnest money at the closing and perform any other duties agreed in

writing among Buyer, Seller, and the closing agent. The closing agent shall not be liable, except for

gross negligence or intentional misconduct, for any matter related to the performance of duties in

connection with this Agreement.

4 . Earnest Money. Buyer has paid to the closing agent a deposit of $______________

toward the purchase price. If this earnest money has been paid by a check that is not honored by the

bank upon which it is drawn, Buyer shall have 48 hours after written notice from the closing agent

to deliver good funds to the closing agent. If Buyer does not do so, Seller shall have the right to

terminate this Agreement upon written notice to Buyer.

5. Closing. This transaction shall be closed on _______________________________ at

____ a.m./p.m. at the office of the closing agent. Any extension of this date and time must be

agreed in writing by Buyer and Seller. Real estate taxes, rents, dues, fees, and expenses relating to

the Property for the year in which the sale is closed shall be prorated as of the date of closing.

Taxes for prior years shall be paid by Seller.

6. Closing Costs. Seller shall pay all existing loans affecting the Property; the cost of a title

search or abstract and any owner’s title policy; the fees of Seller’s attorney; and the fee for

preparation of the deed. Buyer shall pay all transfer taxes and recording fees on the deed and any deed

of trust; the fees of Buyer’s attorney; and the costs of obtaining and closing a loan.

7. Title Insurance. [Select one.]

Title insurance is not required.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3