Department of the Treasury - Internal Revenue Service

13844

Form

Application For Reduced User Fee For Installment Agreements

(January 2018)

The user fee for entering into an installment agreement after January 1, 2007 may be reduced to $43 for individuals

whose income falls below 250% of the criteria established by the poverty guidelines updated annually by the U.S.

Department of Health and Human Services. The reduced user fee for individuals does not apply to corporations or

partnerships. Use this form to apply for the reduced user fee. Please include the Form 433-F if your income has recently

decreased and you wish to apply for the reduced fee. If your application is granted, the amount of any user fee collected

in excess of $43 will be applied against your Internal Revenue Code liabilities and reduce the amount of interest and

penalties that may accrue. To request the reduced user fee, mail this form to: IRS, P.O. Box 219236, Stop 5050, Kansas

City, MO 64121-9236.

If you are an individual, follow the steps below to determine if you qualify for a reduced installment agreement

user fee.

1. Family Unit Size

. Enter the total number of dependents (including yourself and your spouse) claimed on

your current in come tax return (Form 1040, Line 6d).

2. Total Income

. Enter the amount of total income reported on your current income tax return (Form

1040, Line 22).

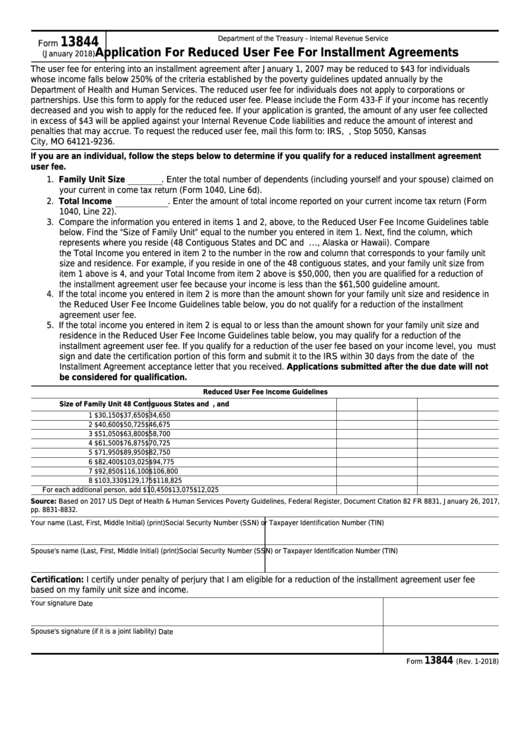

3. Compare the information you entered in items 1 and 2, above, to the Reduced User Fee Income Guidelines table

below. Find the “Size of Family Unit” equal to the number you entered in item 1. Next, find the column, which

represents where you reside (48 Contiguous States and DC and U.S. Territories…, Alaska or Hawaii). Compare

the Total Income you entered in item 2 to the number in the row and column that corresponds to your family unit

size and residence. For example, if you reside in one of the 48 contiguous states, and your family unit size from

item 1 above is 4, and your Total Income from item 2 above is $50,000, then you are qualified for a reduction of

the installment agreement user fee because your income is less than the $61,500 guideline amount.

4. If the total income you entered in item 2 is more than the amount shown for your family unit size and residence in

the Reduced User Fee Income Guidelines table below, you do not qualify for a reduction of the installment

agreement user fee.

5. If the total income you entered in item 2 is equal to or less than the amount shown for your family unit size and

residence in the Reduced User Fee Income Guidelines table below, you may qualify for a reduction of the

installment agreement user fee. If you qualify for a reduction of the user fee based on your income level, you must

sign and date the certification portion of this form and submit it to the IRS within 30 days from the date of the

Installment Agreement acceptance letter that you received. Applications submitted after the due date will not

be considered for qualification.

Reduced User Fee Income Guidelines

Size of Family Unit

48 Contiguous States and D.C., and U.S. Territories

Alaska

Hawaii

1

$30,150

$37,650

$34,650

2

$40,600

$50,725

$46,675

3

$51,050

$63,800

$58,700

4

$61,500

$76,875

$70,725

5

$71,950

$89,950

$82,750

6

$82,400

$103,025

$94,775

7

$92,850

$116,100

$106,800

8

$103,330

$129,175

$118,825

For each additional person, add

$10,450

$13,075

$12,025

Source: Based on 2017 US Dept of Health & Human Services Poverty Guidelines, Federal Register, Document Citation 82 FR 8831, January 26, 2017,

pp. 8831-8832.

Your name (Last, First, Middle Initial) (print)

Social Security Number (SSN) or Taxpayer Identification Number (TIN)

Spouse's name (Last, First, Middle Initial) (print)

Social Security Number (SSN) or Taxpayer Identification Number (TIN)

Certification: I certify under penalty of perjury that I am eligible for a reduction of the installment agreement user fee

based on my family unit size and income.

Your signature

Date

Spouse's signature (if it is a joint liability)

Date

13844

Catalog Number 49443R

Form

(Rev. 1-2018)

1

1