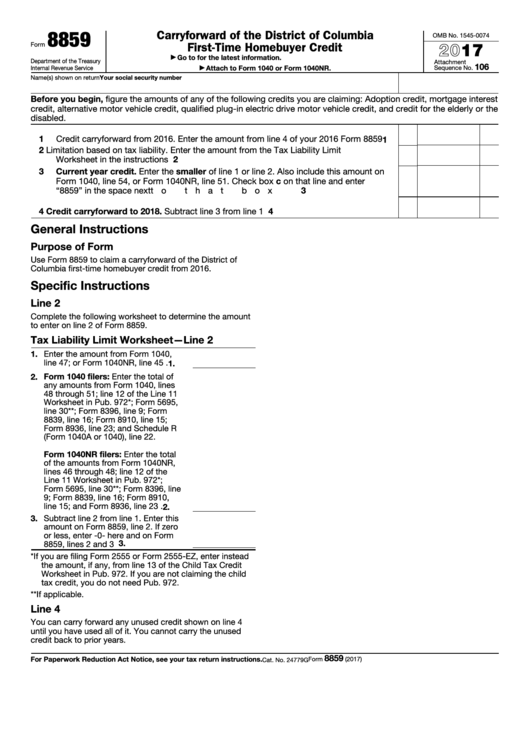

8859

Carryforward of the District of Columbia

OMB No. 1545-0074

2017

First-Time Homebuyer Credit

Form

Go to for the latest information.

▶

Department of the Treasury

Attachment

106

Internal Revenue Service

Attach to Form 1040 or Form 1040NR.

Sequence No.

▶

Name(s) shown on return

Your social security number

Before you begin, figure the amounts of any of the following credits you are claiming: Adoption credit, mortgage interest

credit, alternative motor vehicle credit, qualified plug-in electric drive motor vehicle credit, and credit for the elderly or the

disabled.

1

Credit carryforward from 2016. Enter the amount from line 4 of your 2016 Form 8859

1

2

Limitation based on tax liability. Enter the amount from the Tax Liability Limit

Worksheet in the instructions below . . . . . . . . . . . . . . . . . . .

2

3

Current year credit. Enter the smaller of line 1 or line 2. Also include this amount on

Form 1040, line 54, or Form 1040NR, line 51. Check box c on that line and enter

“8859” in the space next to that box

. . . . . . . . . . . . . . . . . .

3

4

Credit carryforward to 2018. Subtract line 3 from line 1 . . . . . . . . . . .

4

General Instructions

Purpose of Form

Use Form 8859 to claim a carryforward of the District of

Columbia first-time homebuyer credit from 2016.

Specific Instructions

Line 2

Complete the following worksheet to determine the amount

to enter on line 2 of Form 8859.

Tax Liability Limit Worksheet—Line 2

1. Enter the amount from Form 1040,

line 47; or Form 1040NR, line 45 .

1.

2. Form 1040 filers: Enter the total of

any amounts from Form 1040, lines

48 through 51; line 12 of the Line 11

Worksheet in Pub. 972*; Form 5695,

line 30**; Form 8396, line 9; Form

8839, line 16; Form 8910, line 15;

Form 8936, line 23; and Schedule R

(Form 1040A or 1040), line 22.

Form 1040NR filers: Enter the total

of the amounts from Form 1040NR,

lines 46 through 48; line 12 of the

Line 11 Worksheet in Pub. 972*;

Form 5695, line 30**; Form 8396, line

9; Form 8839, line 16; Form 8910,

line 15; and Form 8936, line 23

.

2.

3. Subtract line 2 from line 1. Enter this

amount on Form 8859, line 2. If zero

or less, enter -0- here and on Form

3.

8859, lines 2 and 3

. . . . .

*If you are filing Form 2555 or Form 2555-EZ, enter instead

the amount, if any, from line 13 of the Child Tax Credit

Worksheet in Pub. 972. If you are not claiming the child

tax credit, you do not need Pub. 972.

**If applicable.

Line 4

You can carry forward any unused credit shown on line 4

until you have used all of it. You cannot carry the unused

credit back to prior years.

8859

For Paperwork Reduction Act Notice, see your tax return instructions.

Form

(2017)

Cat. No. 24779G

1

1