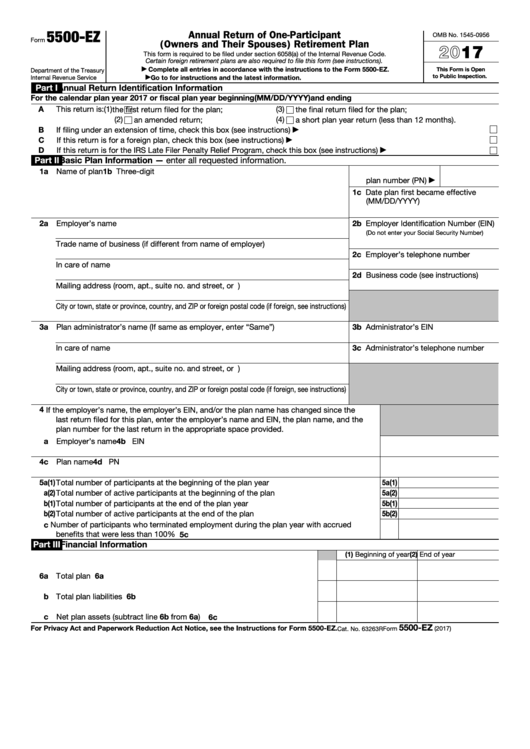

5500-EZ

Annual Return of One-Participant

OMB No. 1545-0956

Form

(Owners and Their Spouses) Retirement Plan

2017

This form is required to be filed under section 6058(a) of the Internal Revenue Code.

Certain foreign retirement plans are also required to file this form (see instructions).

Complete all entries in accordance with the instructions to the Form 5500-EZ.

This Form is Open

▶

Department of the Treasury

to Public Inspection.

Internal Revenue Service

Go to for instructions and the latest information.

▶

Part I

Annual Return Identification Information

For the calendar plan year 2017 or fiscal plan year beginning (MM/DD/YYYY)

and ending

A

This return is:

(1)

(3)

the first return filed for the plan;

the final return filed for the plan;

(2)

(4)

an amended return;

a short plan year return (less than 12 months).

B

If filing under an extension of time, check this box (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

C

If this return is for a foreign plan, check this box (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

D

If this return is for the IRS Late Filer Penalty Relief Program, check this box (see instructions) .

.

.

.

.

.

.

.

.

▶

Part II

Basic Plan Information — enter all requested information.

1a Name of plan

1b Three-digit

plan number (PN)

▶

1c Date plan first became effective

(MM/DD/YYYY)

2a Employer’s name

2b Employer Identification Number (EIN)

(Do not enter your Social Security Number)

Trade name of business (if different from name of employer)

2c Employer’s telephone number

In care of name

2d Business code (see instructions)

Mailing address (room, apt., suite no. and street, or P.O. box)

City or town, state or province, country, and ZIP or foreign postal code (if foreign, see instructions)

3a Plan administrator’s name (If same as employer, enter “Same”)

3b Administrator’s EIN

In care of name

3c Administrator’s telephone number

Mailing address (room, apt., suite no. and street, or P.O. box)

City or town, state or province, country, and ZIP or foreign postal code (if foreign, see instructions)

4

If the employer’s name, the employer’s EIN, and/or the plan name has changed since the

last return filed for this plan, enter the employer’s name and EIN, the plan name, and the

plan number for the last return in the appropriate space provided.

a Employer’s name

4b EIN

4c Plan name

4d PN

5a(1) Total number of participants at the beginning of the plan year

.

.

.

.

.

.

.

.

.

5a(1)

a(2) Total number of active participants at the beginning of the plan year

5a(2)

.

.

.

.

.

.

.

b(1) Total number of participants at the end of the plan year

.

.

.

.

.

.

.

.

.

.

.

5b(1)

b(2) Total number of active participants at the end of the plan year

.

.

.

.

.

.

.

.

.

5b(2)

c Number of participants who terminated employment during the plan year with accrued

benefits that were less than 100% vested .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5c

Part III

Financial Information

(1) Beginning of year

(2) End of year

6a Total plan assets

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6a

b Total plan liabilities .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6b

c Net plan assets (subtract line 6b from 6a)

.

.

.

.

.

.

.

.

.

.

.

6c

5500-EZ

For Privacy Act and Paperwork Reduction Act Notice, see the Instructions for Form 5500-EZ.

Cat. No. 63263R

Form

(2017)

1

1 2

2