10

Form 990-PF (2017)

Page

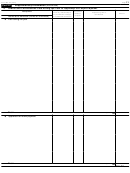

Part XIV

Private Operating Foundations (see instructions and Part VII-A, question 9)

1a

If the foundation has received a ruling or determination letter that it is a private operating

foundation, and the ruling is effective for 2017, enter the date of the ruling .

.

.

.

.

.

▶

b Check box to indicate whether the foundation is a private operating foundation described in section

4942(j)(3) or

4942(j)(5)

2a

Enter the lesser of the adjusted net

Tax year

Prior 3 years

(e) Total

income from Part I or the minimum

(a) 2017

(b) 2016

(c) 2015

(d) 2014

investment return from Part X for

each year listed .

.

.

.

.

.

.

b

85% of line 2a

.

.

.

.

.

.

.

c

Qualifying distributions from Part XII,

line 4 for each year listed .

.

.

.

d

Amounts included in line 2c not used directly

for active conduct of exempt activities .

.

e

Qualifying distributions made directly

for active conduct of exempt activities.

Subtract line 2d from line 2c

.

.

.

3

Complete 3a, b, or c for the

alternative test relied upon:

a

“Assets” alternative test—enter:

(1)

Value of all assets .

.

.

.

.

(2)

Value of assets qualifying under

section 4942(j)(3)(B)(i) .

.

.

.

b

“Endowment” alternative test—enter

/

2

3

of minimum investment return shown in

Part X, line 6 for each year listed .

.

.

c

“Support” alternative test—enter:

(1)

Total support other than gross

investment

income

(interest,

dividends, rents, payments on

securities

loans

(section

512(a)(5)), or royalties) .

.

.

.

(2)

Support

from

general

public

and

5

or

more

exempt

organizations

as

provided

in

section 4942(j)(3)(B)(iii) .

.

.

.

(3)

Largest amount of support from

an exempt organization

.

.

.

(4)

Gross investment income .

.

.

Part XV

Supplementary Information (Complete this part only if the foundation had $5,000 or more in assets at

any time during the year—see instructions.)

1

Information Regarding Foundation Managers:

a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation

before the close of any tax year (but only if they have contributed more than $5,000). (See section 507(d)(2).)

b List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the

ownership of a partnership or other entity) of which the foundation has a 10% or greater interest.

2

Information Regarding Contribution, Grant, Gift, Loan, Scholarship, etc., Programs:

Check here

if the foundation only makes contributions to preselected charitable organizations and does not accept

▶

unsolicited requests for funds. If the foundation makes gifts, grants, etc., to individuals or organizations under other conditions,

complete items 2a, b, c, and d. See instructions.

a The name, address, and telephone number or email address of the person to whom applications should be addressed:

b The form in which applications should be submitted and information and materials they should include:

c Any submission deadlines:

d Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or other

factors:

990-PF

Form

(2017)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13