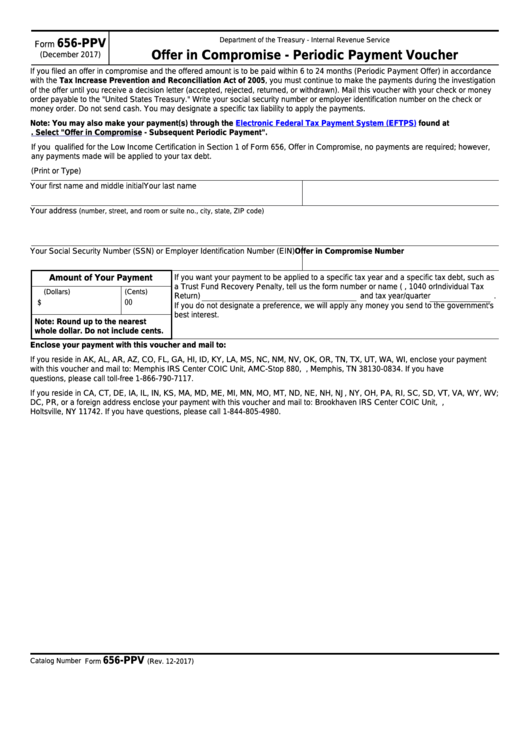

Department of the Treasury - Internal Revenue Service

656-PPV

Form

Offer in Compromise - Periodic Payment Voucher

(December 2017)

If you filed an offer in compromise and the offered amount is to be paid within 6 to 24 months (Periodic Payment Offer) in accordance

with the Tax Increase Prevention and Reconciliation Act of 2005, you must continue to make the payments during the investigation

of the offer until you receive a decision letter (accepted, rejected, returned, or withdrawn). Mail this voucher with your check or money

order payable to the "United States Treasury." Write your social security number or employer identification number on the check or

money order. Do not send cash. You may designate a specific tax liability to apply the payments.

Note: You may also make your payment(s) through the

Electronic Federal Tax Payment System (EFTPS)

found at

https:// Select "Offer in Compromise - Subsequent Periodic Payment".

If you qualified for the Low Income Certification in Section 1 of Form 656, Offer in Compromise, no payments are required; however,

any payments made will be applied to your tax debt.

(Print or Type)

Your first name and middle initial

Your last name

Your address

(number, street, and room or suite no., city, state, ZIP code)

Your Social Security Number (SSN) or Employer Identification Number (EIN)

Offer in Compromise Number

Amount of Your Payment

If you want your payment to be applied to a specific tax year and a specific tax debt, such as

a Trust Fund Recovery Penalty, tell us the form number or name (i.e., 1040 or Individual Tax

(Dollars)

(Cents)

Return)

and tax year/quarter

.

$

00

If you do not designate a preference, we will apply any money you send to the government's

best interest.

Note: Round up to the nearest

whole dollar. Do not include cents.

Enclose your payment with this voucher and mail to:

If you reside in AK, AL, AR, AZ, CO, FL, GA, HI, ID, KY, LA, MS, NC, NM, NV, OK, OR, TN, TX, UT, WA, WI, enclose your payment

with this voucher and mail to: Memphis IRS Center COIC Unit, AMC-Stop 880, P.O. Box 30834, Memphis, TN 38130-0834. If you have

questions, please call toll-free 1-866-790-7117.

If you reside in CA, CT, DE, IA, IL, IN, KS, MA, MD, ME, MI, MN, MO, MT, ND, NE, NH, NJ, NY, OH, PA, RI, SC, SD, VT, VA, WY, WV;

DC, PR, or a foreign address enclose your payment with this voucher and mail to: Brookhaven IRS Center COIC Unit, P.O. Box 9011,

Holtsville, NY 11742. If you have questions, please call 1-844-805-4980.

656-PPV

Catalog Number 31131Y

Form

(Rev. 12-2017)

1

1