Instructions For Form 8940 - Request For Miscellaneous Determination Under Section 507, 509(A), 4940, 4942, 4945, And 6033 Of The Internal Revenue Code Page 5

ADVERTISEMENT

Also check this box if you are a

requests section 509(a)(3) classification or

private foundation status. See line 8h for

nonexempt charitable trust described in

reclassification must check the boxes for

procedures.

section 4947(a)(1) and are requesting an

both line 8f and line 8g. See Table 2 for

initial determination that you are described

details.

in section 509(a)(3).

A private foundation that wishes to

An organization that is not currently

become a public charity does not check

classified under section 509(a)(3) and

this box but instead must terminate its

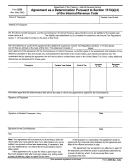

Table 2. Reclassification of Foundation Status

Type of reclassification

Documentation required to support the reclassification

Request for reclassification as a church or a convention or

Submit a completed Form 1023 Schedule A—Churches. Review the Instructions for Form 1023

association of churches under sections 509(a)(1) and

for guidance in completing Schedule A.

170(b)(1)(A)(i)

Request for reclassification as a school, college, or

Submit a completed Form 1023 Schedule B—Schools, Colleges, and Universities. Review the

university under sections 509(a)(1) and 170(b)(1)(A)(ii)

Instructions for Form 1023 for guidance in completing Schedule B.

Request for reclassification as a hospital or medical

Submit a completed Form 1023 Schedule C—Hospitals and Medical Research Organizations.

research organization under sections 509(a)(1) and 170(b)

Review the instructions to Form 1023 for guidance in completing Schedule C.

(1)(A)(iii)

Request for reclassification as an organization operated

Submit a completed Schedule A (Form 990 or 990-EZ), Parts I and II.

for the benefit of a college or university owned or operated

by a governmental unit, as described in sections 509(a)(1)

Submit documentation from your bylaws or other organizational documents indicating that you are

and 170(b)(1)(A)(iv)

organized and operated exclusively to receive, hold, invest, and administer property and to make

expenditures to or for the benefit of a college or university described in section 170(b)(1)(A)(ii).

Also, submit information showing that such college or university is an agency or instrumentality of

a state or political subdivision thereof, or is owned or operated by a state or political subdivision

thereof, or by an agency or instrumentality of one or more States or political subdivisions.

Request for reclassification as an organization that

Submit either:

normally receives a substantial part of its support from a

1.

A copy of your signed Form 990, Parts I through XI, or Form 990-EZ, Parts I through VI,

governmental unit or from the general public described in

with the completed Schedule A (Form 990 or 990-EZ), Public Charity Status and Public Support,

sections 509(a)(1) and 170(b)(1)(A)(vi)

as filed with the IRS for the tax year immediately preceding the tax year in which this request is

made; or

2.

Your support information for the past 5 completed tax years, using your overall method of

accounting used to complete the Form 990 or Form 990-EZ for such years. This information may

be provided to the IRS on a completed Schedule A (Form 990 or 990-EZ), Public Charity Status

and Public Support, to the most recent version of Form 990 or Form 990-EZ.

Submit also a list showing the name of and amount contributed by each person (other than a

governmental unit or an organization described in section 170(b)(1)(A)(vi), including a public

charity that actually qualifies under section 170(b)(1)(A)(vi) but claims or is recognized under a

different public charity status, such as a church or a hospital) whose total gifts for the past 5

completed tax years exceeded 2% of your total support for this period, as described in

Regulations section 1.170A-9T(f)(6) and (7). A “person” includes an organization as well as an

individual. Also state the sum of these excess amounts (this amount is reported on Schedule A

(Form 990 or 990-EZ), Part II, Section A, line 6).

Request for reclassification as an agricultural research

To demonstrate how you meet the requirements for reclassification as an agricultural research

organization under sections 509(a)(1) and 170(b)(1)(A)(ix)

organization, please submit the following.

1.

Your current foundation classification.

2.

A statement requesting a change in foundation classification to sections 509(a)(1) and

170(b)(1)(A)(ix).

3.

Information demonstrating how you are operated in conjunction with a land grant college

or university or a non-land grant college of agriculture (as defined in section 1404 of the

Agricultural Research, Extension, and Teaching Policy Act of 1977).

4.

Information detailing your agricultural research program and how contributions to such

program will be spent.

Instructions for Form 8940 (2018)

-5-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8