Instructions For Form 8940 - Request For Miscellaneous Determination Under Section 507, 509(A), 4940, 4942, 4945, And 6033 Of The Internal Revenue Code Page 7

ADVERTISEMENT

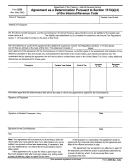

Type of reclassification

Documentation required to support the reclassification

Request for reclassification as a private foundation, as

Submit a completed Schedule A (Form 990 or 990-EZ), Parts II and III. This will assist the IRS in

described in section 509(a)

determining whether or not you are normally publicly supported under either sections 509(a)(1)

and 170(b)(1)(A)(vi) or under section 509(a)(2).

Submit a statement indicating your requested effective date of reclassification as a private

foundation. Also, show how you meet the governing instrument requirements of section 501(e).

See Rev. Rul. 75-38, 1975-1 C.B. 161.

Private foundations are required under section 4945(g) to obtain advance approval of their

grant-making procedures related to scholarships, fellowships, prizes, awards, or other specified

grants to achieve a specific objective, produce a report or similar product, or enhance certain

capacities, skills, or talents of a grantee. If you are requesting reclassification as a private

foundation and conduct, or will conduct, grant-making activities described under section 4945(g),

submit a statement to that effect and submit a separate Form 8940 for line 8c.

Request for reclassification as a private operating

Submit a completed Form 990-PF, Part XIV—Private Operating Foundations. This will assist the

foundation, as described in section 4942(j)(3)

IRS in determining whether you satisfy the following financial tests which are necessary for

classification as a private operating foundation.

The Income Test (Regulations section 53.4942(b)-1(a)), and one of the following three

Alternative Tests.

• The Assets Test (Regulations section 53.4942(b)-2(a)),

• The Endowment Test (Regulations section 53.4942(b)-2(b)), or

• The Support Test (Regulations section 53.4942(b)-2(c)).

A private operating foundation must make direct qualifying distributions to be used for the active

conduct of the operating foundation's own programs or activities. These activities must be

conducted by the foundation rather than by or through one or more grantee organizations that

receive distributions directly or indirectly from the foundation.

Regulations section 53.4942(b)-1(a) lists several types of expenses that are considered direct

qualifying distributions for the active conduct of an operating foundation's exempt activities.

Submit a listing and description of your distributions that details whether your distributions are

used directly for the active conduct of your own programs or activities.

Also, provide a statement describing any adverse impact if you do not receive the requested

status.

If you are changing from public charity to private foundation, then also provide the documentation

required for a request for a reclassification as a private foundation described in section 509(a).

Request for reclassification as an exempt operating

Section 4940(d) provides that the term “exempt operating foundation,” with respect to any tax

foundation, as described in section 4940(d)(2)

year, applies to any private foundation if:

Such foundation is an operating foundation, as defined in section 4942(j)(3);

Such foundation has been publicly supported under section 170(b)(1)(A)(vi) or 509(a)(2) for at

least 10 years, or under section 302(c)(3) of the Tax Reform Act of 1984, Public Law 98-369, such

foundation was an operating foundation, as defined in section 4942(j)(3) as of January 1, 1983;

At all times during the tax year, the governing body of such foundation (i) consists of

individuals at least 75% of whom are not disqualified individuals, as defined in section 4940(d)(3)

(B), and (ii) is broadly representative of the general public; and

At no time during the year does such foundation have an officer who is a disqualified individual.

Submit documentation showing that you meet the requirements for classification as an operating

foundation, as defined in section 4942(j)(3). Refer to the instructions above regarding a request

for reclassification as a private operating foundation, as described in section 4942(j)(3).

Submit documentation indicating whether or not you have been publicly supported under section

170(b)(1)(A)(vi) or 509(a)(2) for at least 10 years, or documentation that you were an operating

foundation, as defined in section 4942(j)(3) as of January 1, 1983.

Submit a listing of your governing body, indicating whether at least 75% of whom are not

disqualified individuals, as defined in section 4940(d)(3)(B), and are broadly representative of the

general public.

Submit a statement indicating whether at any time during the year you had an officer who is a

disqualified individual.

If you are changing from public charity to private foundation, then also provide the documentation

required for a request for reclassification as a private foundation described in section 509(a).

foundation status and become a public

but that actually qualified and has

Line 8h. Termination of private founda-

charity. An organization may terminate its

continued to qualify as a public charity

tion status under section 507(b)(1)

private foundation status under section

may request retroactive reclassification as

(B)—advance ruling or notice of termi-

507(b)(1)(B) if it meets the requirements of

a public charity instead of terminating

nation. Check this box if you are

section 509(a)(1), (2), or (3)) for a

private foundation status under section

requesting an advance ruling on

continuous 60-month period beginning

507(b)(1)(B). The organization must

termination of your private foundation

with the first day of any tax year, and

demonstrate that it has continuously

status under section 507(1)(B) or are

notifies the IRS before beginning the

qualified as a public charity.

providing notice of such termination. If you

60-month period that it is terminating its

are only providing notice and not

An organization that wishes to

private foundation status.

requesting an advance ruling, write

terminate its private foundation status

“Notice Only” on line 8h of the Form 8940.

under section 507(b)(1)(B) is not required

Note. An organization that erroneously

to obtain an advance ruling, but merely to

Section 507(b)(1)(B) allows a private

determined that it was a private foundation

provide notice of intent to terminate and

foundation to terminate its private

Instructions for Form 8940 (2018)

-7-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8