Instructions For Form 8844 - Empowerment Zone Employment Credit - 2017

ADVERTISEMENT

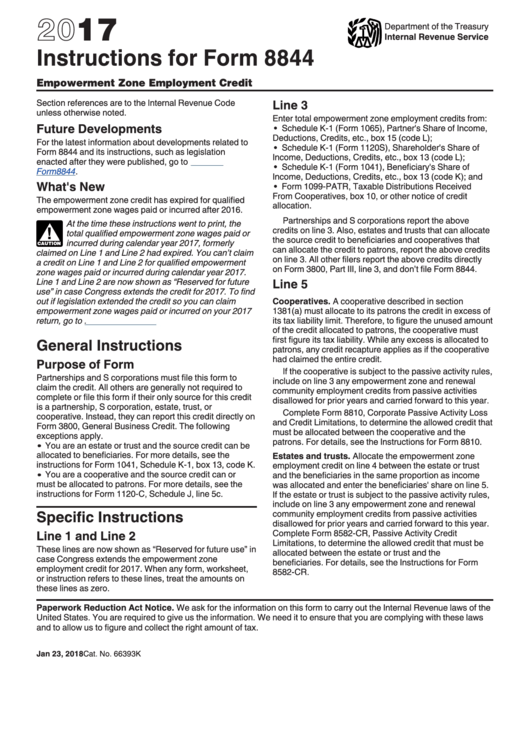

2017

Department of the Treasury

Internal Revenue Service

Instructions for Form 8844

Empowerment Zone Employment Credit

Line 3

Section references are to the Internal Revenue Code

unless otherwise noted.

Enter total empowerment zone employment credits from:

Future Developments

Schedule K-1 (Form 1065), Partner's Share of Income,

Deductions, Credits, etc., box 15 (code L);

For the latest information about developments related to

Schedule K-1 (Form 1120S), Shareholder's Share of

Form 8844 and its instructions, such as legislation

Income, Deductions, Credits, etc., box 13 (code L);

enacted after they were published, go to

IRS.gov/

Schedule K-1 (Form 1041), Beneficiary's Share of

Form8844.

Income, Deductions, Credits, etc., box 13 (code K); and

What's New

Form 1099-PATR, Taxable Distributions Received

From Cooperatives, box 10, or other notice of credit

The empowerment zone credit has expired for qualified

allocation.

empowerment zone wages paid or incurred after 2016.

Partnerships and S corporations report the above

At the time these instructions went to print, the

credits on line 3. Also, estates and trusts that can allocate

total qualified empowerment zone wages paid or

!

the source credit to beneficiaries and cooperatives that

incurred during calendar year 2017, formerly

CAUTION

can allocate the credit to patrons, report the above credits

claimed on Line 1 and Line 2 had expired. You can’t claim

on line 3. All other filers report the above credits directly

a credit on Line 1 and Line 2 for qualified empowerment

on Form 3800, Part III, line 3, and don’t file Form 8844.

zone wages paid or incurred during calendar year 2017.

Line 1 and Line 2 are now shown as “Reserved for future

Line 5

use” in case Congress extends the credit for 2017. To find

out if legislation extended the credit so you can claim

Cooperatives. A cooperative described in section

empowerment zone wages paid or incurred on your 2017

1381(a) must allocate to its patrons the credit in excess of

return, go to IRS.gov/Extenders.

its tax liability limit. Therefore, to figure the unused amount

of the credit allocated to patrons, the cooperative must

first figure its tax liability. While any excess is allocated to

General Instructions

patrons, any credit recapture applies as if the cooperative

had claimed the entire credit.

Purpose of Form

If the cooperative is subject to the passive activity rules,

Partnerships and S corporations must file this form to

include on line 3 any empowerment zone and renewal

claim the credit. All others are generally not required to

community employment credits from passive activities

complete or file this form if their only source for this credit

disallowed for prior years and carried forward to this year.

is a partnership, S corporation, estate, trust, or

Complete Form 8810, Corporate Passive Activity Loss

cooperative. Instead, they can report this credit directly on

and Credit Limitations, to determine the allowed credit that

Form 3800, General Business Credit. The following

must be allocated between the cooperative and the

exceptions apply.

patrons. For details, see the Instructions for Form 8810.

You are an estate or trust and the source credit can be

allocated to beneficiaries. For more details, see the

Estates and trusts. Allocate the empowerment zone

instructions for Form 1041, Schedule K-1, box 13, code K.

employment credit on line 4 between the estate or trust

You are a cooperative and the source credit can or

and the beneficiaries in the same proportion as income

must be allocated to patrons. For more details, see the

was allocated and enter the beneficiaries' share on line 5.

instructions for Form 1120-C, Schedule J, line 5c.

If the estate or trust is subject to the passive activity rules,

include on line 3 any empowerment zone and renewal

Specific Instructions

community employment credits from passive activities

disallowed for prior years and carried forward to this year.

Line 1 and Line 2

Complete Form 8582-CR, Passive Activity Credit

Limitations, to determine the allowed credit that must be

These lines are now shown as “Reserved for future use” in

allocated between the estate or trust and the

case Congress extends the empowerment zone

beneficiaries. For details, see the Instructions for Form

employment credit for 2017. When any form, worksheet,

8582-CR.

or instruction refers to these lines, treat the amounts on

these lines as zero.

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the

United States. You are required to give us the information. We need it to ensure that you are complying with these laws

and to allow us to figure and collect the right amount of tax.

Jan 23, 2018

Cat. No. 66393K

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2