Instructions For Schedule A (Form 1040) - Itemized Deductions - 2017

ADVERTISEMENT

Department of the Treasury

Internal Revenue Service

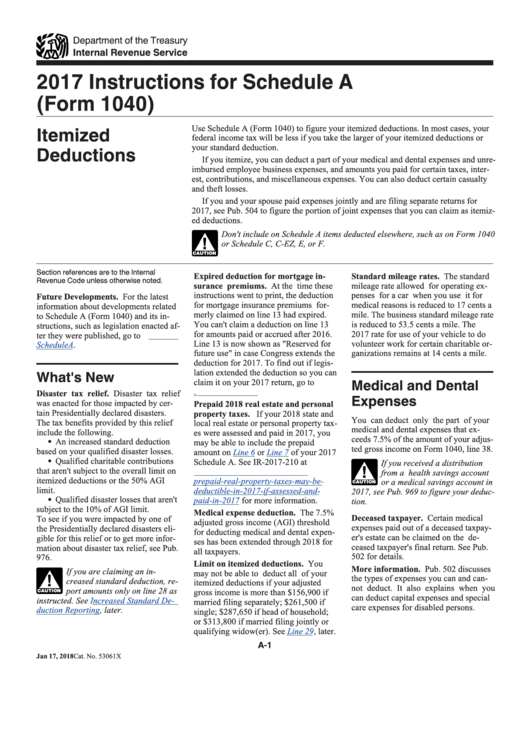

2017 Instructions for Schedule A

(Form 1040)

Itemized

Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your

federal income tax will be less if you take the larger of your itemized deductions or

Deductions

your standard deduction.

If you itemize, you can deduct a part of your medical and dental expenses and unre-

imbursed employee business expenses, and amounts you paid for certain taxes, inter-

est, contributions, and miscellaneous expenses. You can also deduct certain casualty

and theft losses.

If you and your spouse paid expenses jointly and are filing separate returns for

2017, see Pub. 504 to figure the portion of joint expenses that you can claim as itemiz-

ed deductions.

Don't include on Schedule A items deducted elsewhere, such as on Form 1040

!

or Schedule C, C-EZ, E, or F.

CAUTION

Section references are to the Internal

Expired deduction for mortgage in-

Standard mileage rates. The standard

Revenue Code unless otherwise noted.

surance premiums. At the time these

mileage rate allowed for operating ex-

instructions went to print, the deduction

penses for a car when you use it for

Future Developments. For the latest

for mortgage insurance premiums for-

medical reasons is reduced to 17 cents a

information about developments related

merly claimed on line 13 had expired.

mile. The business standard mileage rate

to Schedule A (Form 1040) and its in-

You can't claim a deduction on line 13

is reduced to 53.5 cents a mile. The

structions, such as legislation enacted af-

for amounts paid or accrued after 2016.

2017 rate for use of your vehicle to do

ter they were published, go to

IRS.gov/

Line 13 is now shown as "Reserved for

volunteer work for certain charitable or-

ScheduleA.

future use" in case Congress extends the

ganizations remains at 14 cents a mile.

deduction for 2017. To find out if legis-

What's New

lation extended the deduction so you can

Medical and Dental

claim it on your 2017 return, go to

IRS.gov/Extenders.

Disaster tax relief. Disaster tax relief

Expenses

was enacted for those impacted by cer-

Prepaid 2018 real estate and personal

tain Presidentially declared disasters.

property taxes. If your 2018 state and

You can deduct only the part of your

The tax benefits provided by this relief

local real estate or personal property tax-

medical and dental expenses that ex-

include the following.

es were assessed and paid in 2017, you

ceeds 7.5% of the amount of your adjus-

An increased standard deduction

may be able to include the prepaid

ted gross income on Form 1040, line 38.

based on your qualified disaster losses.

amount on

Line 6

or

Line 7

of your 2017

Qualified charitable contributions

Schedule

A.

See

IR-2017-210

at

If you received a distribution

that aren't subject to the overall limit on

IRS.gov/Newsroom/irs-advisory-

!

from a health savings account

itemized deductions or the 50% AGI

prepaid-real-property-taxes-may-be-

or a medical savings account in

CAUTION

limit.

deductible-in-2017-if-assessed-and-

2017, see Pub. 969 to figure your deduc-

Qualified disaster losses that aren't

paid-in-2017

for more information.

tion.

subject to the 10% of AGI limit.

Medical expense deduction. The 7.5%

Deceased taxpayer. Certain medical

To see if you were impacted by one of

adjusted gross income (AGI) threshold

expenses paid out of a deceased taxpay-

the Presidentially declared disasters eli-

for deducting medical and dental expen-

er's estate can be claimed on the de-

gible for this relief or to get more infor-

ses has been extended through 2018 for

ceased taxpayer's final return. See Pub.

mation about disaster tax relief, see Pub.

all taxpayers.

502 for details.

976.

Limit on itemized deductions. You

More information. Pub. 502 discusses

If you are claiming an in-

may not be able to deduct all of your

the types of expenses you can and can-

!

creased standard deduction, re-

itemized deductions if your adjusted

not deduct. It also explains when you

port amounts only on line 28 as

gross income is more than $156,900 if

CAUTION

can deduct capital expenses and special

instructed. See

Increased Standard De-

married filing separately; $261,500 if

care expenses for disabled persons.

duction

Reporting, later.

single; $287,650 if head of household;

or $313,800 if married filing jointly or

qualifying widow(er). See

Line

29, later.

A-1

Jan 17, 2018

Cat. No. 53061X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18