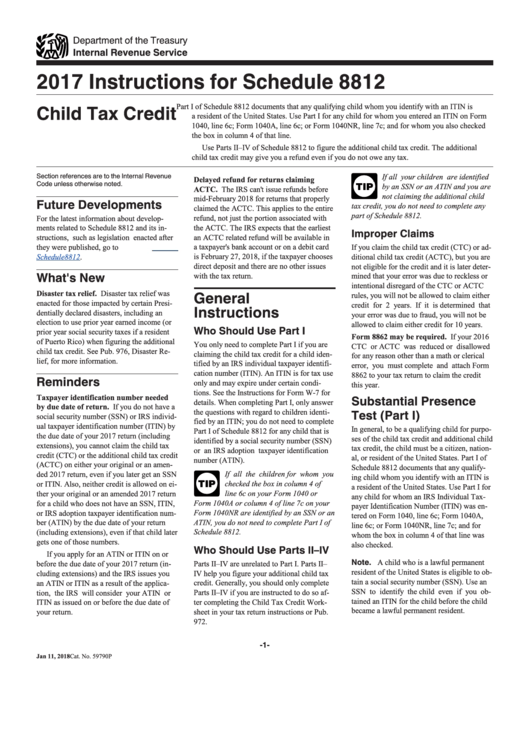

Instructions For Schedule 8812 - Child Tax Credit - 2017

ADVERTISEMENT

Department of the Treasury

Internal Revenue Service

2017 Instructions for Schedule 8812

Child Tax Credit

Part I of Schedule 8812 documents that any qualifying child whom you identify with an ITIN is

a resident of the United States. Use Part I for any child for whom you entered an ITIN on Form

1040, line 6c; Form 1040A, line 6c; or Form 1040NR, line 7c; and for whom you also checked

the box in column 4 of that line.

Use Parts II–IV of Schedule 8812 to figure the additional child tax credit. The additional

child tax credit may give you a refund even if you do not owe any tax.

Section references are to the Internal Revenue

If all your children are identified

Delayed refund for returns claiming

Code unless otherwise noted.

by an SSN or an ATIN and you are

TIP

ACTC. The IRS can't issue refunds before

not claiming the additional child

mid-February 2018 for returns that properly

Future Developments

tax credit, you do not need to complete any

claimed the ACTC. This applies to the entire

part of Schedule 8812.

For the latest information about develop-

refund, not just the portion associated with

ments related to Schedule 8812 and its in-

the ACTC. The IRS expects that the earliest

Improper Claims

an ACTC related refund will be available in

structions, such as legislation enacted after

a taxpayer's bank account or on a debit card

they were published, go to

IRS.gov/

If you claim the child tax credit (CTC) or ad-

is February 27, 2018, if the taxpayer chooses

Schedule8812.

ditional child tax credit (ACTC), but you are

direct deposit and there are no other issues

not eligible for the credit and it is later deter-

What's New

with the tax return.

mined that your error was due to reckless or

intentional disregard of the CTC or ACTC

General

Disaster tax relief. Disaster tax relief was

rules, you will not be allowed to claim either

enacted for those impacted by certain Presi-

Instructions

credit for 2 years. If it is determined that

dentially declared disasters, including an

your error was due to fraud, you will not be

election to use prior year earned income (or

allowed to claim either credit for 10 years.

Who Should Use Part I

prior year social security taxes if a resident

Form 8862 may be required. If your 2016

of Puerto Rico) when figuring the additional

You only need to complete Part I if you are

CTC or ACTC was reduced or disallowed

child tax credit. See Pub. 976, Disaster Re-

claiming the child tax credit for a child iden-

for any reason other than a math or clerical

lief, for more information.

tified by an IRS individual taxpayer identifi-

error, you must complete and attach Form

cation number (ITIN). An ITIN is for tax use

8862 to your tax return to claim the credit

Reminders

only and may expire under certain condi-

this year.

tions. See the Instructions for Form W-7 for

Substantial Presence

Taxpayer identification number needed

details. When completing Part I, only answer

by due date of return. If you do not have a

Test (Part I)

the questions with regard to children identi-

social security number (SSN) or IRS individ-

fied by an ITIN; you do not need to complete

ual taxpayer identification number (ITIN) by

In general, to be a qualifying child for purpo-

Part I of Schedule 8812 for any child that is

the due date of your 2017 return (including

ses of the child tax credit and additional child

identified by a social security number (SSN)

extensions), you cannot claim the child tax

tax credit, the child must be a citizen, nation-

or an IRS adoption taxpayer identification

credit (CTC) or the additional child tax credit

al, or resident of the United States. Part I of

number (ATIN).

(ACTC) on either your original or an amen-

Schedule 8812 documents that any qualify-

If all the children for whom you

ded 2017 return, even if you later get an SSN

ing child whom you identify with an ITIN is

checked the box in column 4 of

or ITIN. Also, neither credit is allowed on ei-

TIP

a resident of the United States. Use Part I for

line 6c on your Form 1040 or

ther your original or an amended 2017 return

any child for whom an IRS Individual Tax-

Form 1040A or column 4 of line 7c on your

for a child who does not have an SSN, ITIN,

payer Identification Number (ITIN) was en-

Form 1040NR are identified by an SSN or an

or IRS adoption taxpayer identification num-

tered on Form 1040, line 6c; Form 1040A,

ber (ATIN) by the due date of your return

ATIN, you do not need to complete Part I of

line 6c; or Form 1040NR, line 7c; and for

Schedule 8812.

(including extensions), even if that child later

whom the box in column 4 of that line was

gets one of those numbers.

also checked.

Who Should Use Parts II–IV

If you apply for an ATIN or ITIN on or

Note. A child who is a lawful permanent

Parts II–IV are unrelated to Part I. Parts II–

before the due date of your 2017 return (in-

resident of the United States is eligible to ob-

IV help you figure your additional child tax

cluding extensions) and the IRS issues you

tain a social security number (SSN). Use an

an ATIN or ITIN as a result of the applica-

credit. Generally, you should only complete

SSN to identify the child even if you ob-

tion, the IRS will consider your ATIN or

Parts II–IV if you are instructed to do so af-

tained an ITIN for the child before the child

ITIN as issued on or before the due date of

ter completing the Child Tax Credit Work-

became a lawful permanent resident.

sheet in your tax return instructions or Pub.

your return.

972.

-1-

Jan 11, 2018

Cat. No. 59790P

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5