Form Mc 1054 - Share-Of-Cost Medi-Cal Provider Letter

ADVERTISEMENT

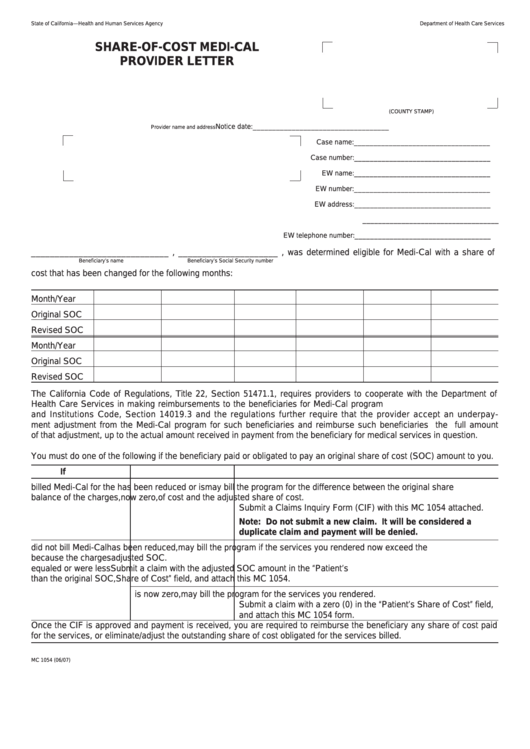

State of California—Health and Human Services Agency

Department of Health Care Services

SHARE-OF-COST MEDI-CAL

PROVIDER LETTER

(COUNTY STAMP)

Notice date:

___________________________________

Provider name and address

Case name:

___________________________________

Case number:

___________________________________

EW name:

___________________________________

EW number:

___________________________________

EW address:

___________________________________

___________________________________

EW telephone number:

___________________________________

_____________________________ , _____________________ , was determined eligible for Medi-Cal with a share of

Beneficiary’s name

Beneficiary’s Social Security number

cost that has been changed for the following months:

Month/Year

Original SOC

Revised SOC

Month/Year

Original SOC

Revised SOC

The California Code of Regulations, Title 22, Section 51471.1, requires providers to cooperate with the Department of

Health Care Services in making reimbursements to the beneficiaries for Medi-Cal program underpayments. The Welfare

and Institutions Code, Section 14019.3 and the regulations further require that the provider accept an underpay-

ment adjustment from the Medi-Cal program for such beneficiaries and reimburse such beneficiaries the full amount

of that adjustment, up to the actual amount received in payment from the beneficiary for medical services in question.

You must do one of the following if the beneficiary paid or obligated to pay an original share of cost (SOC) amount to you.

If you...

And the share of cost...

Then you...

billed Medi-Cal for the

has been reduced or is

may bill the program for the difference between the original share

balance of the charges,

now zero,

of cost and the adjusted share of cost.

Submit a Claims Inquiry Form (CIF) with this MC 1054 attached.

Note: Do not submit a new claim. It will be considered a

duplicate claim and payment will be denied.

did not bill Medi-Cal

has been reduced,

may bill the program if the services you rendered now exceed the

because the charges

adjusted SOC.

equaled or were less

Submit a claim with the adjusted SOC amount in the “Patient’s

than the original SOC,

Share of Cost” field, and attach this MC 1054.

is now zero,

may bill the program for the services you rendered.

Submit a claim with a zero (0) in the “Patient’s Share of Cost” field,

and attach this MC 1054 form.

Once the CIF is approved and payment is received, you are required to reimburse the beneficiary any share of cost paid

for the services, or eliminate/adjust the outstanding share of cost obligated for the services billed.

MC 1054 (06/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1