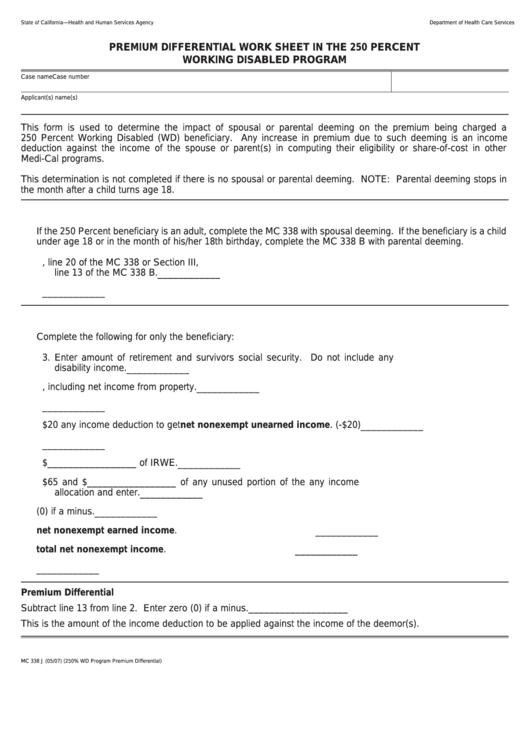

Form Mc 338 J - Premium Differential Work Sheet In The 250 Percent Working Disabled Program

ADVERTISEMENT

State of California—Health and Human Services Agency

Department of Health Care Services

PREMIUM DIFFERENTIAL WORK SHEET IN THE 250 PERCENT

WORKING DISABLED PROGRAM

Case name

Case number

Applicant(s) name(s)

This form is used to determine the impact of spousal or parental deeming on the premium being charged a

250 Percent Working Disabled (WD) beneficiary. Any increase in premium due to such deeming is an income

deduction against the income of the spouse or parent(s) in computing their eligibility or share-of-cost in other

Medi-Cal programs.

This determination is not completed if there is no spousal or parental deeming. NOTE: Parental deeming stops in

the month after a child turns age 18.

I. Premium Based on Spousal or Parental Deeming

If the 250 Percent beneficiary is an adult, complete the MC 338 with spousal deeming. If the beneficiary is a child

under age 18 or in the month of his/her 18th birthday, complete the MC 338 B with parental deeming.

1. Enter total countable income from Section I, line 20 of the MC 338 or Section III,

line 13 of the MC 338 B.

____________

2. Enter the amount of the premium based on income on line 1.

____________

II. Premium Without Spousal or Parental Deeming

Complete the following for only the beneficiary:

3. Enter amount of retirement and survivors social security. Do not include any

disability income.

____________

4. Enter any other unearned income, including net income from property.

____________

5. Add lines 3 and 4.

____________

6. Subtract the $20 any income deduction to get net nonexempt unearned income. (-$20)

____________

7. Enter gross earned income.

____________

8. Subtract $_________________ of IRWE.

____________

9. Add $65 and $_________________ of any unused portion of the any income

allocation and enter.

____________

10. Subtract line 9 from line 8. Enter zero (0) if a minus.

____________

11. Divide line 10 by 2 to get net nonexempt earned income.

____________

12. Add amount from line 6 to get total net nonexempt income.

____________

13. Enter premium amount based on line 12.

____________

Premium Differential

Subtract line 13 from line 2. Enter zero (0) if a minus.

___________________

This is the amount of the income deduction to be applied against the income of the deemor(s).

MC 338 J (05/07) (250% WD Program Premium Differential)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1