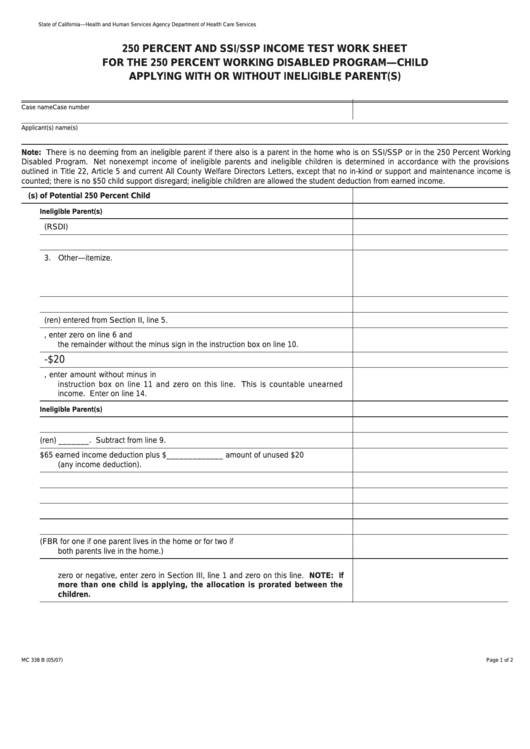

Form Mc 338 B - 250 Percent And Ssi/ssp Income Test Work Sheet For The 250 Percent Working Disabled Program-Child Applying With Or Without Ineligible Parent(S)

ADVERTISEMENT

State of California—Health and Human Services Agency

Department of Health Care Services

250 PERCENT AND SSI/SSP INCOME TEST WORK SHEET

FOR THE 250 PERCENT WORKING DISABLED PROGRAM—CHILD

APPLYING WITH OR WITHOUT INELIGIBLE PARENT(S)

Case name

Case number

Applicant(s) name(s)

Note: There is no deeming from an ineligible parent if there also is a parent in the home who is on SSI/SSP or in the 250 Percent Working

Disabled Program. Net nonexempt income of ineligible parents and ineligible children is determined in accordance with the provisions

outlined in Title 22, Article 5 and current All County Welfare Directors Letters, except that no in-kind or support and maintenance income is

counted; there is no $50 child support disregard; ineligible children are allowed the student deduction from earned income.

I. Income of Ineligible Parent(s) of Potential 250 Percent Child

A.

Nonexempt Unearned Income

Ineligible Parent(s)

1. Social Security (RSDI)

2. Net income from property

3. Other—itemize.

4. Add lines 1 through 3.

5. Allocation to ineligible child(ren) entered from Section II, line 5.

6. Remainder. Subtract line 5 from line 4. If minus amount, enter zero on line 6 and

the remainder without the minus sign in the instruction box on line 10.

-$20

7. Any income deduction.

8. Remainder. Subtract line 7 from line 6. If minus, enter amount without minus in

instruction box on line 11 and zero on this line. This is countable unearned

income. Enter on line 14.

B.

Nonexempt Earned Income

Ineligible Parent(s)

9. Gross earned income.

10. Unused portion of allocation to ineligible child(ren) _______. Subtract from line 9.

11. Add $65 earned income deduction plus $_____________ amount of unused $20

(any income deduction).

12. Subtract line 11 from line 10.

13. Divide by 2 to get countable earned income.

14. This is countable unearned income from line 8.

15. Add lines 13 and 14.

16. Enter parental deduction. (FBR for one if one parent lives in the home or for two if

both parents live in the home.)

17. Subtract line 16 from line 15 for the Allocation to Potential 250 Percent child. If

zero or negative, enter zero in Section III, line 1 and zero on this line. NOTE: If

more than one child is applying, the allocation is prorated between the

children.

MC 338 B (05/07)

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2