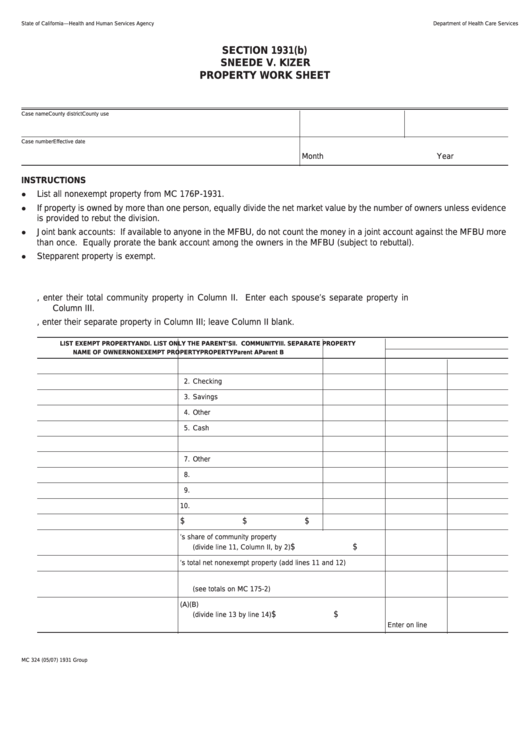

Form Mc 324 - Section 1931(B) Sneede V. Kizer Property Work Sheet

ADVERTISEMENT

State of California—Health and Human Services Agency

Department of Health Care Services

SECTION 1931(b)

SNEEDE V. KIZER

PROPERTY WORK SHEET

Case name

County district

County use

Case number

Effective date

Month

Year

INSTRUCTIONS

List all nonexempt property from MC 176P-1931.

If property is owned by more than one person, equally divide the net market value by the number of owners unless evidence

is provided to rebut the division.

Joint bank accounts: If available to anyone in the MFBU, do not count the money in a joint account against the MFBU more

than once. Equally prorate the bank account among the owners in the MFBU (subject to rebuttal).

Stepparent property is exempt.

I. ALLOCATION FROM SPOUSE/PARENT

A. For a married couple, enter their total community property in Column II. Enter each spouse’s separate property in

Column III.

B. For an unmarried couple or a single parent, enter their separate property in Column III; leave Column II blank.

LIST EXEMPT PROPERTY AND

I. LIST ONLY THE PARENT’S

II. COMMUNITY

III. SEPARATE PROPERTY

NAME OF OWNER

NONEXEMPT PROPERTY

PROPERTY

Parent A

Parent B

1. Nonexempt Other Real Property

2. Checking

3. Savings

4. Other

5. Cash

6. Nonexempt Vehicle

7. Other

8.

9.

10.

$

$

$

11. Subtotal Net Nonexempt Property

12. Enter each spouse’s share of community property

$

$

(divide line 11, Column II, by 2)

13. Parent’s total net nonexempt property (add lines 11 and 12)

14. Number of persons for whom each parent is responsible

(see totals on MC 175-2)

15. Allocation to each person for whom parent is responsible

(A)

(B)

$

$

(divide line 13 by line 14)

Enter on line 27.

Enter on line 28.

MC 324 (05/07) 1931 Group

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2