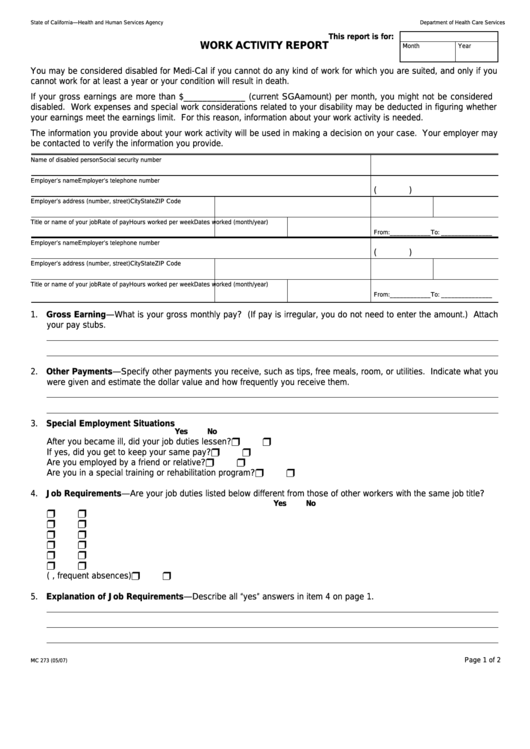

State of California—Health and Human Services Agency

Department of Health Care Services

This report is for:

WORK ACTIVITY REPORT

Month

Year

You may be considered disabled for Medi-Cal if you cannot do any kind of work for which you are suited, and only if you

cannot work for at least a year or your condition will result in death.

If your gross earnings are more than $_____________ (current SGA amount) per month, you might not be considered

disabled. Work expenses and special work considerations related to your disability may be deducted in figuring whether

your earnings meet the earnings limit. For this reason, information about your work activity is needed.

The information you provide about your work activity will be used in making a decision on your case. Your employer may

be contacted to verify the information you provide.

Name of disabled person

Social security number

Employer’s name

Employer’s telephone number

(

)

Employer’s address (number, street)

City

State

ZIP Code

Title or name of your job

Rate of pay

Hours worked per week

Dates worked (month/year)

From: ____________ To: _______________

Employer’s name

Employer’s telephone number

(

)

Employer’s address (number, street)

City

State

ZIP Code

Title or name of your job

Rate of pay

Hours worked per week

Dates worked (month/year)

From: ____________ To: _______________

1. Gross Earning—What is your gross monthly pay? (If pay is irregular, you do not need to enter the amount.) Attach

your pay stubs.

2. Other Payments—Specify other payments you receive, such as tips, free meals, room, or utilities. Indicate what you

were given and estimate the dollar value and how frequently you receive them.

3. Special Employment Situations

Yes

No

❒

❒

After you became ill, did your job duties lessen?

❒

❒

If yes, did you get to keep your same pay?

❒

❒

Are you employed by a friend or relative?

❒

❒

Are you in a special training or rehabilitation program?

4. Job Requirements—Are your job duties listed below different from those of other workers with the same job title?

Yes

No

❒

❒

a. Shorter hours

❒

❒

b. Different pay scale

❒

❒

c. Less or easier duties

❒

❒

d. Extra help given

❒

❒

e. Lower production

❒

❒

f.

Lower quality

❒

❒

g. Other differences (e.g., frequent absences)

5. Explanation of Job Requirements—Describe all “yes” answers in item 4 on page 1.

Page 1 of 2

MC 273 (05/07)

1

1 2

2