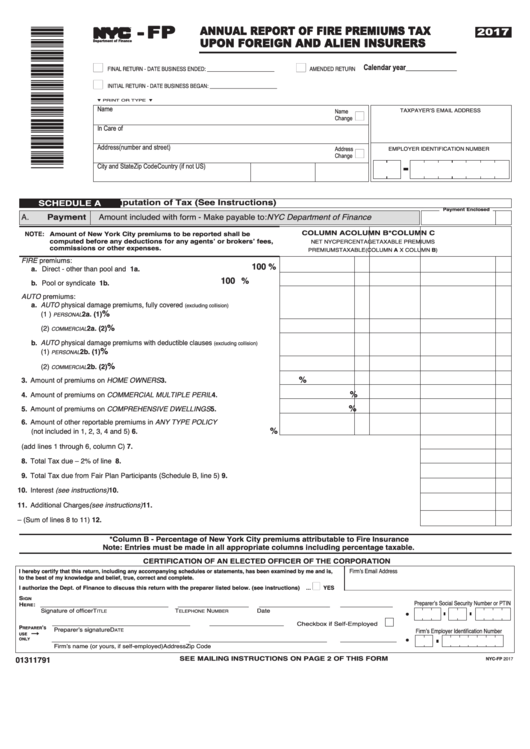

Form Nyc-Fp - Annual Report Of Fire Premiums Tax Upon Foreign And Alien Insurers - 2017

ADVERTISEMENT

- FP

ANNUAL REPORT OF FIRE PREMIUMS TAX

2017

UPON FOREIGN AND ALIEN INSURERS

TM

Department of Finance

n

n

Calendar year______________

FINAL RETURN - DATE BUSINESS ENDED: _________________________

AMENDED RETURN

n

INITIAL RETURN - DATE BUSINESS BEGAN: _________________________

t PRINT OR TYPE t

Name

Name

n

TAXPAYER’S EMAIL ADDRESS

Change

In Care of

Address (number and street)

Address

n

EMPLOYER IDENTIFICATION NUMBER

Change

City and State

Zip Code

Country (if not US)

Computation of Tax (See Instructions)

SCHEDULE A

Payment Enclosed

Payment

A.

Amount included with form - Make payable to: NYC Department of Finance............ A.

COLUMN A

COLUMN B*

COLUMN C

NOTE: Amount of New York City premiums to be reported shall be

computed before any deductions for any agents’ or brokers’ fees,

NET NYC

PERCENTAGE

TAXABLE PREMIUMS

commissions or other expenses.

PREMIUMS

TAXABLE

(COLUMN A X COLUMN B)

1. Amount of FIRE premiums:

100 %

a. Direct - other than pool and syndicate........................................................ 1a.

100 %

b. Pool or syndicate participation.................................................................... 1b.

2. Amount of AUTO premiums:

a. AUTO physical damage premiums, fully covered

(excluding collision)

%

.......................................................................................... 2a. (1)

(1 )

PERSONAL

%

........................................................................................2a. (2)

(2)

COMMERCIAL

b. AUTO physical damage premiums with deductible clauses

(excluding collision)

%

........................................................................................... 2b. (1)

(1)

PERSONAL

%

........................................................................................2b. (2)

(2)

COMMERCIAL

%

3. Amount of premiums on HOME OWNERS insurance........................................ 3.

%

4. Amount of premiums on COMMERCIAL MULTIPLE PERIL insurance..............4.

%

5. Amount of premiums on COMPREHENSIVE DWELLINGS...............................5.

6. Amount of other reportable premiums in ANY TYPE POLICY

%

(not included in 1, 2, 3, 4 and 5)......................................................................... 6.

7. TOTAL TAXABLE PREMIUMS (add lines 1 through 6, column C)......................................................................................... 7.

8. Total Tax due – 2% of line 7..................................................................................................................................................... 8.

9. Total Tax due from Fair Plan Participants (Schedule B, line 5)................................................................................................ 9.

10. Interest (see instructions)....................................................................................................................................................... 10.

11. Additional Charges (see instructions)..................................................................................................................................... 11.

12. TOTAL REMITTANCE DUE – (Sum of lines 8 to 11).............................................................................................................12.

*Column B - Percentage of New York City premiums attributable to Fire Insurance

Note: Entries must be made in all appropriate columns including percentage taxable.

CERTIFICATION OF AN ELECTED OFFICER OF THE CORPORATION

Firm’s Email Address

I hereby certify that this return, including any accompanying schedules or statements, has been examined by me and is,

to the best of my knowledge and belief, true, correct and complete.

n

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions)...

YES

_______________________________________________________

S

•

IGN

Preparer’s Social Security Number or PTIN

H

:

ERE

Signature of officer

T

T

N

Date

ITLE

ELEPhONE

UMBER

Checkbox if Self-Employed

•

P

’

Preparer’s signature

D

REPARER

S

Firm’s Employer Identification Number

ATE

fi

USE

ONLY

Firm’s name (or yours, if self-employed)

Address

Zip Code

01311791

SEE MAILING INSTRUCTIONS ON PAGE 2 OF THIS FORM

NYC-FP 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4