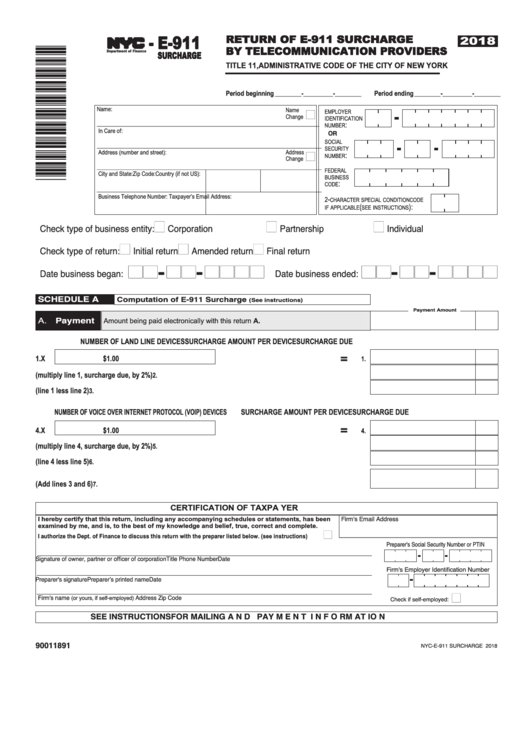

Form Nyc-E-911 - Return Of E-911 Surcharge By Telecommunication Providers - 2018

ADVERTISEMENT

- E-911

RETURN OF E-911 SURCHARGE

2018

BY TELECOMMUNICATION PROVIDERS

TM

SURCHARGE

Department of Finance

TITLE 11, ADMINISTRATIVE CODE OF THE CITY OF NEW YORK

Period beginning ________-_________-________

Period ending ________-_________-________

Name:

n

Name

EMPLOYER

Change

IDENTIFICATION

:

____________________________________________________________________________________________

NUMBER

In Care of:

OR

SOCIAL

_____________________________________________________________________________________________

SECURITY

n

:

Address (number and street):

Address

NUMBER

Change

_____________________________________________________________________________________________

FEDERAL

City and State:

Zip Code:

Country (if not US):

BUSINESS

:

CODE

_____________________________________________________________________________________________

-

Business Telephone Number:

Taxpayer’s Email Address:

2

CHARACTER SPECIAL CONDITION CODE

(

):

IF APPLICABLE

SEE INSTRUCTIONS

n

n

n

Check type of business entity:

Corporation

Partnership

Individual

n

n

n

Check type of return:

Initial return

Amended return

Final return

nn-nn-nnnn

nn-nn-

nnnn

Date business began:

Date business ended:

S C H E D U L E A

Computation of E-911 Surcharge

(See instructions)

Payment Amount

Payment

A.

A.

Amount being paid electronically with this return

NUMBER OF LAND LINE DEVICES

SURCHARGE AMOUNT PER DEVICE

SURCHARGE DUE

=

1.

X

$1.00

1.

2. Less Administrative Fee (multiply line 1, surcharge due, by 2%)

2.

....................................................................................

3. Net Surcharge Due on Land Line devices (line 1 less line 2)

3.

.............................................................................................

NUMBER OF VOICE OVER INTERNET PROTOCOL (VOIP) DEVICES

SURCHARGE AMOUNT PER DEVICE

SURCHARGE DUE

=

4.

X

$1.00

4.

5. Less Administrative Fee (multiply line 4, surcharge due, by 2%)

5.

....................................................................................

6. Net Surcharge Due on VOIP devices (line 4 less line 5)

6.

........................................................................................................

7. TOTAL REMITTANCE DUE (Add lines 3 and 6)

7.

.............................................................................................................................

C E R T I F I C A T I O N

O F

T A X P A Y E R

Firm's Email Address

I hereby certify that this return, including any accompanying schedules or statements, has been

examined by me, and is, to the best of my knowledge and belief, true, correct and complete.

______________________________

n

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) ..YES

Preparer's Social Security Number or PTIN

Signature of owner, partner or officer of corporation

Title

Phone Number

Date

Firm's Employer Identification Number

Preparer's signature

Preparer’s printed name

Date

n

Firm's name

Address

Zip Code

(or yours, if self-employed)

Check if self-employed:

S E E I N S T R U C T I O N S F O R M A I L I N G A N D P A Y M E N T I N F O R M A T I O N

90011891

NYC-E-911 SURCHARGE 2018

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2