Form Nyc-579-Ubtp - Signature Authorization For E-Filed Unincorporated Business Tax Return For Partnerships - 2017

ADVERTISEMENT

2017

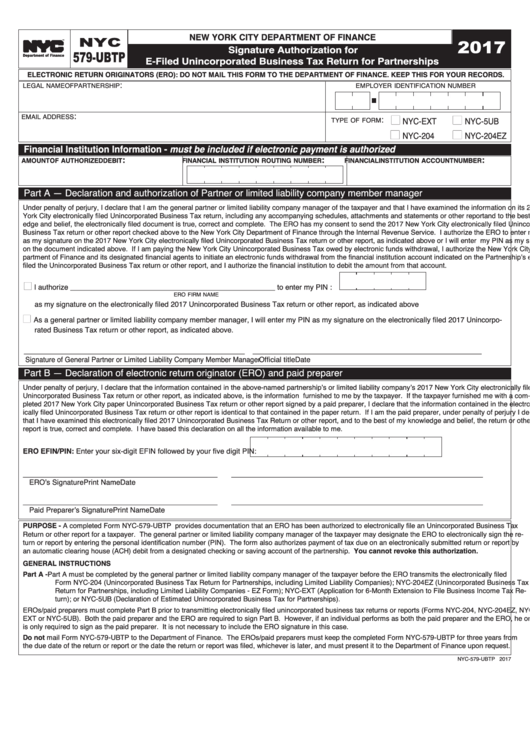

NEW YORK CITY DEPARTMENT OF FINANCE

NYC

Signature Authorization for

579 UBTP

TM

E-Filed Unincorporated Business Tax Return for Partnerships

Department of Finance

ELECTRONIC RETURN ORIGINATORS (ERO): DO NOT MAIL THIS FORM TO THE DEPARTMENT OF FINANCE. KEEP THIS FOR YOUR RECORDS.

:

LEGAL NAME OF PARTNERSHIP

EMPLOYER IDENTIFICATION NUMBER

:

:

n

n

EMAIL ADDRESS

NYC-EXT

NYC-5UB

TYPE OF FORM

n

n

NYC-204

NYC-204EZ

Financial Institution Information - must be included if electronic payment is authorized

:

:

:

AMOUNT OF AUTHORIZED DEBIT

FINANCIAL INSTITUTION ROUTING NUMBER

FINANCIAL INSTITUTION ACCOUNT NUMBER

Part A — Declaration and authorization of Partner or limited liability company member manager

Under penalty of perjury, I declare that I am the general partner or limited liability company manager of the taxpayer and that I have examined the information on its 2017 New

York City electronically filed Unincorporated Business Tax return, including any accompanying schedules, attachments and statements or other report and to the best of my knowl-

edge and belief, the electronically filed document is true, correct and complete. The ERO has my consent to send the 2017 New York City electronically filed Unincorporated

Business Tax return or other report checked above to the New York City Department of Finance through the Internal Revenue Service. I authorize the ERO to enter my PIN

as my signature on the 2017 New York City electronically filed Unincorporated Business Tax return or other report, as indicated above or I will enter my PIN as my signature

on the document indicated above. If I am paying the New York City Unincorporated Business Tax owed by electronic funds withdrawal, I authorize the New York City De-

partment of Finance and its designated financial agents to initiate an electronic funds withdrawal from the financial institution account indicated on the Partnership’s electronically

filed the Unincorporated Business Tax return or other report, and I authorize the financial institution to debit the amount from that account.

n

I authorize ___________________________________________________ to enter my PIN :

ERO FIRM NAME

as my signature on the electronically filed 2017 Unincorporated Business Tax return or other report, as indicated above

n

As a general partner or limited liability company member manager, I will enter my PIN as my signature on the electronically filed 2017 Unincorpo-

rated Business Tax return or other report, as indicated above.

_______________________________________________________

_____________________________________

____________________

Signature of General Partner or Limited Liability Company Member Manager

Official title

Date

Part B — Declaration of electronic return originator (ERO) and paid preparer

Under penalty of perjury, I declare that the information contained in the above-named partnership’s or limited liability company’s 2017 New York City electronically filed

Unincorporated Business Tax return or other report, as indicated above, is the information furnished to me by the taxpayer. If the taxpayer furnished me with a com-

pleted 2017 New York City paper Unincorporated Business Tax return or other report signed by a paid preparer, I declare that the information contained in the electron-

ically filed Unincorporated Business Tax return or other report is identical to that contained in the paper return. If I am the paid preparer, under penalty of perjury I declare

that I have examined this electronically filed 2017 Unincorporated Business Tax Return or other report, and to the best of my knowledge and belief, the return or other

report is true, correct and complete. I have based this declaration on all the information available to me.

ERO EFIN/PIN: Enter your six-digit EFIN followed by your five digit PIN:

_________________________________________

_____________________________________

________________

ERO’s Signature

Print Name

Date

_________________________________________

_____________________________________

________________

Paid Preparer’s Signature

Print Name

Date

PURPOSE - A completed Form NYC-579-UBTP provides documentation that an ERO has been authorized to electronically file an Unincorporated Business Tax

Return or other report for a taxpayer. The general partner or limited liability company manager of the taxpayer may designate the ERO to electronically sign the re-

turn or report by entering the personal identification number (PIN). The form also authorizes payment of tax due on an electronically submitted return or report by

an automatic clearing house (ACH) debit from a designated checking or saving account of the partnership. You cannot revoke this authorization.

GENERAL INSTRUCTIONS

Part A -

Part A must be completed by the general partner or limited liability company manager of the taxpayer before the ERO transmits the electronically filed

Form NYC-204 (Unincorporated Business Tax Return for Partnerships, including Limited Liability Companies); NYC-204EZ (Unincorporated Business Tax

Return for Partnerships, including Limited Liability Companies - EZ Form); NYC-EXT (Application for 6-Month Extension to File Business Income Tax Re-

turn); or NYC-5UB (Declaration of Estimated Unincorporated Business Tax for Partnerships).

EROs/paid preparers must complete Part B prior to transmitting electronically filed unincorporated business tax returns or reports (Forms NYC-204, NYC-204EZ, NYC-

EXT or NYC-5UB). Both the paid preparer and the ERO are required to sign Part B. However, if an individual performs as both the paid preparer and the ERO, he or she

is only required to sign as the paid preparer. It is not necessary to include the ERO signature in this case.

Do not mail Form NYC-579-UBTP to the Department of Finance. The EROs/paid preparers must keep the completed Form NYC-579-UBTP for three years from

the due date of the return or report or the date the return or report was filed, whichever is later, and must present it to the Department of Finance upon request.

NYC-579-UBTP 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1