Form Nyc-221 - Underpayment Of Estimated Unincorporated Business Tax - 2017

ADVERTISEMENT

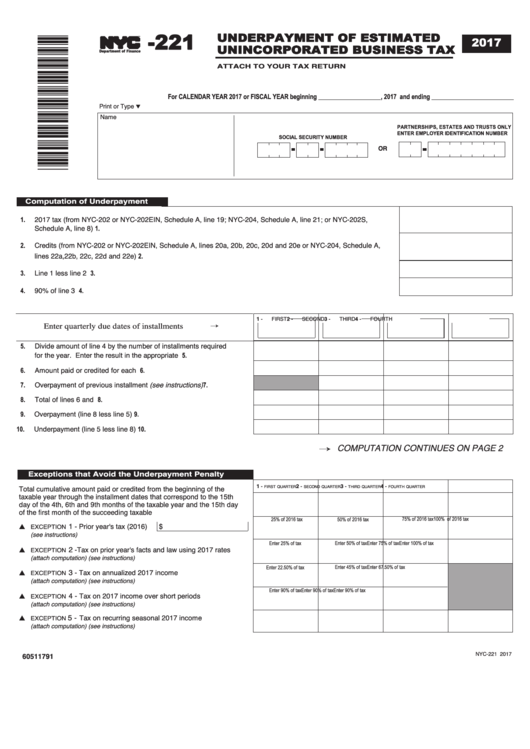

-221

UNDERPAYMENT OF ESTIMATED

2017

UNINCORPORATED BUSINESS TAX

TM

Department of Finance

ATTACH TO YOUR TAX RETURN

For CALENDAR YEAR 2017 or FISCAL YEAR beginning ___________________, 2017 and ending _________________________

Print or Type

t

Name

PARTNERSHIPS, ESTATES AND TRUSTS ONLY

ENTER EMPLOYER IDENTIFICATION NUMBER

SOCIAL SECURITY NUMBER

OR

Computation of Underpayment

1.

2017 tax (from NYC-202 or NYC-202EIN, Schedule A, line 19; NYC-204, Schedule A, line 21; or NYC-202S,

Schedule A, line 8) ......................................................................................................................................................... 1.

2.

Credits (from NYC-202 or NYC-202EIN, Schedule A, lines 20a, 20b, 20c, 20d and 20e or NYC-204, Schedule A,

lines 22a,22b, 22c, 22d and 22e)................................................................................................................................... 2.

3.

Line 1 less line 2 ........................................................................................................................................................... 3.

4.

90% of line 3 ................................................................................................................................................................. 4.

1 -

2 -

3 -

4 -

Enter quarterly due dates of installments

FIRST

SECOND

THIRD

FOURTH

’

5.

Divide amount of line 4 by the number of installments required

for the year. Enter the result in the appropriate columns................... 5.

6.

Amount paid or credited for each period ............................................ 6.

Overpayment of previous installment (see instructions)..................... 7.

7.

8.

Total of lines 6 and 7 .......................................................................... 8.

9.

Overpayment (line 8 less line 5)......................................................... 9.

10.

Underpayment (line 5 less line 8) ..................................................... 10.

COMPUTATION CONTINUES ON PAGE 2

’

Exceptions that Avoid the Underpayment Penalty

1 -

2 -

3 -

4 -

Total cumulative amount paid or credited from the beginning of the

FIRST QUARTER

SECOND QUARTER

THIRD QUARTER

FOURTH QUARTER

taxable year through the installment dates that correspond to the 15th

day of the 4th, 6th and 9th months of the taxable year and the 15th day

of the first month of the succeeding taxable year..........................................

75% of 2016 tax

25% of 2016 tax

50% of 2016 tax

100% of 2016 tax

1

- Prior year's tax (2016)

$

EXCEPTION

s

(see instructions) ...................................................................................................

Enter 25% of tax

Enter 50% of tax

Enter 75% of tax

Enter 100% of tax

2

-Tax on prior year's facts and law using 2017 rates

EXCEPTION

s

...........................................................

(attach computation) (see instructions)

Enter 45% of tax

Enter 22.50% of tax

Enter 67.50% of tax

3

- Tax on annualized 2017 income

EXCEPTION

s

(attach computation) (see instructions) ...................................................................

Enter 90% of tax

Enter 90% of tax

Enter 90% of tax

4 -

Tax on 2017 income over short periods

EXCEPTION

s

(attach computation) (see instructions) ...................................................................

5 -

Tax on recurring seasonal 2017 income

EXCEPTION

s

(attach computation) (see instructions) ...................................................................

6 511791

NYC-221 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4