Form Nyc-202s - Unincorporated Business Tax Return For Individuals - 2017

ADVERTISEMENT

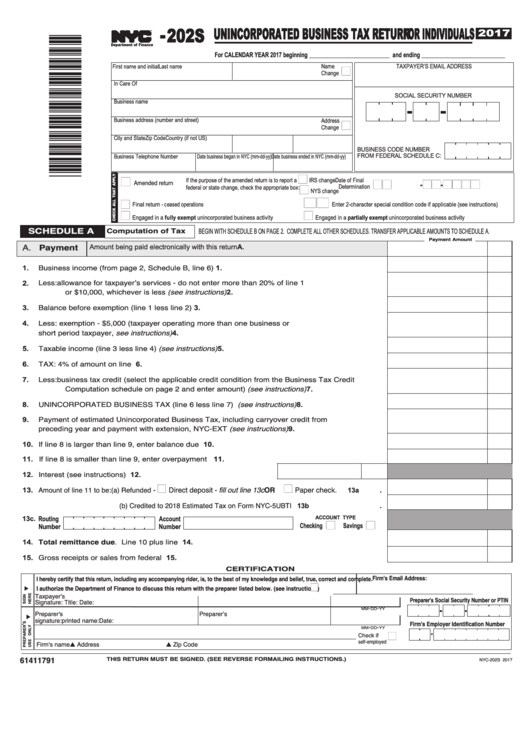

- 202S

UNINCORPORATED BUSINESS TAX RETURN FOR INDIVIDUALS

2017

TM

Department of Finance

For CALENDAR YEAR 2017 beginning ___________________________ and ending ____________________________

n

First name and initial

Last name

Name

TAXPAYER’S EMAIL ADDRESS

Change

In Care Of

SOCIAL SECURITY NUMBER

Business name

Business address (number and street)

Address

n

Change

City and State

Zip Code

Country (if not US)

BUSINESS CODE NUMBER

FROM FEDERAL SCHEDULE C:

Business Telephone Number

Date business began in NYC (mm-dd-yy) Date business ended in NYC (mm-dd-yy)

n

n

nn-nn-nnnn

If the purpose of the amended return is to report a

IRS change

Date of Final

Amended return

n

Determination

federal or state change, check the appropriate box:

NYS change

nn

n

Final return - ceased operations

Enter 2-character special condition code if applicable (see instructions)

n

n

Engaged in a fully exempt unincorporated business activity

Engaged in a partially exempt unincorporated business activity

SCHEDULE A

Computation of Tax

BEGIN WITH SCHEDULE B ON PAGE 2. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A.

Payment Amount

A. Payment

A.

Amount being paid electronically with this return

Business income (from page 2, Schedule B, line 6) .................................................................

1.

1.

Less:

allowance for taxpayer’s services - do not enter more than 20% of line 1

2.

or $10,000, whichever is less (see instructions) ...........................................................

2.

Balance before exemption (line 1 less line 2) ...........................................................................

3.

3.

Less: exemption - $5,000 (taxpayer operating more than one business or

4.

short period taxpayer, see instructions).....................................................................................

4.

Taxable income (line 3 less line 4) (see instructions)................................................................

5.

5.

TAX: 4% of amount on line 5.....................................................................................................

6.

6.

Less:

business tax credit (select the applicable credit condition from the Business Tax Credit

7.

Computation schedule on page 2 and enter amount) (see instructions) ..........................

7.

UNINCORPORATED BUSINESS TAX (line 6 less line 7) (see instructions)...........................

8.

8.

Payment of estimated Unincorporated Business Tax, including carryover credit from

9.

preceding year and payment with extension, NYC-EXT (see instructions) ..............................

9.

10. If line 8 is larger than line 9, enter balance due .......................................................................

10.

11. If line 8 is smaller than line 9, enter overpayment ...................................................................

11.

12. Interest (see instructions) ..............................................................12.

n

n

OR

(a) Refunded -

Direct deposit - fill out line 13c

Paper check .

13. Amount of line 11 to be:

13a.

(b) Credited to 2018 Estimated Tax on Form NYC-5UBTI ................................

13b.

13c. Routing

Account

ACCOUNT TYPE

n

n

Checking

Savings

Number

Number

14. Total remittance due. Line 10 plus line 12. ............................................................................

14.

15. Gross receipts or sales from federal return...............................................................................

15.

C E R T I F I C AT I O N

Firm's Email Address:

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

n

I authorize the Department of Finance to discuss this return with the preparer listed below. (see instructions)..........YES

_________________________________________

Taxpayer’s

Preparer's Social Security Number or PTIN

Signature:

Title:

Date:

-

-

MM

DD

YY

Preparer's

Preparer’s

signature:

printed name:

Date:

Firm's Employer Identification Number

-

-

MM

DD

YY

n

Check if

self-employed

Firm's name

▲ Address

▲ Zip Code

61411791

THIS RETURN MUST BE SIGNED. (SEE REVERSE FOR MAILING INSTRUCTIONS.)

NYC-202S 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2