Form Nyc-114.10 - Claim For Biotechnology Credit - 2017

ADVERTISEMENT

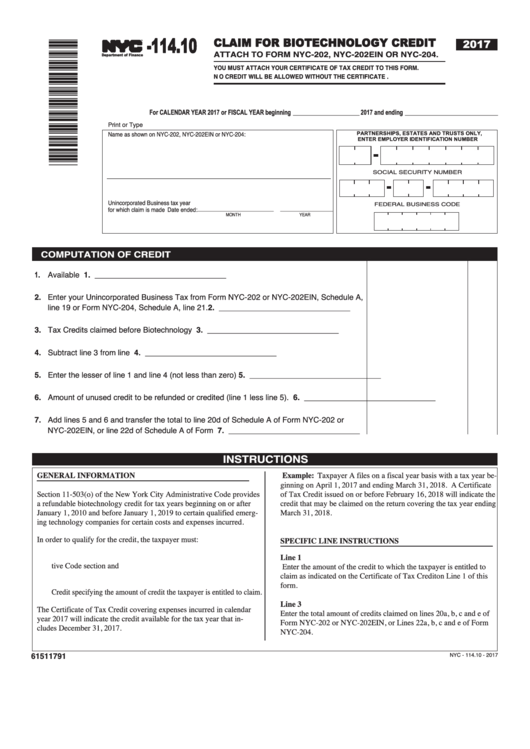

-114.10

CLAIM FOR BIOTECHNOLOGY CREDIT

2017

TM

ATTACH TO FORM NYC-202, NYC-202EIN OR NYC-204.

Department of Finance

YOU MUST ATTACH YOUR CERTIFICATE OF TAX CREDIT TO THIS FORM.

N O C R E D I T W I L L B E A L L O W E D W I T H O U T T H E C E R T I F I C A T E .

For CALENDAR YEAR 2017 or FISCAL YEAR beginning

2017 and ending

Print or Type

Name as shown on NYC-202, NYC-202EIN or NYC-204:

PARTNERSHIPS, ESTATES AND TRUSTS ONLY,

ENTER EMPLOYER IDENTIFICATION NUMBER

SOCIAL SECURITY NUMBER

Unincorporated Business tax year

FEDERAL BUSINESS CODE

for which claim is made

Date ended:

_____________________________

____________________

.

MONTH

YEAR

C O M P U TAT I O N O F C R E D I T

1. Available Credit..................................................................................................................... 1. ______________________________

2. Enter your Unincorporated Business Tax from Form NYC-202 or NYC-202EIN, Schedule A,

line 19 or Form NYC-204, Schedule A, line 21................................................................. 2. ______________________________

3. Tax Credits claimed before Biotechnology Credit................................................................. 3. ______________________________

4. Subtract line 3 from line 2..................................................................................................... 4. ______________________________

5. Enter the lesser of line 1 and line 4 (not less than zero)....................................................... 5. ______________________________

6. Amount of unused credit to be refunded or credited (line 1 less line 5). .............................. 6. ______________________________

7. Add lines 5 and 6 and transfer the total to line 20d of Schedule A of Form NYC-202 or

NYC-202EIN, or line 22d of Schedule A of Form NYC-204.................................................. 7. ______________________________

INSTRUCTIONS

GENERAL INFORMATION

Example: Taxpayer A files on a fiscal year basis with a tax year be-

ginning on April 1, 2017 and ending March 31, 2018. A Certificate

Section 11-503(o) of the New York City Administrative Code provides

of Tax Credit issued on or before February 16, 2018 will indicate the

a refundable biotechnology credit for tax years beginning on or after

credit that may be claimed on the return covering the tax year ending

January 1, 2010 and before January 1, 2019 to certain qualified emerg-

March 31, 2018.

ing technology companies for certain costs and expenses incurred.

In order to qualify for the credit, the taxpayer must:

SPECIFIC LINE INSTRUCTIONS

1.

meet the eligibility criteria as specified in the above Administra-

Line 1

tive Code section and

Enter the amount of the credit to which the taxpayer is entitled to

claim as indicated on the Certificate of Tax Credit on Line 1 of this

2.

must have applied for the credit and received a Certificate of Tax

form.

Credit specifying the amount of credit the taxpayer is entitled to claim.

Line 3

The Certificate of Tax Credit covering expenses incurred in calendar

Enter the total amount of credits claimed on lines 20a, b, c and e of

year 2017 will indicate the credit available for the tax year that in-

Form NYC-202 or NYC-202EIN, or Lines 22a, b, c and e of Form

cludes December 31, 2017.

NYC-204.

61511791

NYC - 114.10 - 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1