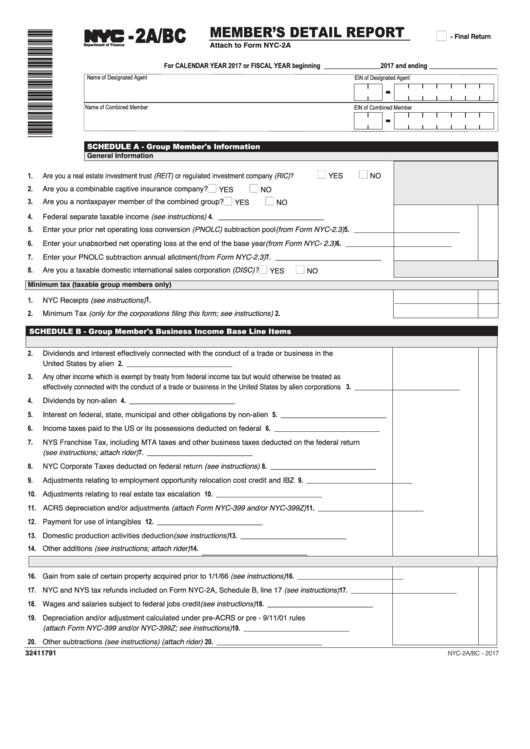

Form Nyc-2a/bc - Member'S Detail Report - 2017

ADVERTISEMENT

-2A/BC

MEMBER’S DETAIL REPORT

n

- Final Return

TM

Attach to Form NYC-2A

Department of Finance

For CALENDAR YEAR 2017 or FISCAL YEAR beginning _______________ 2017 and ending __________________

SCHEDULE A - Group Member's Information

General Information

n

n

Are you a real estate investment trust (REIT) or regulated investment company (RIC)?..........

1.

YES

NO

n

n

Are you a combinable captive insurance company? .................................................

2.

YES

NO

n

n

3.

Are you a nontaxpayer member of the combined group? .........................................

YES

NO

Federal separate taxable income (see instructions) .................................................................................... 4. _______________________________

4.

Enter your prior net operating loss conversion (PNOLC) subtraction pool (from Form NYC-2.3) ............... 5. _______________________________

5.

Enter your unabsorbed net operating loss at the end of the base year (from Form NYC- 2.3)................... 6. _______________________________

6.

Enter your PNOLC subtraction annual allotment (from Form NYC-2.3) ...................................................... 7. _______________________________

7.

n

n

Are you a taxable domestic international sales corporation (DISC)?..........................

8.

YES

NO

Minimum tax (taxable group members only)

NYC Receipts (see instructions).................................................................................................................... 1 . _________________________________

1.

Minimum Tax (only for the corporations filing this form; see instructions) ................................................... 2.

2.

SCHEDULE B - Group Member's Business Income Base Line Items

2.

Dividends and interest effectively connected with the conduct of a trade or business in the

United States by alien corporations.............................................................................................................. 2. _______________________________

Any other income which is exempt by treaty from federal income tax but would otherwise be treated as

3.

effectively connected with the conduct of a trade or business in the United States by alien corporations.................. 3. _______________________________

4.

Dividends by non-alien corporations ............................................................................................................ 4. _______________________________

5.

Interest on federal, state, municipal and other obligations by non-alien corporations ................................. 5. _______________________________

6.

Income taxes paid to the US or its possessions deducted on federal return............................................... 6. _______________________________

7.

NYS Franchise Tax, including MTA taxes and other business taxes deducted on the federal return

(see instructions; attach rider) ...................................................................................................................... 7. _______________________________

NYC Corporate Taxes deducted on federal return (see instructions) .......................................................... 8. _______________________________

8.

9.

Adjustments relating to employment opportunity relocation cost credit and IBZ credit ............................... 9. _______________________________

10. Adjustments relating to real estate tax escalation credit ............................................................................ 10. _______________________________

11. ACRS depreciation and/or adjustments (attach Form NYC-399 and/or NYC-399Z).................................. 11. _______________________________

12. Payment for use of intangibles ................................................................................................................... 12. _______________________________

13. Domestic production activities deduction (see instructions) ....................................................................... 13. _______________________________

14. Other additions (see instructions; attach rider)........................................................................................... 14. _______________________________

16. Gain from sale of certain property acquired prior to 1/1/66 (see instructions) ........................................... 16. _______________________________

17. NYC and NYS tax refunds included on Form NYC-2A, Schedule B, line 17 (see instructions)................. 17. _______________________________

18. Wages and salaries subject to federal jobs credit (see instructions).......................................................... 18. _______________________________

19. Depreciation and/or adjustment calculated under pre-ACRS or pre - 9/11/01 rules

(attach Form NYC-399 and/or NYC-399Z; see instructions) ...................................................................... 19. _______________________________

20. Other subtractions (see instructions) (attach rider) .................................................................................... 20. _______________________________

32411791

NYC-2A/BC - 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3