Form Nyc-9.10 - Claim For Biotechnology Credit Applied To Business And General Corporation Taxes - 2017

ADVERTISEMENT

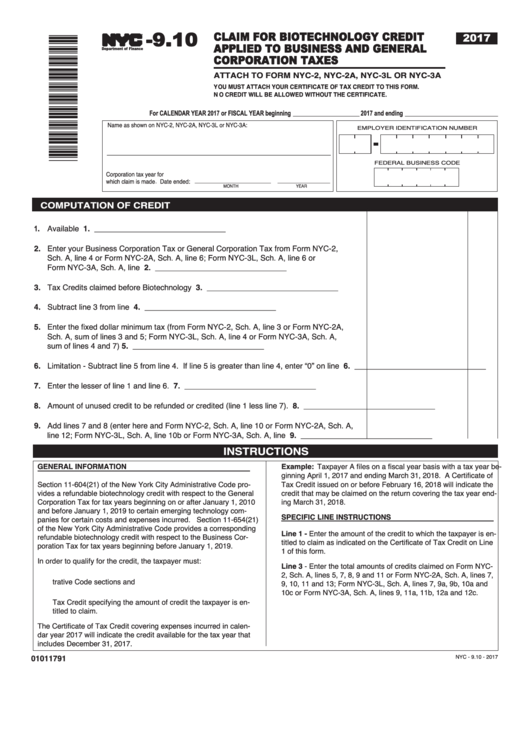

-9.10

CLAIM FOR BIOTECHNOLOGY CREDIT

2017

APPLIED TO BUSINESS AND GENERAL

TM

CORPORATION TAXES

Department of Finance

ATTACH TO FORM NYC-2, NYC-2A, NYC-3L OR NYC-3A

YOU MUST ATTACH YOUR CERTIFICATE OF TAX CREDIT TO THIS FORM.

N O C R E D I T W I L L B E A L L O W E D W I T H O U T T H E C E R T I F I C A T E .

For CALENDAR YEAR 2017 or FISCAL YEAR beginning

2017 and ending

Name as shown on NYC-2, NYC-2A, NYC-3L or NYC-3A:

EMPLOYER IDENTIFICATION NUMBER

FEDERAL BUSINESS CODE

Corporation tax year for

which claim is made

Date ended:

_____________________________

____________________

.

MONTH

YEAR

C O M P U TAT I O N O F C R E D I T

1. Available Credit..................................................................................................................... 1. ______________________________

2. Enter your Business Corporation Tax or General Corporation Tax from Form NYC-2,

Sch. A, line 4 or Form NYC-2A, Sch. A, line 6; Form NYC-3L, Sch. A, line 6 or

Form NYC-3A, Sch. A, line 8.................................................................................................2. ______________________________

3. Tax Credits claimed before Biotechnology Credit................................................................. 3. ______________________________

4. Subtract line 3 from line 2..................................................................................................... 4. ______________________________

5. Enter the fixed dollar minimum tax (from Form NYC-2, Sch. A, line 3 or Form NYC-2A,

Sch. A, sum of lines 3 and 5; Form NYC-3L, Sch. A, line 4 or Form NYC-3A, Sch. A,

sum of lines 4 and 7) ............................................................................................................. 5. ______________________________

6. Limitation - Subtract line 5 from line 4. If line 5 is greater than line 4, enter “0” on line 6.... 6. ______________________________

7. Enter the lesser of line 1 and line 6. .....................................................................................7. ______________________________

8. Amount of unused credit to be refunded or credited (line 1 less line 7). .............................. 8. ______________________________

9. Add lines 7 and 8 (enter here and Form NYC-2, Sch. A, line 10 or Form NYC-2A, Sch. A,

line 12; Form NYC-3L, Sch. A, line 10b or Form NYC-3A, Sch. A, line 12b............................ 9. ______________________________

INSTRUCTIONS

GENERAL INFORMATION

Example: Taxpayer A files on a fiscal year basis with a tax year be-

ginning April 1, 2017 and ending March 31, 2018. A Certificate of

Section 11-604(21) of the New York City Administrative Code pro-

Tax Credit issued on or before February 16, 2018 will indicate the

vides a refundable biotechnology credit with respect to the General

credit that may be claimed on the return covering the tax year end-

Corporation Tax for tax years beginning on or after January 1, 2010

ing March 31, 2018.

and before January 1, 2019 to certain emerging technology com-

SPECIFIC LINE INSTRUCTIONS

panies for certain costs and expenses incurred. Section 11-654(21)

of the New York City Administrative Code provides a corresponding

Line 1 - Enter the amount of the credit to which the taxpayer is en-

refundable biotechnology credit with respect to the Business Cor-

titled to claim as indicated on the Certificate of Tax Credit on Line

poration Tax for tax years beginning before January 1, 2019.

1 of this form.

In order to qualify for the credit, the taxpayer must:

Line 3 - Enter the total amounts of credits claimed on Form NYC-

1.

meet the eligibility criteria as specified in the above Adminis-

2, Sch. A, lines 5, 7, 8, 9 and 11 or Form NYC-2A, Sch. A, lines 7,

trative Code sections and

9, 10, 11 and 13; Form NYC-3L, Sch. A, lines 7, 9a, 9b, 10a and

10c or Form NYC-3A, Sch. A, lines 9, 11a, 11b, 12a and 12c.

2.

must have applied for the credit and received a Certificate of

Tax Credit specifying the amount of credit the taxpayer is en-

titled to claim.

The Certificate of Tax Credit covering expenses incurred in calen-

dar year 2017 will indicate the credit available for the tax year that

includes December 31, 2017.

01011791

NYC - 9.10 - 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1