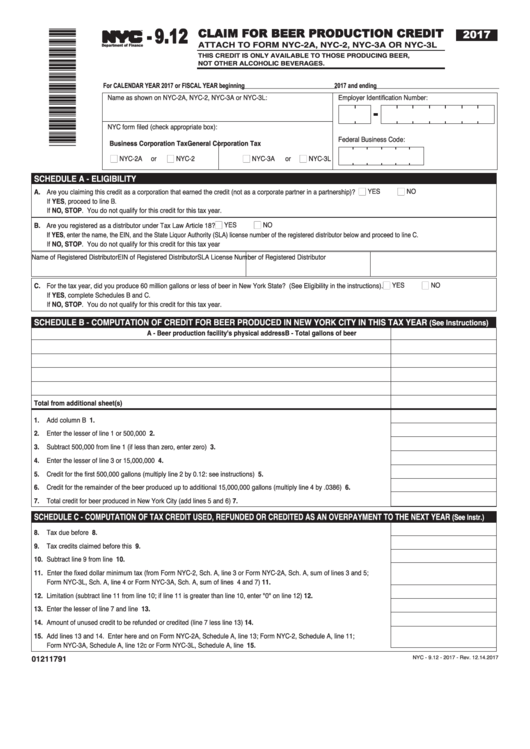

Form Nyc-9.12 - Claim For Beer Production Credit - 2017

ADVERTISEMENT

- 9.12

CLAIM FOR BEER PRODUCTION CREDIT

2017

TM

ATTACH TO FORM NYC-2A, NYC-2, NYC-3A OR NYC-3L

Department of Finance

T H I S C R E D I T I S O N LY AVA I L A B L E TO T H O S E P R O D U C I N G B E E R ,

NOT OTHER ALCOHOLIC BEVERAGES.

For CALENDAR YEAR 2017 or FISCAL YEAR beginning

2017 and ending

Name as shown on NYC-2A, NYC-2, NYC-3A or NYC-3L:

Employer Identification Number:

NYC form filed (check appropriate box):

Federal Business Code:

Business Corporation Tax

General Corporation Tax

n

NYC-2A

or

n

NYC-2

n

NYC-3A

or

n

NYC-3L

SCHEDULE A - ELIGIBILITY

A. Are you claiming this credit as a corporation that earned the credit (not as a corporate partner in a partnership)?

n

YES

n

NO

If YES, proceed to line B.

If NO, STOP. You do not qualify for this credit for this tax year.

B. Are you registered as a distributor under Tax Law Article 18?

n

YES

n

NO

If YES, enter the name, the EIN, and the State Liquor Authority (SLA) license number of the registered distributor below and proceed to line C.

If NO, STOP. You do not qualify for this credit for this tax year

Name of Registered Distributor

EIN of Registered Distributor

SLA License Number of Registered Distributor

C. For the tax year, did you produce 60 million gallons or less of beer in New York State? (See Eligibility in the instructions).

n

YES

n

NO

If YES, complete Schedules B and C.

If NO, STOP. You do not qualify for this credit for this tax year.

SCHEDULE B - COMPUTATION OF CREDIT FOR BEER PRODUCED IN NEW YORK CITY IN THIS TAX YEAR

(See Instructions)

A - Beer production facility's physical address

B - Total gallons of beer

Total from additional sheet(s)...........................................................................................................................................................

1.

Add column B amounts ...........................................................................................................................................................1.

2.

Enter the lesser of line 1 or 500,000 .......................................................................................................................................2.

3.

Subtract 500,000 from line 1 (if less than zero, enter zero) ....................................................................................................3.

4.

Enter the lesser of line 3 or 15,000,000 ..................................................................................................................................4.

5.

Credit for the first 500,000 gallons (multiply line 2 by 0.12: see instructions) .........................................................................5.

6.

Credit for the remainder of the beer produced up to additional 15,000,000 gallons (multiply line 4 by .0386) .......................6.

7.

Total credit for beer produced in New York City (add lines 5 and 6)........................................................................................7.

SCHEDULE C - COMPUTATION OF TAX CREDIT USED, REFUNDED OR CREDITED AS AN OVERPAYMENT TO THE NEXT YEAR

(See Instr.)

8.

Tax due before credits .............................................................................................................................................................8.

9.

Tax credits claimed before this credit ......................................................................................................................................9.

10. Subtract line 9 from line 8......................................................................................................................................................10.

11. Enter the fixed dollar minimum tax (from Form NYC-2, Sch. A, line 3 or Form NYC-2A, Sch. A, sum of lines 3 and 5;

Form NYC-3L, Sch. A, line 4 or Form NYC-3A, Sch. A, sum of lines 4 and 7).....................................................................11.

12. Limitation (subtract line 11 from line 10; if line 11 is greater than line 10, enter "0" on line 12).............................................12.

13. Enter the lesser of line 7 and line 12 .....................................................................................................................................13.

14. Amount of unused credit to be refunded or credited (line 7 less line 13) ..............................................................................14.

15. Add lines 13 and 14. Enter here and on Form NYC-2A, Schedule A, line 13; Form NYC-2, Schedule A, line 11;

Form NYC-3A, Schedule A, line 12c or Form NYC-3L, Schedule A, line 10c. ......................................................................15.

01211791

NYC - 9.12 - 2017 - Rev. 12.14.2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2