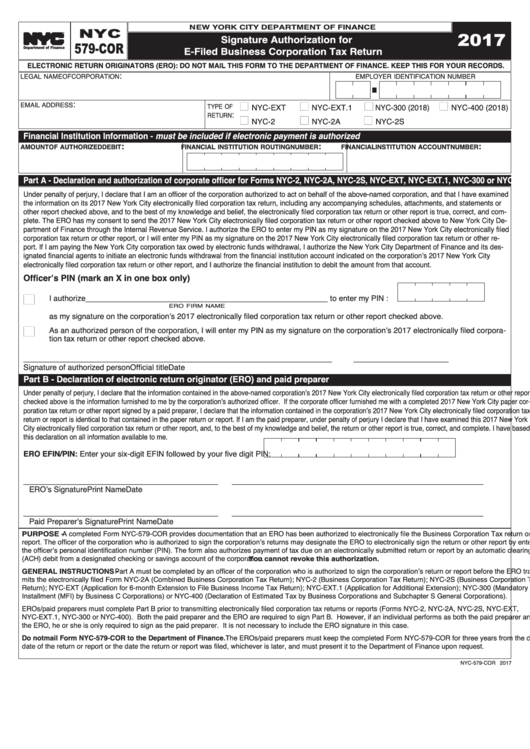

Form Nyc 579-Cor - Signature Authorization For E-Filed Business Corporation Tax Return - 2017

ADVERTISEMENT

2017

NYC

NEW YORK CITY DEPARTMENT OF FINANCE

Signature Authorization for

579 COR

TM

E-Filed Business Corporation Tax Return

Department of Finance

ELECTRONIC RETURN ORIGINATORS (ERO): DO NOT MAIL THIS FORM TO THE DEPARTMENT OF FINANCE. KEEP THIS FOR YOUR RECORDS.

:

legal name of corporation

employer identification number

:

n

n

n

n

email address

nyc-eXt

nyc-eXt.1

nyc-300 (2018)

nyc-400 (2018)

type of

:

return

n

n

n

nyc-2

nyc-2a

nyc-2s

Financial Institution Information - must be included if electronic payment is authorized

:

:

:

AMOUNT OF AUTHORIZED DEBIT

FINANCIAL INSTITUTION ROUTING NUMBER

FINANCIAL INSTITUTION ACCOUNT NUMBER

Part A - Declaration and authorization of corporate officer for Forms NYC-2, NYC-2A, NYC-2S, NYC-EXT, NYC-EXT.1, NYC-300 or NYC-400

under penalty of perjury, i declare that i am an officer of the corporation authorized to act on behalf of the above-named corporation, and that i have examined

the information on its 2017 new york city electronically filed corporation tax return, including any accompanying schedules, attachments, and statements or

other report checked above, and to the best of my knowledge and belief, the electronically filed corporation tax return or other report is true, correct, and com-

plete. the ero has my consent to send the 2017 new york city electronically filed corporation tax return or other report checked above to new york city de-

partment of finance through the internal revenue service. i authorize the ero to enter my pin as my signature on the 2017 new york city electronically filed

corporation tax return or other report, or i will enter my pin as my signature on the 2017 new york city electronically filed corporation tax return or other re-

port. if i am paying the new york city corporation tax owed by electronic funds withdrawal, i authorize the new york city department of finance and its des-

ignated financial agents to initiate an electronic funds withdrawal from the financial institution account indicated on the corporation’s 2017 new york city

electronically filed corporation tax return or other report, and i authorize the financial institution to debit the amount from that account.

Officer’s PIN (mark an X in one box only)

___________________________________________________

n

i authorize

to enter my pin :

ero firm name

as my signature on the corporation’s 2017 electronically filed corporation tax return or other report checked above.

n

as an authorized person of the corporation, i will enter my pin as my signature on the corporation’s 2017 electronically filed corpora-

tion tax return or other report checked above.

________________________________________

_________________________

____________________

signature of authorized person

official title

date

Part B - Declaration of electronic return originator (ERO) and paid preparer

under penalty of perjury, i declare that the information contained in the above-named corporation’s 2017 new york city electronically filed corporation tax return or other report

checked above is the information furnished to me by the corporation’s authorized officer. if the corporate officer furnished me with a completed 2017 new york city paper cor-

poration tax return or other report signed by a paid preparer, i declare that the information contained in the corporation’s 2017 new york city electronically filed corporation tax

return or report is identical to that contained in the paper return or report. if i am the paid preparer, under penalty of perjury i declare that i have examined this 2017 new york

city electronically filed corporation tax return or other report, and, to the best of my knowledge and belief, the return or other report is true, correct, and complete. i have based

this declaration on all information available to me.

ERO EFIN/PIN: enter your six-digit efin followed by your five digit pin:

_________________________________________

_____________________________________

________________

ero’s signature

print name

date

_________________________________________

_____________________________________

________________

paid preparer’s signature

print name

date

PURPOSE - a completed form nyc-579-cor provides documentation that an ero has been authorized to electronically file the business corporation tax return or other

report. the officer of the corporation who is authorized to sign the corporationʼs returns may designate the ero to electronically sign the return or other report by entering

the officerʼs personal identification number (pin). the form also authorizes payment of tax due on an electronically submitted return or report by an automatic clearing house

(acH) debit from a designated checking or savings account of the corporation. You cannot revoke this authorization.

GENERAL INSTRUCTIONS - part a must be completed by an officer of the corporation who is authorized to sign the corporation’s return or report before the ero trans-

mits the electronically filed form nyc-2a (combined business corporation tax return); nyc-2 (business corporation tax return); nyc-2s (business corporation tax

return); nyc-eXt (application for 6-month extension to file business income tax return); nyc-eXt.1 (application for additional extension); nyc-300 (mandatory first

installment (mfi) by business c corporations) or nyc-400 (declaration of estimated tax by business corporations and subchapter s general corporations).

eros/paid preparers must complete part b prior to transmitting electronically filed corporation tax returns or reports (forms nyc-2, nyc-2a, nyc-2s, nyc-eXt,

nyc-eXt.1, nyc-300 or nyc-400). both the paid preparer and the ero are required to sign part b. However, if an individual performs as both the paid preparer and

the ero, he or she is only required to sign as the paid preparer. it is not necessary to include the ero signature in this case.

Do not mail Form NYC-579-COR to the Department of Finance. the eros/paid preparers must keep the completed form nyc-579-cor for three years from the due

date of the return or report or the date the return or report was filed, whichever is later, and must present it to the department of finance upon request.

nyc-579-cor 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1