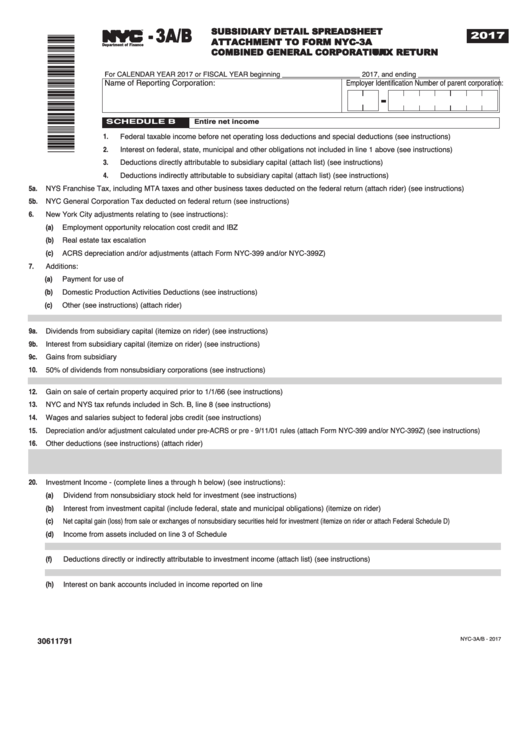

Form Nyc-3a/b - Subsidiary Detail Spreadsheet Attachment To Form Nyc-3a Combined General Corporation Tax Return - 2017

ADVERTISEMENT

- 3A/B

SUBSIDIARY DETAIL SPREADSHEET

2017

ATTACHMENT TO FORM NYC-3A

TM

COMBINED GENERAL CORPORATION TAX RETURN

Department of Finance

For CALENDAR YEAR 2017 or FISCAL YEAR beginning ____________________ 2017, and ending _____________________

Name of Reporting Corporation:

Employer Identification Number of parent corporation:

SCHEDULE B

Entire net income

1.

Federal taxable income before net operating loss deductions and special deductions (see instructions) .......................

2.

Interest on federal, state, municipal and other obligations not included in line 1 above (see instructions) ......................

3.

Deductions directly attributable to subsidiary capital (attach list) (see instructions) .........................................................

4.

Deductions indirectly attributable to subsidiary capital (attach list) (see instructions) ......................................................

5a.

NYS Franchise Tax, including MTA taxes and other business taxes deducted on the federal return (attach rider) (see instructions)..................

5b.

NYC General Corporation Tax deducted on federal return (see instructions) .......................................................................................................

6.

New York City adjustments relating to (see instructions):

(a)

Employment opportunity relocation cost credit and IBZ credit ......................................................................................................................

(b)

Real estate tax escalation credit ...................................................................................................................................................................

(c)

ACRS depreciation and/or adjustments (attach Form NYC-399 and/or NYC-399Z) ....................................................................................

7.

Additions:

(a)

Payment for use of intangibles ......................................................................................................................................................................

(b)

Domestic Production Activities Deductions (see instructions) .......................................................................................................................

(c)

Other (see instructions) (attach rider)............................................................................................................................................................

9a.

Dividends from subsidiary capital (itemize on rider) (see instructions) .................................................................................................................

9b.

Interest from subsidiary capital (itemize on rider) (see instructions) .....................................................................................................................

9c.

Gains from subsidiary capital ................................................................................................................................................................................

10.

50% of dividends from nonsubsidiary corporations (see instructions) ..................................................................................................................

12.

Gain on sale of certain property acquired prior to 1/1/66 (see instructions)..........................................................................................................

13.

NYC and NYS tax refunds included in Sch. B, line 8 (see instructions)................................................................................................................

14.

Wages and salaries subject to federal jobs credit (see instructions).....................................................................................................................

15.

Depreciation and/or adjustment calculated under pre-ACRS or pre - 9/11/01 rules (attach Form NYC-399 and/or NYC-399Z) (see instructions) .........

16.

Other deductions (see instructions) (attach rider) .................................................................................................................................................

20.

Investment Income - (complete lines a through h below) (see instructions):

(a)

Dividend from nonsubsidiary stock held for investment (see instructions) ...................................................................................................

(b)

Interest from investment capital (include federal, state and municipal obligations) (itemize on rider)..........................................................

(c)

Net capital gain (loss) from sale or exchanges of nonsubsidiary securities held for investment (itemize on rider or attach Federal Schedule D).........................................

(d)

Income from assets included on line 3 of Schedule D..................................................................................................................................

(f)

Deductions directly or indirectly attributable to investment income (attach list) (see instructions) ...............................................................

(h)

Interest on bank accounts included in income reported on line 20d.............................................................................................................

30611791

NYC-3A/B - 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6