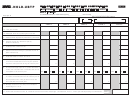

Form Nyc-Nold-Ubti - Net Operating Loss Deduction Computation - 2017

ADVERTISEMENT

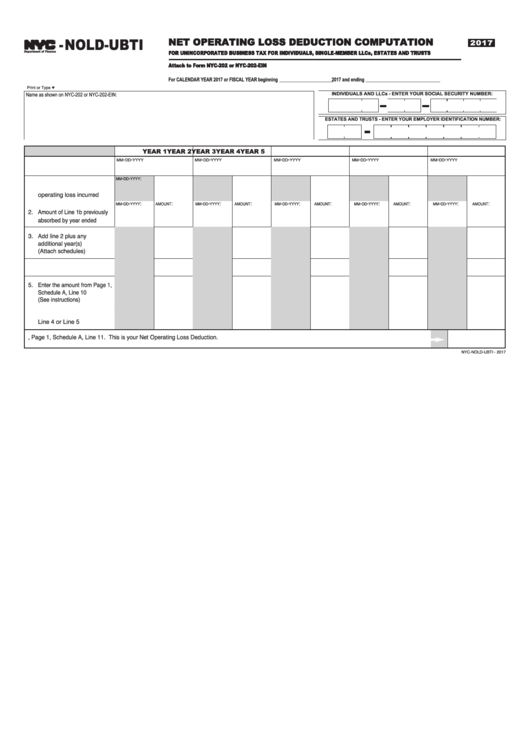

-NOLD-UBTI

NET OPERATING LOSS DEDUCTION COMPUTATION

2017

TM

FOR UNINCORPORATED BUSINESS TAX FOR INDIVIDUALS, SINGLE-MEMBER LLCs, ESTATES AND TRUSTS

Department of Finance

Attach to Form NYC-202 or NYC-202-EIN

For CALENDAR YEAR 2017 or FISCAL YEAR beginning ____________________ 2017 and ending ____________________________

Print or Type

Name as shown on NYC-202 or NYC-202-EIN:

INDIVIDUALS AND LLCs - ENTER YOUR SOCIAL SECURITY NUMBER:

ESTATES AND TRUSTS - ENTER YOUR EMPLOYER IDENTIFICATION NUMBER:

YEAR 1

YEAR 2

YEAR 3

YEAR 4

YEAR 5

-

-

-

-

-

-

-

-

-

-

MM

DD

YYYY

MM

DD

YYYY

MM

DD

YYYY

MM

DD

YYYY

MM

DD

YYYY

1a. Loss year ended

-

-

:

MM

DD

YYYY

1b. Allocated NYC net

operating loss incurred

-

-

:

:

-

-

:

:

-

-

:

:

-

-

:

:

-

-

:

:

MM

DD

YYYY

AMOUNT

MM

DD

YYYY

AMOUNT

MM

DD

YYYY

AMOUNT

MM

DD

YYYY

AMOUNT

MM

DD

YYYY

AMOUNT

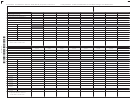

2. Amount of Line 1b previously

absorbed by year ended

3. Add line 2 plus any

additional year(s)

(Attach schedules)

4. Subtract Line 3 from Line 1b

5. Enter the amount from Page 1,

Schedule A, Line 10

(See instructions)

6. Enter the lesser of

Line 4 or Line 5

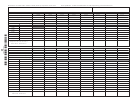

7. Sum of the amounts on line 6. Enter here and on Form NYC-202 or NYC-202-EIN, Page 1, Schedule A, Line 11. This is your Net Operating Loss Deduction.

NYC-NOLD-UBTI - 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2