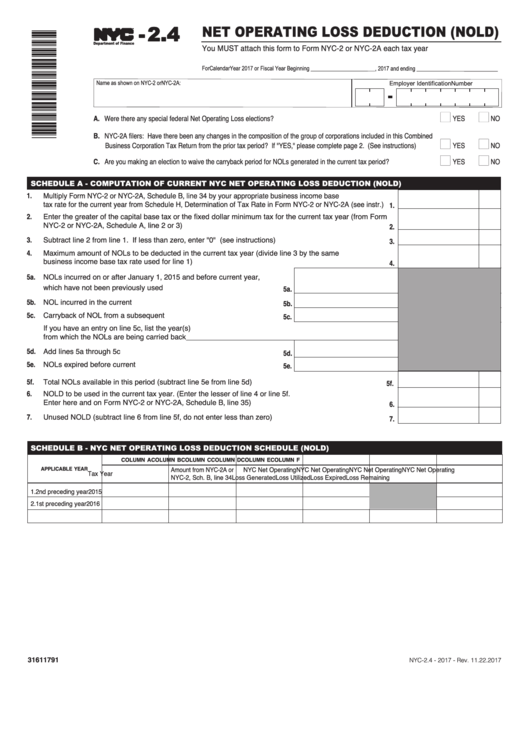

Form Nyc-2.4 - Net Operating Loss Deduction (Nold) - 2017

ADVERTISEMENT

- 2.4

NET OPERATING LOSS DEDUCTION (NOLD)

TM

You MUST attach this form to Form NYC-2 or NYC-2A each tax year

Department of Finance

n

n

A. Were there any special federal Net Operating Loss elections? ...........................................................................................

YES

NO

B. NYC-2A filers: Have there been any changes in the composition of the group of corporations included in this Combined

n

n

Business Corporation Tax Return from the prior tax period? If "YES," please complete page 2. (See instructions) .............

YES

NO

n

n

C. Are you making an election to waive the carryback period for NOLs generated in the current tax period?........................

YES

NO

SCHEDULE A - COMPUTATION OF CURRENT NYC NET OPERATING LOSS DEDUCTION (NOLD)

1.

Multiply Form NYC-2 or NYC-2A, Schedule B, line 34 by your appropriate business income base

tax rate for the current year from Schedule H, Determination of Tax Rate in Form NYC-2 or NYC-2A (see instr.) .... 1.

2.

Enter the greater of the capital base tax or the fixed dollar minimum tax for the current tax year (from Form

NYC-2 or NYC-2A, Schedule A, line 2 or 3) ................................................................................................. 2.

3.

Subtract line 2 from line 1. If less than zero, enter "0" (see instructions) .................................................. 3.

4.

Maximum amount of NOLs to be deducted in the current tax year (divide line 3 by the same

business income base tax rate used for line 1) ............................................................................................ 4.

5a.

NOLs incurred on or after January 1, 2015 and before current year,

which have not been previously used ........................................................... 5a.

5b. NOL incurred in the current year .................................................................. 5b.

5c.

Carryback of NOL from a subsequent year ................................................... 5c.

If you have an entry on line 5c, list the year(s)

from which the NOLs are being carried back ___________________________

5d. Add lines 5a through 5c ............................................................................... 5d.

5e.

NOLs expired before current year ................................................................ 5e.

5f.

Total NOLs available in this period (subtract line 5e from line 5d) ..................................................................... 5f.

6.

NOLD to be used in the current tax year. (Enter the lesser of line 4 or line 5f.

Enter here and on Form NYC-2 or NYC-2A, Schedule B, line 35) .............................................................. 6.

7.

Unused NOLD (subtract line 6 from line 5f, do not enter less than zero) .................................................... 7.

SCHEDULE B - NYC NET OPERATING LOSS DEDUCTION SCHEDULE (NOLD)

COLUMN A

COLUMN B

COLUMN C

COLUMN D

COLUMN E

COLUMN F

Amount from NYC-2A or

NYC Net Operating

NYC Net Operating

NYC Net Operating

NYC Net Operating

APPLICABLE YEAR

Tax Year

NYC-2, Sch. B, line 34

Loss Generated

Loss Utilized

Loss Expired

Loss Remaining

1. 2nd preceding year

2015

2. 1st preceding year

2016

3. Current year

2017

31611791

NYC-2.4 - 2017 - Rev. 11.22.2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2