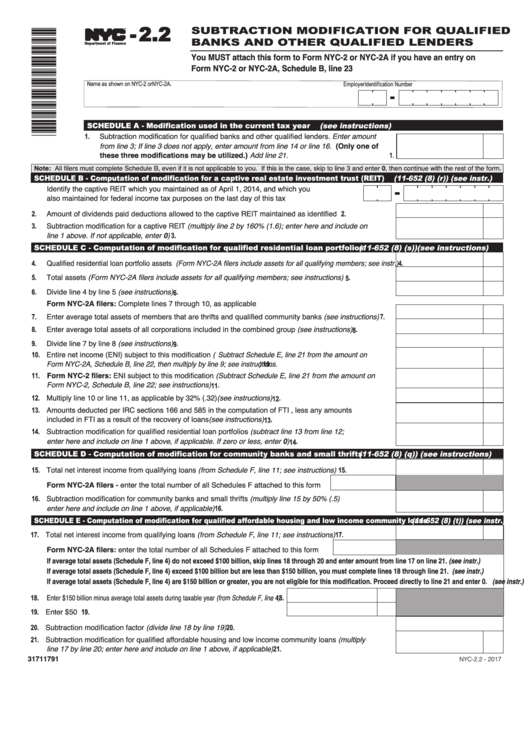

Form Nyc-2.2 - Subtraction Modification For Qualified Banks And Other Qualified Lenders

ADVERTISEMENT

- 2.2

SUBTRACTION MODIFICATION FOR QUALIFIED

BANKS AND OTHER QUALIFIED LENDERS

TM

Department of Finance

You MUST attach this form to Form NYC-2 or NYC-2A if you have an entry on

Form NYC-2 or NYC-2A, Schedule B, line 23

SCHEDULE A - Modification used in the current tax year (see instructions)

1

Subtraction modification for qualified banks and other qualified lenders. Enter amount

from line 3; If line 3 does not apply, enter amount from line 14 or line 16. (Only one of

these three modifications may be utilized.) Add line 21..................................................1

Note: All filers must complete Schedule B, even if it is not applicable to you. If this is the case, skip to line 3 and enter 0, then continue with the rest of the form.

SCHEDULE B - Computation of modification for a captive real estate investment trust (REIT) (11-652 (8) (r)) (see instr.)

Identify the captive REIT which you maintained as of April 1, 2014, and which you

also maintained for federal income tax purposes on the last day of this tax year .........................

2

Amount of dividends paid deductions allowed to the captive REIT maintained as identified above ........... 2

Subtraction modification for a captive REIT (multiply line 2 by 160% (1.6); enter here and include on

3

line 1 above. If not applicable, enter 0) ........................................................................................................ 3

SCHEDULE C - Computation of modification for qualified residential loan portfolios (11-652 (8) (s)) (see instructions)

Qualified residential loan portfolio assets (Form NYC-2A filers include assets for all qualifying members; see instr.)............4

4

5

Total assets (Form NYC-2A filers include assets for all qualifying members; see instructions) .................. 5

6

Divide line 4 by line 5 (see instructions)....................................................................................................... 6

Form NYC-2A filers: Complete lines 7 through 10, as applicable

Enter average total assets of members that are thrifts and qualified community banks (see instructions).....7

7

Enter average total assets of all corporations included in the combined group (see instructions).............. 8

8

Divide line 7 by line 8 (see instructions)....................................................................................................... 9

9

Entire net income (ENI) subject to this modification (Subtract Schedule E, line 21 from the amount on

10

Form NYC-2A, Schedule B, line 22, then multiply by line 9; see instructions.) ............................................................10

Form NYC-2 filers: ENI subject to this modification (Subtract Schedule E, line 21 from the amount on

11

Form NYC-2, Schedule B, line 22; see instructions) ............................................................................................ 11

Multiply line 10 or line 11, as applicable by 32% (.32) (see instructions) .................................................... 12

12

13

Amounts deducted per IRC sections 166 and 585 in the computation of FTI , less any amounts

included in FTI as a result of the recovery of loans (see instructions) ........................................................ 13

Subtraction modification for qualified residential loan portfolios (subtract line 13 from line 12;

14

enter here and include on line 1 above, if applicable. If zero or less, enter 0)............................................ 14

SCHEDULE D - Computation of modification for community banks and small thrifts (11-652 (8) (q)) (see instructions)

Total net interest income from qualifying loans (from Schedule F, line 11; see instructions) .....................15

15

Form NYC-2A filers - enter the total number of all Schedules F attached to this form

16

Subtraction modification for community banks and small thrifts (multiply line 15 by 50% (.5)

enter here and include on line 1 above, if applicable)................................................................................ 16

SCHEDULE E - Computation of modification for qualified affordable housing and low income community loans (11-652 (8) (t)) (see instr.)

17

Total net interest income from qualifying loans (from Schedule F, line 11; see instructions) ..................... 17

Form NYC-2A filers: enter the total number of all Schedules F attached to this form

If average total assets (Schedule F, line 4) do not exceed $100 billion, skip lines 18 through 20 and enter amount from line 17 on line 21. (see instr.)

If average total assets (Schedule F, line 4) exceed $100 billion but are less than $150 billion, you must complete lines 18 through line 21. (see instr.)

If average total assets (Schedule F, line 4) are $150 billion or greater, you are not eligible for this modification. Proceed directly to line 21 and enter 0. (see instr.)

Enter $150 billion minus average total assets during taxable year (from Schedule F, line 4) .. 18

18

19

Enter $50 billion..................................................................................... 19

Subtraction modification factor (divide line 18 by line 19) .......................................................................... 20

20

Subtraction modification for qualified affordable housing and low income community loans (multiply

21

line 17 by line 20; enter here and include on line 1 above, if applicable) .................................................. 21

31711791

NYC-2.2 - 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2