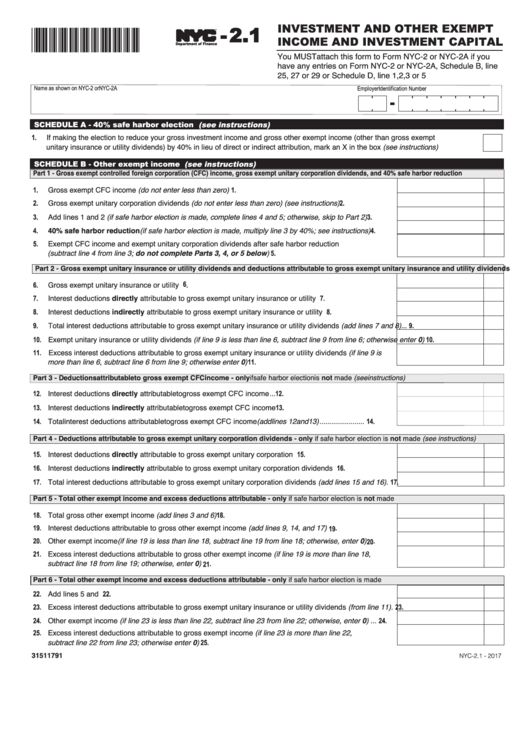

Form Nyc-2.1 - Investment And Other Exempt Income And Investment Capital

ADVERTISEMENT

- 2.1

INVESTMENT AND OTHER EXEMPT

INCOME AND INVESTMENT CAPITAL

31511791

TM

Department of Finance

You MUST attach this form to Form NYC-2 or NYC-2A if you

have any entries on Form NYC-2 or NYC-2A, Schedule B, line

25, 27 or 29 or Schedule D, line 1,2,3 or 5

SCHEDULE A - 40% safe harbor election (see instructions)

1

If making the election to reduce your gross investment income and gross other exempt income (other than gross exempt

unitary insurance or utility dividends) by 40% in lieu of direct or indirect attribution, mark an X in the box (see instructions)..................1

SCHEDULE B - Other exempt income (see instructions)

Part 1 - Gross exempt controlled foreign corporation (CFC) income, gross exempt unitary corporation dividends, and 40% safe harbor reduction

Gross exempt CFC income (do not enter less than zero) ...........................................................................1

1

2

Gross exempt unitary corporation dividends (do not enter less than zero) (see instructions)..................... 2

3

Add lines 1 and 2 (if safe harbor election is made, complete lines 4 and 5; otherwise, skip to Part 2) ...... 3

40% safe harbor reduction (if safe harbor election is made, multiply line 3 by 40%; see instructions).... 4

4

Exempt CFC income and exempt unitary corporation dividends after safe harbor reduction

5

(subtract line 4 from line 3; do not complete Parts 3, 4, or 5 below) ....................................................... 5

Part 2 - Gross exempt unitary insurance or utility dividends and deductions attributable to gross exempt unitary insurance and utility dividends

Gross exempt unitary insurance or utility dividends ...................................................................................... 6

6

Interest deductions directly attributable to gross exempt unitary insurance or utility dividends ................. 7

7

Interest deductions indirectly attributable to gross exempt unitary insurance or utility dividends .............. 8

8

Total interest deductions attributable to gross exempt unitary insurance or utility dividends (add lines 7 and 8)... 9

9

Exempt unitary insurance or utility dividends (if line 9 is less than line 6, subtract line 9 from line 6; otherwise enter 0) 10

10

Excess interest deductions attributable to gross exempt unitary insurance or utility dividends (if line 9 is

11

more than line 6, subtract line 6 from line 9; otherwise enter 0)......................................................................... 11

Part 4 - Deductions attributable to gross exempt unitary corporation dividends - only if safe harbor election is not made (see instructions)

Interest deductions directly attributable to gross exempt unitary corporation dividends........................... 15

15

Interest deductions indirectly attributable to gross exempt unitary corporation dividends ....................... 16

16

Total interest deductions attributable to gross exempt unitary corporation dividends (add lines 15 and 16) . 17

17

Part 5 - Total other exempt income and excess deductions attributable - only if safe harbor election is not made

Total gross other exempt income (add lines 3 and 6)..................................................................................18

18

Interest deductions attributable to gross other exempt income (add lines 9, 14, and 17) ......................... 19

19

Other exempt income (if line 19 is less than line 18, subtract line 19 from line 18; otherwise, enter 0).... 20

20

Excess interest deductions attributable to gross other exempt income (if line 19 is more than line 18,

21

subtract line 18 from line 19; otherwise, enter 0) ....................................................................................... 21

Part 6 - Total other exempt income and excess deductions attributable - only if safe harbor election is made

22

Add lines 5 and 10 ......................................................................................................................................22

Excess interest deductions attributable to gross exempt unitary insurance or utility dividends (from line 11) . 23

23

Other exempt income (if line 23 is less than line 22, subtract line 23 from line 22; otherwise, enter 0) ... 24

24

25

Excess interest deductions attributable to gross exempt income (if line 23 is more than line 22,

subtract line 22 from line 23; otherwise enter 0) ........................................................................................ 25

31511791

NYC-2.1 - 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4