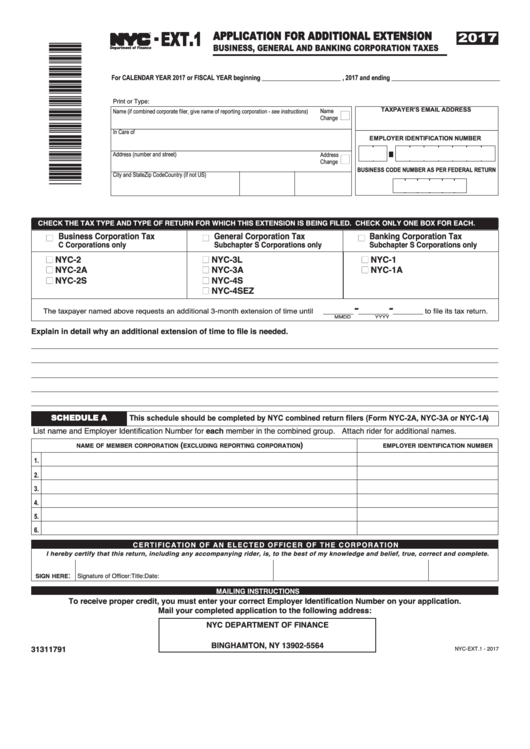

- EXT.1

APPLICATION FOR ADDITIONAL EXTENSION

2017

TM

BUSINESS, GENERAL AND BANKING CORPORATION TAXES

Department of Finance

For CALENDAR YEAR 2017 or FISCAL YEAR beginning ________________________ , 2017 and ending _________________________________

Print or Type:

TAXPAYER’S EMAIL ADDRESS

Name (if combined corporate filer, give name of reporting corporation - see instructions)

Name

n

Change

In Care of

EMPLOYER IDENTIFICATION NUMBER

Address (number and street)

Address

n

Change

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

City and State

Zip Code

Country (if not US)

CHECK THE TAX TYPE AND TYPE OF RETURN FOR WHICH THIS EXTENSION IS BEING FILED. CHECK ONLY ONE BOX FOR EACH.

Business Corporation Tax

General Corporation Tax

Banking Corporation Tax

n

n

n

C Corporations only

Subchapter S Corporations only

Subchapter S Corporations only

NYC-2

NYC-3L

NYC-1

n

n

n

NYC-2A

NYC-3A

NYC-1A

n

n

n

NYC-2S

NYC-4S

n

n

NYC-4SEZ

n

The taxpayer named above requests an additional 3-month extension of time until

________ ________ ________ to file its tax return.

MM

DD

YYYY

Explain in detail why an additional extension of time to file is needed.

SCHEDULE A

This schedule should be completed by NYC combined return filers (Form NYC-2A, NYC-3A or NYC-1A)

List name and Employer Identification Number for each member in the combined group. Attach rider for additional names.

(

)

NAME OF MEMBER CORPORATION

EXCLUDING REPORTING CORPORATION

EMPLOYER IDENTIFICATION NUMBER

1.

2.

3.

4.

5.

6.

C E R T I F I C AT I O N O F A N E L E C T E D O F F I C E R O F T H E C O R P O R AT I O N

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

:

SIGN HERE

Signature of Officer:

Title:

Date:

M A I L I N G I N S T R U C T I O N S

To receive proper credit, you must enter your correct Employer Identification Number on your application.

Mail your completed application to the following address:

NYC DEPARTMENT OF FINANCE

P.O. BOX 5564

BINGHAMTON, NY 13902-5564

31311791

NYC-EXT.1 - 2017

1

1 2

2