*171341*

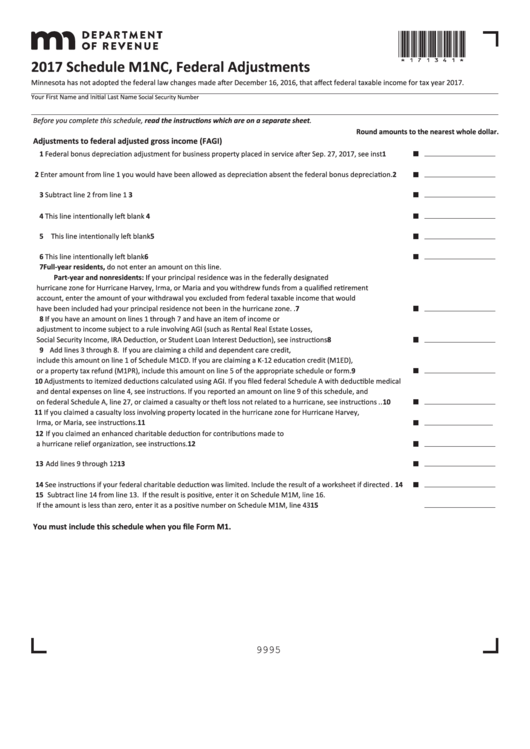

2017 Schedule M1NC, Federal Adjustments

Minnesota has not adopted the federal law changes made after December 16, 2016, that affect federal taxable income for tax year 2017.

Your First Name and Initial

Last Name

Social Security Number

Before you complete this schedule, read the instructions which are on a separate sheet.

Round amounts to the nearest whole dollar.

Adjustments to federal adjusted gross income (FAGI)

1 Federal bonus depreciation adjustment for business property placed in service after Sep. 27, 2017, see inst . . . . 1

2 Enter amount from line 1 you would have been allowed as depreciation absent the federal bonus depreciation . 2

3 Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 This line intentionally left blank. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 This line intentionally left blank. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Full-year residents, do not enter an amount on this line.

Part-year and nonresidents: If your principal residence was in the federally designated

hurricane zone for Hurricane Harvey, Irma, or Maria and you withdrew funds from a qualified retirement

account, enter the amount of your withdrawal you excluded from federal taxable income that would

have been included had your principal residence not been in the hurricane zone. . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 If you have an amount on lines 1 through 7 and have an item of income or

adjustment to income subject to a rule involving AGI (such as Rental Real Estate Losses,

Social Security Income, IRA Deduction, or Student Loan Interest Deduction), see instructions . . . . . . . . . . . . . . . . 8

9 Add lines 3 through 8. If you are claiming a child and dependent care credit,

include this amount on line 1 of Schedule M1CD. If you are claiming a K-12 education credit (M1ED),

or a property tax refund (M1PR), include this amount on line 5 of the appropriate schedule or form. . . . . . . . . . . 9

10 Adjustments to itemized deductions calculated using AGI. If you filed federal Schedule A with deductible medical

and dental expenses on line 4, see instructions. If you reported an amount on line 9 of this schedule, and

on federal Schedule A, line 27, or claimed a casualty or theft loss not related to a hurricane, see instructions . . 10

11 If you claimed a casualty loss involving property located in the hurricane zone for Hurricane Harvey,

Irma, or Maria, see instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 If you claimed an enhanced charitable deduction for contributions made to

a hurricane relief organization, see instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Add lines 9 through 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13

14 See instructions if your federal charitable deduction was limited. Include the result of a worksheet if directed . 14

15 Subtract line 14 from line 13. If the result is positive, enter it on Schedule M1M, line 16.

If the amount is less than zero, enter it as a positive number on Schedule M1M, line 43 . . . . . . . . . . . . . . . . . . . . 15

You must include this schedule when you file Form M1.

9995

1

1 2

2 3

3 4

4 5

5 6

6