*171291*

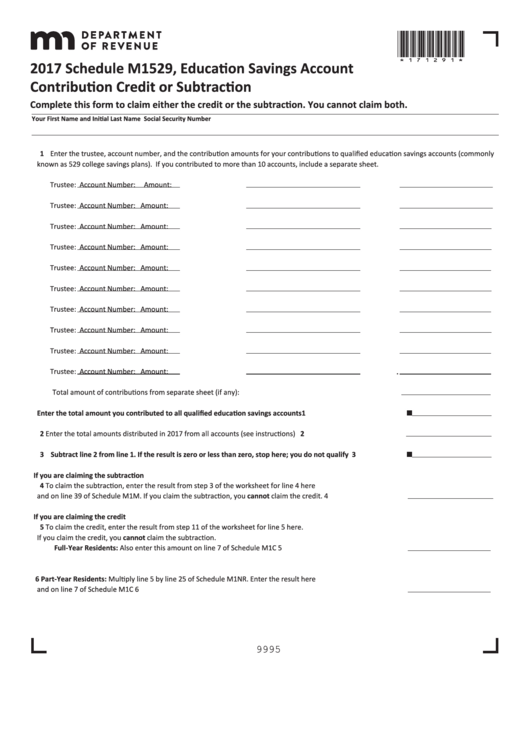

2017 Schedule M1529, Education Savings Account

Contribution Credit or Subtraction

Complete this form to claim either the credit or the subtraction. You cannot claim both.

Your First Name and Initial

Last Name

Social Security Number

1 Enter the trustee, account number, and the contribution amounts for your contributions to qualified education savings accounts (commonly

known as 529 college savings plans). If you contributed to more than 10 accounts, include a separate sheet.

Trustee:

Account Number:

Amount:

Trustee:

Account Number:

Amount:

Trustee:

Account Number:

Amount:

Trustee:

Account Number:

Amount:

Trustee:

Account Number:

Amount:

Trustee:

Account Number:

Amount:

Trustee:

Account Number:

Amount:

Trustee:

Account Number:

Amount:

Trustee:

Account Number:

Amount:

.

Trustee:

Account Number:

Amount:

Total amount of contributions from separate sheet (if any):

Enter the total amount you contributed to all qualified education savings accounts . . . . . . . . . . . . . . . . . . . . 1

2 Enter the total amounts distributed in 2017 from all accounts (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Subtract line 2 from line 1. If the result is zero or less than zero, stop here; you do not qualify . . . . . . . . . . . 3

If you are claiming the subtraction

4 To claim the subtraction, enter the result from step 3 of the worksheet for line 4 here

and on line 39 of Schedule M1M. If you claim the subtraction, you cannot claim the credit. . . . . . . . . . . . . . . 4

If you are claiming the credit

5 To claim the credit, enter the result from step 11 of the worksheet for line 5 here.

If you claim the credit, you cannot claim the subtraction.

Full-Year Residents: Also enter this amount on line 7 of Schedule M1C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Part-Year Residents: Multiply line 5 by line 25 of Schedule M1NR. Enter the result here

and on line 7 of Schedule M1C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

9995

1

1 2

2