Form M1 - Individual Income Tax - 2017

ADVERTISEMENT

*171112*

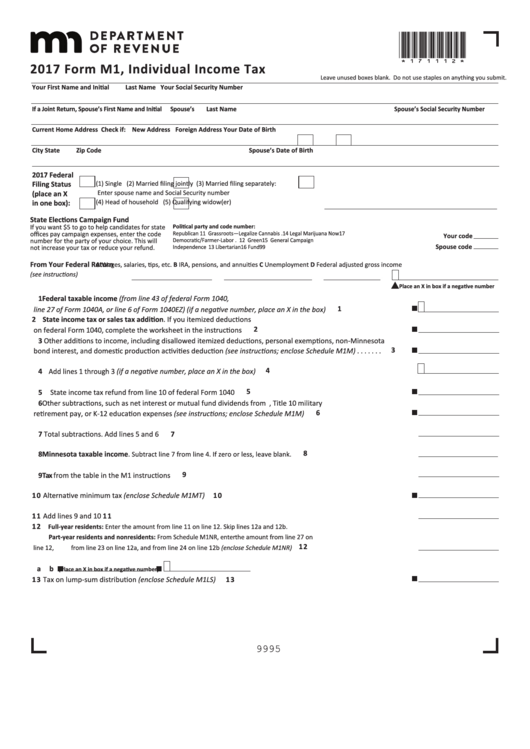

2017 Form M1, Individual Income Tax

Leave unused boxes blank. Do not use staples on anything you submit.

Your First Name and Initial

Last Name

Your Social Security Number

If a Joint Return, Spouse’s First Name and Initial

Spouse’s Last Name

Spouse’s Social Security Number

Current Home Address

Check if: New Address Foreign Address

Your Date of Birth

City

State

Zip Code

Spouse’s Date of Birth

2017 Federal

Filing Status

(1) Single

(2) Married filing jointly

(3) Married filing separately:

Enter spouse name and Social Security number

(place an X

(4) Head of household

(5) Qualifying widow(er)

in one box):

State Elections Campaign Fund

If you want $5 to go to help candidates for state

Political party and code number:

Republican . . . . . . . . . . . . . . 11

Grassroots—Legalize Cannabis . 14 Legal Marijuana Now . . . . 17

offices pay campaign expenses, enter the code

Your code

number for the party of your choice. This will

Democratic/Farmer-Labor . 12

Green . . . . . . . . . . . . . . . . . . . . . . 15 General Campaign

Spouse code

not increase your tax or reduce your refund.

Independence . . . . . . . . . . . 13

Libertarian . . . . . . . . . . . . . . . . . . 16 Fund . . . . . . . . . . . . . . . . . . 99

From Your Federal Return

A Wages, salaries, tips, etc.

B IRA, pensions, and annuities

C Unemployment

D Federal adjusted gross income

(see instructions)

Place an X in box if a negative number

1 Federal taxable income (from line 43 of federal Form 1040,

1

line 27 of Form 1040A, or line 6 of Form 1040EZ) (if a negative number, place an X in the box) . . . . . . . . . . . . . .

2 State income tax or sales tax addition. If you itemized deductions

2

on federal Form 1040, complete the worksheet in the instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Other additions to income, including disallowed itemized deductions, personal exemptions, non-Minnesota

3

bond interest, and domestic production activities deduction (see instructions; enclose Schedule M1M) . . . . . . .

4

4 Add lines 1 through 3 (if a negative number, place an X in the box) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 State income tax refund from line 10 of federal Form 1040 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Other subtractions, such as net interest or mutual fund dividends from U.S. bonds, Title 10 military

6

retirement pay, or K-12 education expenses (see instructions; enclose Schedule M1M) . . . . . . . . . . . . . . . . . . . .

7 Total subtractions. Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8

8 Minnesota taxable income .

. . . . . . . . . . . . . . . . . . . . . . . . . .

Subtract line 7 from line 4. If zero or less, leave blank.

9

9 Tax from the table in the M1 instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 Alternative minimum tax (enclose Schedule M1MT) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 0

11 Add lines 9 and 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 1

12

Full-year residents: Enter the amount from line 11 on line 12. Skip lines 12a and 12b.

Part-year residents and nonresidents: From Schedule M1NR, enter the amount from line 27 on

1 2

. . . . . . . . . . . . . . . . . . . . . . . . . . .

line 12, from line 23 on line 12a, and from line 24 on line 12b (enclose Schedule M1NR)

a

b

(Place an X in box if a negative number)

13 Tax on lump-sum distribution (enclose Schedule M1LS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 3

9995

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2