Schedule In-112 - Vermont Tax Adjustments And Credits Instructions - 2016

ADVERTISEMENT

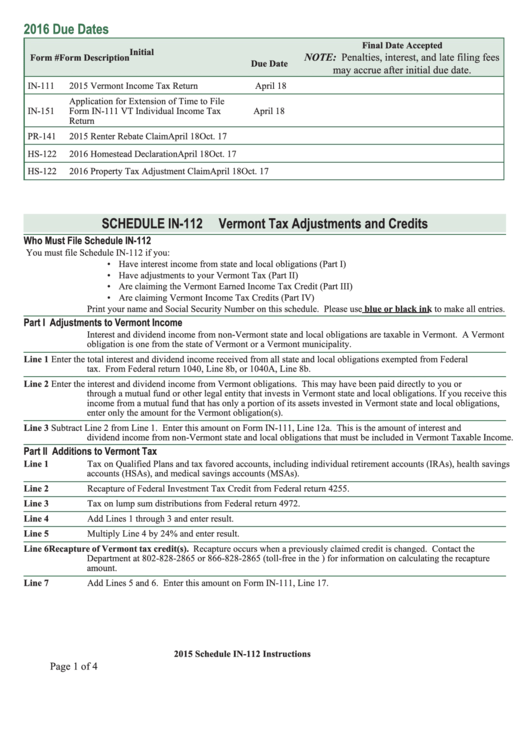

2016 Due Dates

Final Date Accepted

Initial

NOTE: Penalties, interest, and late filing fees

Form #

Form Description

Due Date

may accrue after initial due date.

IN-111

2015 Vermont Income Tax Return

April 18

Application for Extension of Time to File

IN-151

Form IN-111 VT Individual Income Tax

April 18

Return

PR-141

2015 Renter Rebate Claim

April 18

Oct. 17

HS-122

2016 Homestead Declaration

April 18

Oct. 17

HS-122

2016 Property Tax Adjustment Claim

April 18

Oct. 17

SCHEDULE IN-112

Vermont Tax Adjustments and Credits

Who Must File Schedule IN-112

You must file Schedule IN-112 if you:

• Have interest income from state and local obligations (Part I)

• Have adjustments to your Vermont Tax (Part II)

• Are claiming the Vermont Earned Income Tax Credit (Part III)

• Are claiming Vermont Income Tax Credits (Part IV)

Print your name and Social Security Number on this schedule. Please use blue or black ink to make all entries.

Part I Adjustments to Vermont Income

Interest and dividend income from non-Vermont state and local obligations are taxable in Vermont. A Vermont

obligation is one from the state of Vermont or a Vermont municipality.

Line 1

Enter the total interest and dividend income received from all state and local obligations exempted from Federal

tax. From Federal return 1040, Line 8b, or 1040A, Line 8b.

Line 2

Enter the interest and dividend income from Vermont obligations. This may have been paid directly to you or

through a mutual fund or other legal entity that invests in Vermont state and local obligations. If you receive this

income from a mutual fund that has only a portion of its assets invested in Vermont state and local obligations,

enter only the amount for the Vermont obligation(s).

Line 3

Subtract Line 2 from Line 1. Enter this amount on Form IN-111, Line 12a. This is the amount of interest and

dividend income from non-Vermont state and local obligations that must be included in Vermont Taxable Income.

Part II Additions to Vermont Tax

Line 1

Tax on Qualified Plans and tax favored accounts, including individual retirement accounts (IRAs), health savings

accounts (HSAs), and medical savings accounts (MSAs).

Line 2

Recapture of Federal Investment Tax Credit from Federal return 4255.

Line 3

Tax on lump sum distributions from Federal return 4972.

Line 4

Add Lines 1 through 3 and enter result.

Line 5

Multiply Line 4 by 24% and enter result.

Line 6

Recapture of Vermont tax credit(s). Recapture occurs when a previously claimed credit is changed. Contact the

Department at 802-828-2865 or 866-828-2865 (toll-free in the U.S.) for information on calculating the recapture

amount.

Line 7

Add Lines 5 and 6. Enter this amount on Form IN-111, Line 17.

2015 Schedule IN-112 Instructions

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4