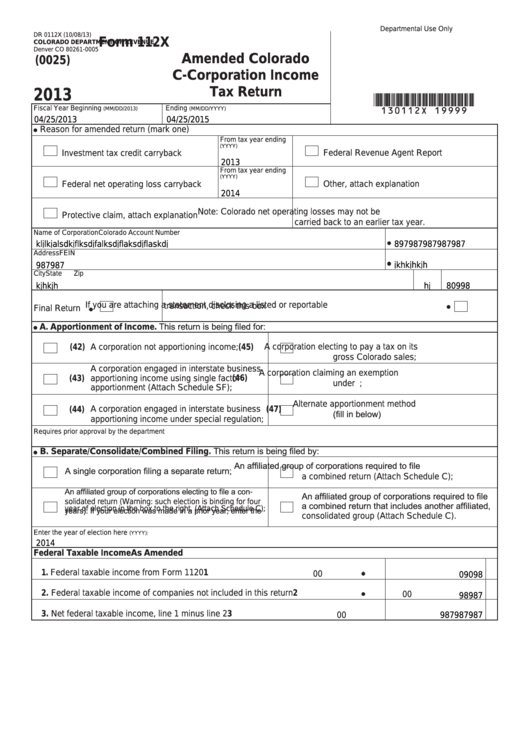

Departmental Use Only

DR 0112X (10/08/13)

Form 112X

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0005

Amended Colorado

(0025)

C-Corporation Income

Tax Return

2013

*130112X=19999*

Fiscal Year Beginning

Ending

(MM/DD/2013)

(MM/DD/YYYY)

04/25/2013

04/25/2015

Reason for amended return (mark one)

From tax year ending

(YYYY)

Investment tax credit carryback

Federal Revenue Agent Report

2013

From tax year ending

(YYYY)

Federal net operating loss carryback

Other, attach explanation

2014

Note: Colorado net operating losses may not be

Protective claim, attach explanation

carried back to an earlier tax year.

Name of Corporation

Colorado Account Number

kljlkjalsdkjflksdjfalksdjflaksdjflaskdj

897987987987987

Address

FEIN

987987

jkhkjhkjh

City

State

Zip

kjhkjh

80998

hj

If you are attaching a statement disclosing a listed or reportable

Final Return

transaction, check this box

A. Apportionment of Income. This return is being filed for:

(42) A corporation not apportioning income;

(45)

A corporation electing to pay a tax on its

gross Colorado sales;

A corporation engaged in interstate business

A corporation claiming an exemption

(43)

apportioning income using single factor

(46)

under P.L. 86-272;

apportionment (Attach Schedule SF);

Alternate apportionment method

(44) A corporation engaged in interstate business

(47)

(fill in below)

apportioning income under special regulation;

Requires prior approval by the department

B. Separate/Consolidate/Combined Filing. This return is being filed by:

An affiliated group of corporations required to file

A single corporation filing a separate return;

a combined return (Attach Schedule C);

An affiliated group of corporations electing to file a con-

An affiliated group of corporations required to file

solidated return (Warning: such election is binding for four

a combined return that includes another affiliated,

years). If your election was made in a prior year, enter the

consolidated group (Attach Schedule C).

year of election in the box to the right. (Attach Schedule C);

Enter the year of election here

(YYYY):

2014

Federal Taxable Income

As Amended

1.

Federal taxable income from Form 1120

1

00

09098

2. Federal taxable income of companies not included in this return

2

00

98987

3.

Net federal taxable income, line 1 minus line 2

3

987987987

00

1

1 2

2 3

3 4

4