Clear Form

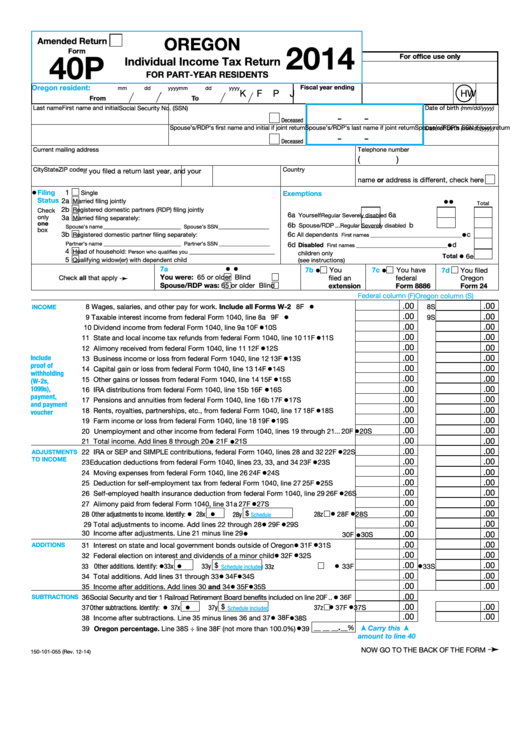

OREGON

Amended Return

2014

Form

40P

For office use only

Individual Income Tax Return

FOR PART-YEAR RESIDENTS

Oregon resident:

Fiscal year ending

mm

dd

yyyy

mm

dd

yyyy

K

F

P

J

H W

From

To

Last name

First name and initial

Social Security No. (SSN)

Date of birth

(mm/dd/yyyy)

–

–

Deceased

Spouse’s/RDP’s last name if joint return

Spouse’s/RDP’s first name and initial if joint return

Spouse’s/RDP’s SSN if joint return

Date of birth

(mm/dd/yyyy)

–

–

Deceased

Current mailing address

Telephone number

(

)

City

State

ZIP code

Country

If you filed a return last year, and your

name or address is different, check here

•

Filing

1

Single

Exemptions

Status

•

•

2a

Married filing jointly

Total

2b

Registered domestic partners (RDP) filing jointly

Check

6a

6a

Yourself ...........

Regular

...... Severely disabled

....

only

3a

Married filing separately:

one

6b

b

Spouse/RDP ...

Regular

...... Severely disabled

......

Spouse’s name _____________________________ Spouse’s SSN ___________________

box

•

3b

Registered domestic partner filing separately:

6c

c

All dependents

First names __________________________________

Partner’s name _____________________________ Partner’s SSN ___________________

•

6d

d

Disabled

First names __________________________________

4

Head of household:

Person who qualifies you ________________________________

children only

•

Total

6e

5

Qualifying widow(er) with dependent child

(see instructions)

•

•

•

•

7a

7b

You

7c

You have

7d

You filed

You were:

65 or older

Blind

Check all that apply

➛

filed an

federal

Oregon

Spouse/RDP was:

65 or older

Blind

extension

Form 8886

Form 24

Federal column (F)

Oregon column (S)

.00

•

.00

8 Wages, salaries, and other pay for work. Include all Forms W-2 ........................ 8F

INCOME

8S

.00

•

.00

9 Taxable interest income from federal Form 1040, line 8a ...................................... 9F

9S

.00

•

.00

10 Dividend income from federal Form 1040, line 9a ................................................. 10F

10S

.00

•

.00

11 State and local income tax refunds from federal Form 1040, line 10 .................... 11F

11S

.00

•

.00

12 Alimony received from federal Form 1040, line 11 ................................................ 12F

12S

.00

•

.00

Include

13 Business income or loss from federal Form 1040, line 12 ..................................... 13F

13S

proof of

.00

•

.00

14 Capital gain or loss from federal Form 1040, line 13 ............................................. 14F

14S

withholding

.00

•

.00

15 Other gains or losses from federal Form 1040, line 14 .......................................... 15F

15S

(W-2s,

.00

•

.00

1099s),

16 IRA distributions from federal Form 1040, line 15b ............................................... 16F

16S

payment,

.00

•

.00

17 Pensions and annuities from federal Form 1040, line 16b ..................................... 17F

17S

and payment

.00

•

.00

18 Rents, royalties, partnerships, etc., from federal Form 1040, line 17 .................... 18F

18S

voucher

.00

•

.00

19 Farm income or loss from federal Form 1040, line 18 ........................................... 19F

19S

.00

•

.00

20 Unemployment and other income from federal Form 1040, lines 19 through 21 ... 20F

20S

•

.00

•

.00

21F

21S

21 Total income. Add lines 8 through 20 .................................................................

.00

•

.00

ADJUSTMENTS

22 IRA or SEP and SIMPLE contributions, federal Form 1040, lines 28 and 32 ......... 22F

22S

TO INCOME

.00

•

.00

23 Education deductions from federal Form 1040, lines 23, 33, and 34 .................... 23F

23S

.00

•

.00

24 Moving expenses from federal Form 1040, line 26 ................................................ 24F

24S

.00

•

.00

25 Deduction for self-employment tax from federal Form 1040, line 27 .................... 25F

25S

.00

•

.00

26 Self-employed health insurance deduction from federal Form 1040, line 29 ........ 26F

26S

.00

•

.00

27 Alimony paid from federal Form 1040, line 31a ..................................................... 27F

27S

•

•

•

•

.00

.00

28y $

28 Other adjustments to income. Identify:

28x

28z

28F

28S

Schedule

•

.00

•

.00

29 Total adjustments to income. Add lines 22 through 28 ......................................

29F

29S

•

.00

•

.00

30 Income after adjustments. Line 21 minus line 29 ...............................................

30F

30S

•

•

.00

.00

ADDITIONS

31 Interest on state and local government bonds outside of Oregon .....................

31F

31S

•

•

.00

.00

32 Federal election on interest and dividends of a minor child ...............................

32F

32S

•

•

•

•

.00

.00

33y $

33 Other additions. Identify:

33x

33z

......

33F

33S

Schedule included

•

.00

•

.00

34 Total additions. Add lines 31 through 33 ............................................................

34F

34S

•

.00

•

.00

35 Income after additions. Add lines 30 and 34 ......................................................

35F

35S

•

.00

SUBTRACTIONS

36 Social Security and tier 1 Railroad Retirement Board benefits included on line 20F ..

36F

•

•

•

•

.00

.00

37y $

37 Other subtractions. Identify:

37x

37z

37F

37S

Schedule included

.00

.00

•

•

38F

38 Income after subtractions. Line 35 minus lines 36 and 37 .................................

38S

•

.

__ __ __

__ %

Carry this

39 Oregon percentage. Line 38S ÷ line 38F (not more than 100.0%)

39

amount to line 40

➛

NOW GO TO THE BACK OF THE FORM

150-101-055 (Rev. 12-14)

1

1 2

2