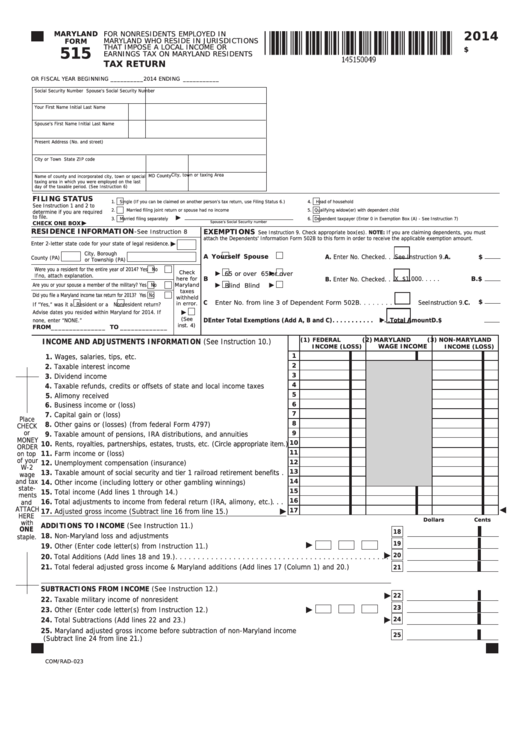

2014

MARYLAND

FOR NONRESIDENTS EMPLOYED IN

MARYLAND WHO RESIDE IN JURISDICTIONS

FORM

515

THAT IMPOSE A LOCAL INCOME OR

$

EARNINGS TAX ON MARYLAND RESIDENTS

TAX RETURN

OR FISCAL YEAR BEGINNING __________2014 ENDING ___________

Social Security Number

Spouse's Social Security Number

Your First Name

Initial

Last Name

Spouse's First Name

Initial

Last Name

Present Address (No. and street)

City or Town

State

ZIP code

City, town or taxing Area

MD County

Name of county and incorporated city, town or special

taxing area in which you were employed on the last

day of the taxable period. (See Instruction 6)

FILING STATUS

1.

Single (If you can be claimed on another person’s tax return, use Filing Status 6.)

4.

Head of household

See Instruction 1 and 2 to

2.

Married filing joint return or spouse had no income

5.

Qualifying widow(er) with dependent child

determine if you are required

to file.

3.

Married filing separately

6.

Dependent taxpayer (Enter 0 in Exemption Box (A) - See Instruction 7)

CHECK ONE BOX

Spouse's Social Security number

RESIDENCE INFORMATION

EXEMPTIONS

-

See Instruction 8

See Instruction 9. Check appropriate box(es). NOTE: If you are claiming dependents, you must

attach the Dependents' Information Form 502B to this form in order to receive the applicable exemption amount.

Enter 2-letter state code for your state of legal residence.

City, Borough

A

Yourself

Spouse

A. Enter No. Checked. . .

See Instruction 9. A. $

County (PA)

or Township (PA)

Were you a resident for the entire year of 2014? Yes

No

Check

65 or over

65 or over

If no, attach explanation.

B

X $1,000. . . . .

B.$

here for

B. Enter No. Checked. . .

Are you or your spouse a member of the military? Yes

No

Maryland

Blind

Blind

taxes

Did you file a Maryland income tax return for 2013? Yes

No

withheld

See Instruction 9. C. $

C

Enter No. from line 3 of Dependent Form 502B. . . . . . . . .

in error.

If “Yes,” was it a

Resident or a

Nonresident return?

Advise dates you resided within Maryland for 2014. If

(See

D Enter Total Exemptions (Add A, B and C). . . . . . . . . . .

. . .Total Amount D. $

none, enter “NONE.”

inst. 4)

FROM_______________ TO _____________

(2) MARYLAND

(1) FEDERAL

(3) NON-MARYLAND

INCOME AND ADJUSTMENTS INFORMATION (See Instruction 10.)

INCOME (LOSS)

WAGE INCOME

INCOME (LOSS)

1

1. Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2. Taxable interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3. Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4. Taxable refunds, credits or offsets of state and local income taxes . . . . .

5

5. Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6. Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7. Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Place

8

8. Other gains or (losses) (from federal Form 4797) . . . . . . . . . . . . . . . .

CHECK

or

9

9. Taxable amount of pensions, IRA distributions, and annuities . . . . . . . .

MONEY

10

10. Rents, royalties, partnerships, estates, trusts, etc. (Circle appropriate item.)

ORDER

11. Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

on top

of your

12. Unemployment compensation (insurance) . . . . . . . . . . . . . . . . . . . . . .

12

W-2

13. Taxable amount of social security and tier 1 railroad retirement benefits . .

13

wage

and tax

14

14. Other income (including lottery or other gambling winnings) . . . . . . . . .

state-

15

15. Total income (Add lines 1 through 14.) . . . . . . . . . . . . . . . . . . . . . . . .

ments

16

16. Total adjustments to income from federal return (IRA, alimony, etc.) . . .

and

ATTACH

17

17. Adjusted gross income (Subtract line 16 from line 15.) . . . . . . . . . . . .

HERE

Dollars

Cents

with

ADDITIONS TO INCOME (See Instruction 11.)

ONE

18

18. Non-Maryland loss and adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

staple.

19

19. Other (Enter code letter(s) from Instruction 11.) . . . . . . . . . . . . . . . . . . . . . .

20

20. Total Additions (Add lines 18 and 19.). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21. Total federal adjusted gross income & Maryland additions (Add lines 17 (Column 1) and 20.) . . . . . . . . .

21

SUBTRACTIONS FROM INCOME (See Instruction 12.)

22

22. Taxable military income of nonresident . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

23. Other (Enter code letter(s) from Instruction 12.) . . . . . . . . . . . . . . . . . . . . .

24

24. Total Subtractions (Add lines 22 and 23.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25. Maryland adjusted gross income before subtraction of non-Maryland income

25

(Subtract line 24 from line 21.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

COM/RAD-023

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12