Form 500ez - Georgia Short Income Tax Return - 2000

ADVERTISEMENT

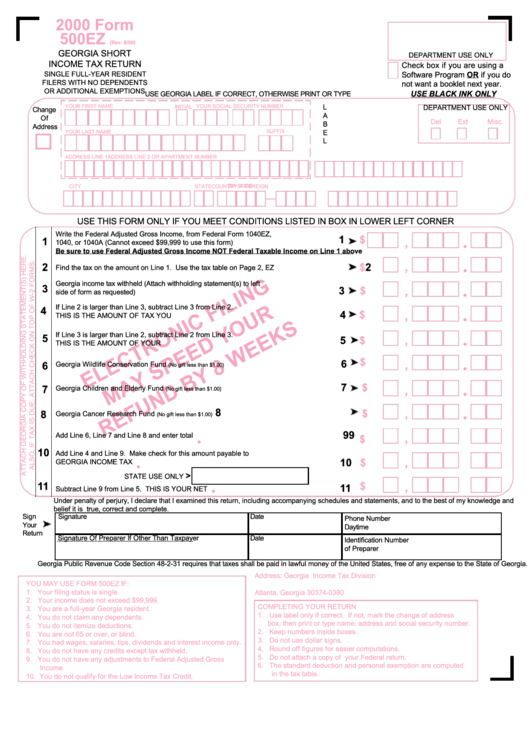

2000 Form

500EZ

(Rev. 8/00)

GEORGIA SHORT

DEPARTMENT USE ONLY

INCOME TAX RETURN

Check box if you are using a

Software Program OR if you do

SINGLE FULL-YEAR RESIDENT

FILERS WITH NO DEPENDENTS

not want a booklet next year.

OR ADDITIONAL EXEMPTIONS

USE BLACK INK ONLY

USE GEORGIA LABEL IF CORRECT, OTHERWISE PRINT OR TYPE

YOUR FIRST NAME

INITIAL

YOUR SOCIAL SECURITY NUMBER

L

DEPARTMENT USE ONLY

Change

A

Of

Del

Ext

Misc.

B

Address

YOUR LAST NAME

SUFFIX

E

L

ADDRESS LINE 1

ADDRESS LINE 2 OR APARTMENT NUMBER

ZIP CODE

CITY

STATE

COUNTRY IF FOREIGN

USE THIS FORM ONLY IF YOU MEET CONDITIONS LISTED IN BOX IN LOWER LEFT CORNER

Write the Federal Adjusted Gross Income, from Federal Form 1040EZ,

1

$

1

,

1040, or 1040A (Cannot exceed $99,999 to use this form)....................................................

•

Be sure to use Federal Adjusted Gross Income NOT Federal Taxable Income on Line 1 above

,

2

2

$

Find the tax on the amount on Line 1. Use the tax table on Page 2, EZ Form........................

•

Georgia income tax withheld (Attach withholding statement(s) to left

3

,

3

$

side of form as requested)..............................................................................................................

•

If Line 2 is larger than Line 3, subtract Line 3 from Line 2.

4

4

$

,

THIS IS THE AMOUNT OF TAX YOU OWE................................................................................

•

If Line 3 is larger than Line 2, subtract Line 2 from Line 3.

5

,

5

$

•

THIS IS THE AMOUNT OF YOUR OVERPAYMENT...................................................................

$

6

,

6

Georgia Wildlife Conservation Fund

.............................................................

(No gift less than $1.00)

•

7

$

7

,

Georgia Children and Elderly Fund

...............................................................

(No gift less than $1.00)

•

8

$

,

8

Georgia Cancer Research Fund

...................................................................

(No gift less than $1.00)

•

9

9

Add Line 6, Line 7 and Line 8 and enter total here..................................................................

,

$

•

10

Add Line 4 and Line 9. Make check for this amount payable to

,

10

$

GEORGIA INCOME TAX DIVISION.............................................................................................

•

>

STATE USE ONLY

11

$

,

11

Subtract Line 9 from Line 5. THIS IS YOUR NET REFUND........................................................

•

Under penalty of perjury, I declare that I examined this return, including accompanying schedules and statements, and to the best of my knowledge and

belief it is true, correct and complete.

Sign

Signature

Date

Phone Number

Your

Daytime

Return

Signature Of Preparer If Other Than Taxpayer

Date

Identification Number

of Preparer

Georgia Public Revenue Code Section 48-2-31 requires that taxes shall be paid in lawful money of the United States, free of any expense to the State of Georgia.

Address: Georgia Income Tax Division

YOU MAY USE FORM 500EZ IF:

P.O. BOX 740380

1. Your filing status is single.

Atlanta, Georgia 30374-0380

2. Your income does not exceed $99,999.

COMPLETING YOUR RETURN

3. You are a full-year Georgia resident.

1. Use label only if correct. If not, mark the change of address

4. You do not claim any dependents.

box, then print or type name, address and social security number.

5. You do not itemize deductions.

2. Keep numbers inside boxes.

6. You are not 65 or over, or blind.

3. Do not use dollar signs.

7. You had wages, salaries, tips, dividends and interest income only.

4. Round off figures for easier computations.

8. You do not have any credits except tax withheld.

5. Do not attach a copy of your Federal return.

9. You do not have any adjustments to Federal Adjusted Gross

6. The standard deduction and personal exemption are computed

Income.

in the tax table.

10. You do not qualify for the Low Income Tax Credit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2